Following its explosive start to 2026, $XRP stands at a critical juncture. Hailed by CNBC as the "hottest crypto trade" for its 20-25% weekly surge that outpaced Bitcoin and Ethereum, the token has undoubtedly reclaimed market attention. However, beneath the headlines of outperformance lies a more nuanced picture of technical indecision and a battle between institutional accumulation and persistent fundamental questions. This analysis breaks down the last 7 days, the key levels to watch, and what might come next.

🔍 Weekly Snapshot & Technical Position

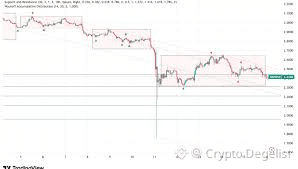

After a brutal Q4 2025, XRP opened 2026 near $1.84 and rocketed to a high of $2.38 by January 6—a staggering ~25-28% gain in a single week. This rally decisively broke through the psychological $2.00 resistance but has since cooled, with the price consolidating around $2.10 - $2.30.

Current technical indicators paint a picture of high volatility and conflicting signals. The overall market sentiment is classified as Bearish with "Extreme Fear" on the Fear & Greed Index, yet key momentum oscillators like the RSI are in neutral territory.

Critical Technical Levels to Watch:

Immediate Resistance: $2.22 - $2.40. A sustained break above this zone is needed to confirm the bullish breakout and target higher levels.

Key Support Zone: $2.01 - $2.12. This area has acted as a historical floor for buyers. A breakdown below could signal a deeper correction.

Major Bearish Threshold: $1.85 - $1.77. A drop to this level would invalidate the current bullish structure and likely trigger further sell-offs.

⚖️ The Bull vs. Bear Fundamentals

The market's divide is rooted in two powerful, opposing narratives.

THE BULLISH PILLARS

✅ Record ETF Inflows: U.S. spot XRP ETFs absorbed $1.3 billion in just 50 days with zero daily outflows, locking up millions of tokens

✅ Supply Squeeze: Exchange balances dropped 57% in 2025, one of the largest annual reductions on record, shrinking readily available tokens

✅ Regulatory Clarity: The 2025 resolution of the SEC lawsuit removed a major overhang, reopening doors for U.S. institutions and exchanges

THE BEARISH PILLARS

⚠️ Supply Overhang: Despite reductions, XRP's large circulating supply (approx. 57B) remains a headwind. Ripple's monthly escrow releases add consistent sell pressure

⚠️ Utility-Price Disconnect: XRP's utility in RippleNet for cross-border settlements is proven, but this does not necessarily require long-term token holding, limiting value capture

⚠️ Macro Dependence: Like all risk assets, XRP's trajectory is tied to Federal Reserve policy. Delayed rate cuts or renewed inflation could cool investor appetite

🎯 Price Outlook: A Spectrum of Possibilities

Predictions for $XRP in 2026 vary wildly, reflecting its volatile and catalyst-driven nature.

Conservative Short-Term (Jan 2026): AI models like ChatGPT suggest a consolidation around $2.15 by month-end, describing XRP's tendency to "grind rather than explode".

Base Case (2026): Many analysts foresee a range of $2.50 - $3.50, assuming steady ETF inflows and gradual adoption without explosive new catalysts.

Bull Case (2026): Institutions like Standard Chartered project $8.00, predicated on massive ETF inflows ($4-8B) and XRP capturing significant cross-border settlement flows. Some technical analyses see a path to $3.26 if momentum holds.

Aggressive Long-Term: Speculative analyst targets (like $33-$50) exist but are highly controversial and would require unprecedented adoption and market cap expansion.

💎 The Verdict: Strength Meets Skepticism

XRP enters 2026 with its strongest institutional foundation ever, proven by undeniable ETF demand and a tightening supply landscape. The bullish case is more credible than it has been in years.

However, the path to $4 or beyond is not guaranteed. It requires near-perfect execution: sustained ETF inflows, a break above $2.40 resistance, and tangible growth in token utility. Investors should watch $2.00 support as the key level holding the current thesis together. The coming weeks will reveal whether this rally is the start of a major re-rating or another chapter in $XRP volatile history.