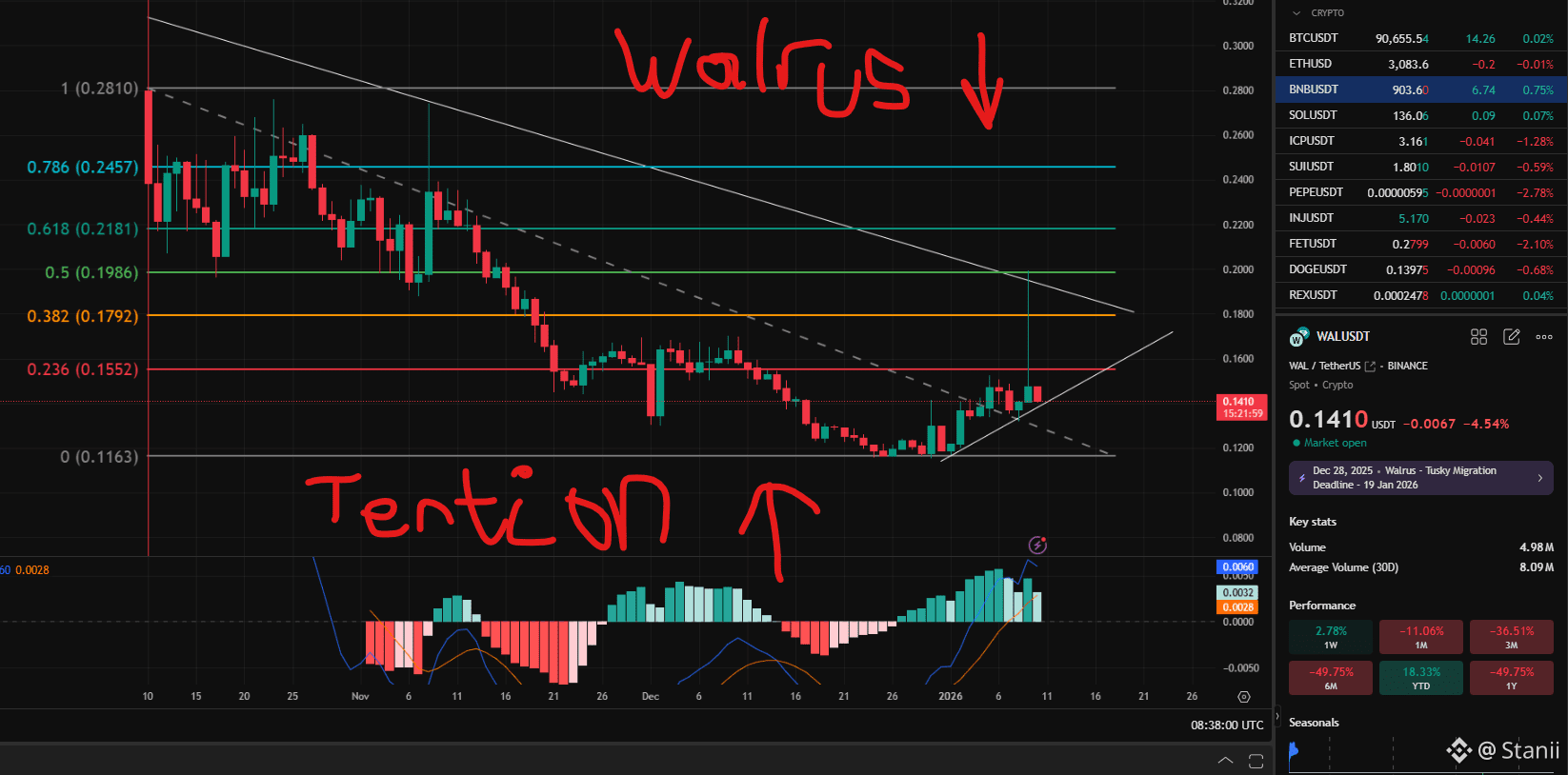

Sooo here is the article on @Walrus 🦭/acc , daily chart is attached .. have a look at it ..

we can see that the prices are bouncing off levels, we see the fib drawn from top around .2810 down to bottom .1163 and the price ran up to meet the 0.5 fib around .1986 and got rejected hard and dipped again, that rejection shows sellers still heavy above .18 ...... so we can say that the fib is real, not just noise, levels matter like magnets if crowd respects them…. price right now according to markets is around $0.14–$0.1445 depending where you look, this is the current live WAL price, and 24h volume is big ... around $28m+ in real traded volume most recent feeds (so people are active) and market cap over $200m range on Sui and on Binance spots.

on our daily MACD ... momentum climbed from deep red histogram and negative lines toward zero zone, it crossed some signal recently and histogram turned green and then flattened a bit, that tells you momentum is real but not yet ripping into new trend ... so daily MACD is “tension” but not confirmed breakout, you need bigger green expansion and above key fib zones to shift the narrative. image shows that spike then pullback .... classic retest. the trendline you drew from the recent lows is holding right now as support, so price is alive, inside this wedge it’s squeezing, yeah that building tension feels real.

look at the volume now for a moment... if volume climbs while price holds this ascending support, that’s how breakouts begin, not the other way. there was a volume pick up during that big candle that hit near .18–.20 range, then sellers stepped in, but it tells us walrus isn’t dead. some of this volume is on Binance, others decentralized too. don’t ignore volume as indicator of crowd participation, it’s pretty high for the market cap.

now coming to the utility part of this ... #walrus Protocol isn’t just a memecoin or random hype token, it’s infrastructure for decentralized storage markets, built on the Sui blockchain, aimed at solving data availability and storage cost problems for future AI and blockchain apps. you pay storage, pay fees, and that creates real usage of the network, not just speculation. there’s on-chain gas burn/decentralization implications tied into the Sui gas model, meaning large usage ties back to SUI deflation and real crypto economic flows. the protocol is actively building data markets and storage layers meant for real apps.

The key to a better understanding is that you zoom into daily, note price around .14, check if trendline support holds, check volume bars if they grow on green days, check MACD histogram if it keeps expanding green instead of fading, and check your fib zones .382 around .179 and .5 around .1986 are still resistance confluences those are the levels crowd watches. if price closes above those with decent volume, shift bias up, if it fails again and breaks support, then retest lower zone near fib .236 .155 and below. daily momentum and fib vibe become narrative. that looks like what you’re feeling in the pic, tension, waiting, squeeze.

$WAL has

• decentralized data storage network where providers get paid and users get storage guarantees.

• token $WAL used for fees, incentives, governance-like network participation.

• integrative demand from Sui ecosystem and potential external use as data needs grow.

so right now it’s not just price, it’s volume + fib rej + MACD plus the tension all telling you to watch the daily support and resistance levels closely ... traders watching those are real ones, not random hype. that’s why people are still trading and volume stays alive even when price isn’t ripping, because the utility and protocol story stays in the background, feeding demand even when the market is sideways.

now the choice is yours... if you wana buy it in spot be my guest .... if you wanna SHORT it ... all is upto you ... But do let me know in the comment section below about your thoughts and opinions on this ..