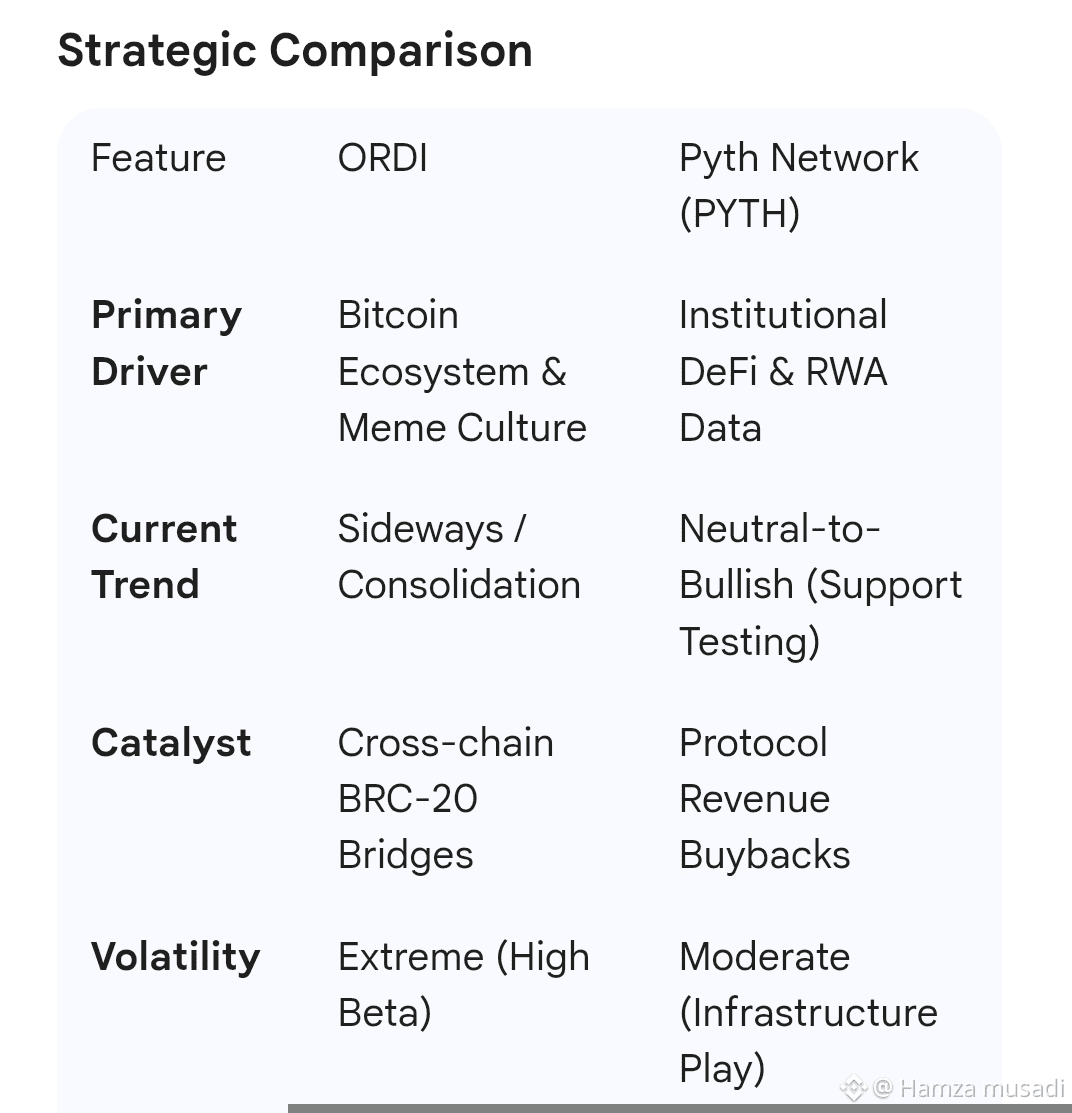

In early 2026, ORDI and Pyth Network (PYTH) serve as foundational assets in two different sectors: ORDI as the benchmark for Bitcoin inscriptions (BRC-20) and PYTH as the institutional-grade oracle for DeFi.

