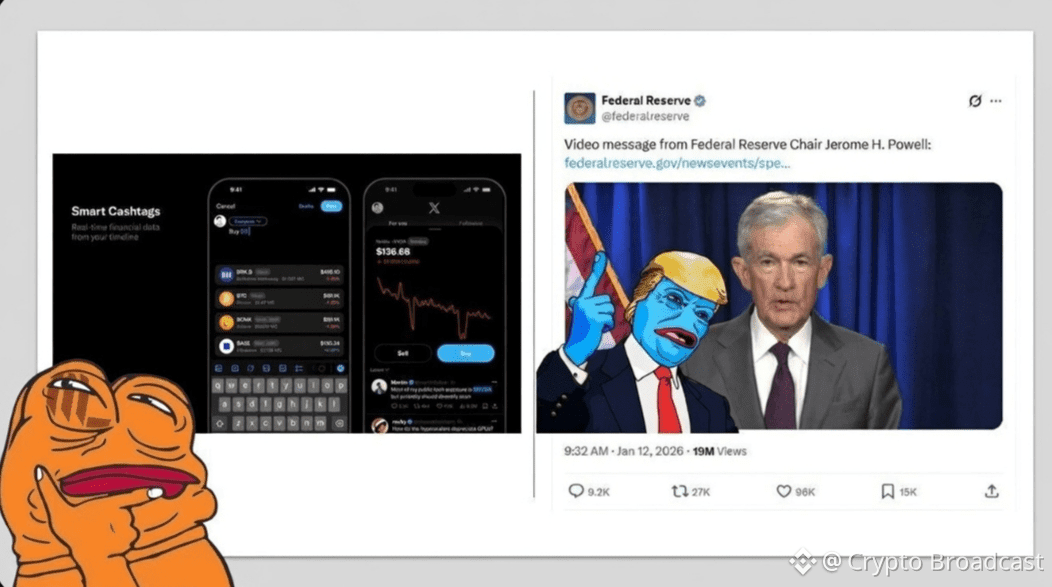

- DOJ is threatening the Fed with criminal charges for refusing to follow President Trump's interest rate demands

- X to launch Smart Cashtags for real-time tracking

- $ZAMA Binance, Bybit Perpetual Listing (Pre-Market)

- $FOGO Binance, Bybit Perpetual Listing (Pre-Market)

- $TRU Exploit $26.6M, token to plunge 99.9%

- $PUMP Pump.fun plan to change Creator fees, alon is back

- $XRP Ripple secures UK FCA regulatory approvals

- Vitalik Buterin has thrown his public support behind Tornado Cash developer Roman Storm

- $IMU Announces TGE Event on January 22

- $MEGA MegaETH NFTs will be live on opensea

- Stablecoin firm Rain raised Series C and reached a $1.95 billion valuation

- BNY debuts tokenized deposits for institutional clients

- a16z raises $15B for US tech leadership

- Nasdaq and CME deepen crypto investing partnership

- VitalikButerin: Three pillars for better decentralized stablecoins

- SharpLink deploys $170M ETH for institutional yields

—————————————————

• Jerome Powell says The Department of Justice issued grand jury subpoenas to the Federal Reserve, threatening criminal indictment over my June Senate testimony regarding a historic building renovation project. he said This unprecedented action is not truly about the testimony or renovations, but stems from the Fed’s independent decisions on interest rates that differ from the President’s preferences.

• X is launching 'Smart Cashtags' that allow you to specify the exact asset (or smart contract) next month to enable real-time price tracking and specific asset identification directly from the timeline.

• $TRU - Truebit protocol suffered a $26.6M exploit due to a smart contract vulnerability, causing its TRU token to plunge 99.9%, Bug was in a 5-year-old Purchase contract. Pricing flaw allowed minting billions of $TRU for almost $0.

• Dynamic Fees V1 effectively incentivized high-quality Project Tokens but overly rewarded low-risk memecoin creation, discouraging trading activity while offering poor UX and limited real utility for boosting token value.Major market-driven changes are planned for 2026, shifting the system so traders decide which narratives truly deserve Creator Fees and how they should be used, prioritizing trading and liquidity over excessive coin-launch incentives.

• $XRP - Ripple has secured key regulatory approvals from the UK’s FCA, including an EMI license and cryptoasset registration. The firm’s approval comes one day after the FCA shared new details about the permissions required for firms seeking to conduct regulated crypto asset activities in the country when its new regulation commences in 2027.

• $ETH, $TORN - Ethereum co-founder Vitalik Buterin has thrown his public support behind Tornado Cash developer Roman Storm—who was convicted last August of a money transmitting charge. Storm was charged in 2023 with conspiracy to commit money laundering, conspiracy to violate sanctions, and conspiracy to operate an unlicensed money transmitting business.

• $IMU - Immunefi is the largest Web3 bug bounty platform that connects blockchain projects with security researchers to identify and responsibly disclose critical vulnerabilities in exchange for rewards.

• $MEGA - MegaETH NFTs will be live on opensea. App devs are busy deploying to @megaeth during its "Frontier" phase ahead of the full mainnet release.

• Stablecoin firm Rain reached a $1.95 billion valuation following its latest funding round. Rain plans to utilize the newly raised capital to expand its global payment infrastructure and accelerate the development of regulatory-compliant stablecoin solutions for institutional investors.

• BNY, the world's largest custodial bank with nearly $58 trillion in assets under custody, is launching tokenized deposits for institutional investors to enhance settlement efficiency. The platform mirrors client balances on a private blockchain to enhance settlement speed and liquidity management.

• Andreessen Horowitz has raised $15 billion in new capital to bolster U.S. leadership in AI, defense, and emerging technologies(a16z). This capital will be focused on investments to ensure America wins in key future technologies such as AI and crypto, and to apply these technologies to critical areas that drive human flourishing—including biology, health, defense, education, and more.The ultimate goal is to secure America's technological dominance for the next 100 years, thereby preserving and strengthening the "American system" that gives opportunities to people around the world.

• Nasdaq and CME Group are deepening their partnership to advance the infrastructure and investment opportunities for the crypto market