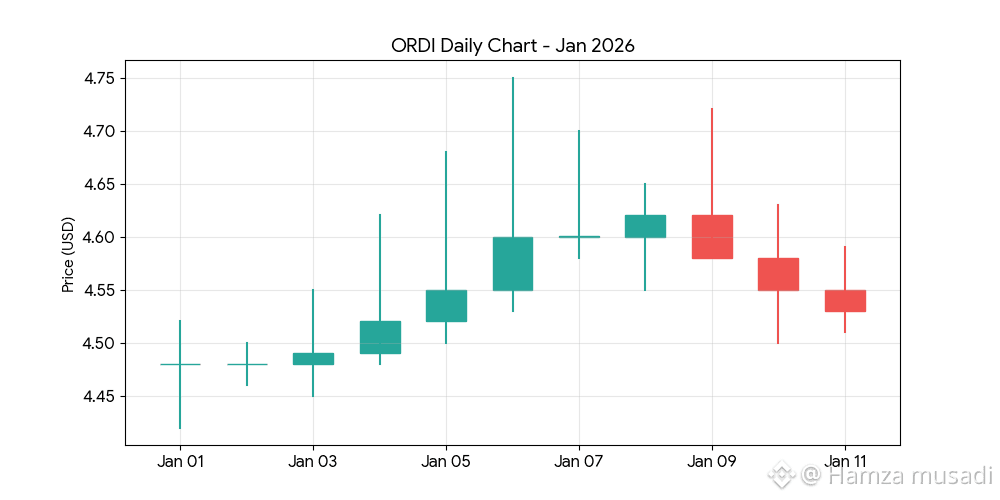

1. ORDI Coin Analysis

ORDI continues to act as a high-leverage "beta" for the Bitcoin ecosystem. Its performance is intrinsically tied to Bitcoin's price action and the ongoing development of the Ordinals protocol.

Ecosystem Evolution:

The primary narrative for ORDI in 2026 is cross-chain interoperability. Integrations with bridges like BitVMX (connecting to Cardano) and LayerZero support (connecting to over 70 chains) have transformed ORDI from a static inscription into a mobile utility token.

Market Sentiment:

As of January 12, 2026, ORDI is in a consolidation phase. While it hit periodic highs near $$4.75 earlier in the month, it has recently stabilized around the $$4.50 level. Technical indicators show a neutral RSI (around 53), suggesting the market is waiting for a decisive Bitcoin move before picking a direction.

Key Risks:

Liquidity remains a concern. With an annualized volatility of nearly 98%, ORDI is prone to sharp "flash crashes" if Bitcoin experiences sudden deleveraging.

2. Pyth Network (PYTH) Analysis

PYTH has successfully pivoted from being "the Solana oracle" to an industry-wide data standard, particularly for Real-World Assets (RWA) and institutional finance.

Institutional Growth:

The launch of Pyth Pro (institutional data subscriptions) has created a significant revenue stream. In early 2026, the protocol began redirecting 33% of revenue toward a buyback program, creating structural demand for the token.

Network Expansion:

Following the finalized Cardano integration on January 5, 2026, PYTH has seen a surge in Total Value Secured (TVS). It now provides data feeds for a vast array of assets, including Hong Kong equities and global ETFs.

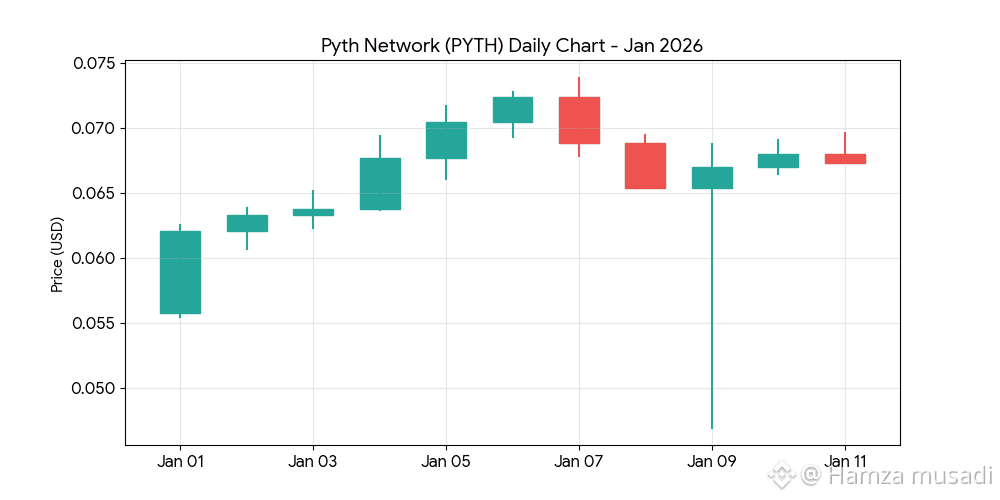

Price Action:

PYTH showed strong bullish momentum in the first week of January, rising from $$0.055 to a peak of $$0.073. It is currently testing a major support zone around $$0.067 after a slight cool-off, mirroring the broader altcoin market's "sideways" trend.