SOL/USDT Shows Recovery Above Key Support — Technical & Fundamental Outlook

SOL/USDT Shows Recovery Above Key Support — Technical & Fundamental Outlook

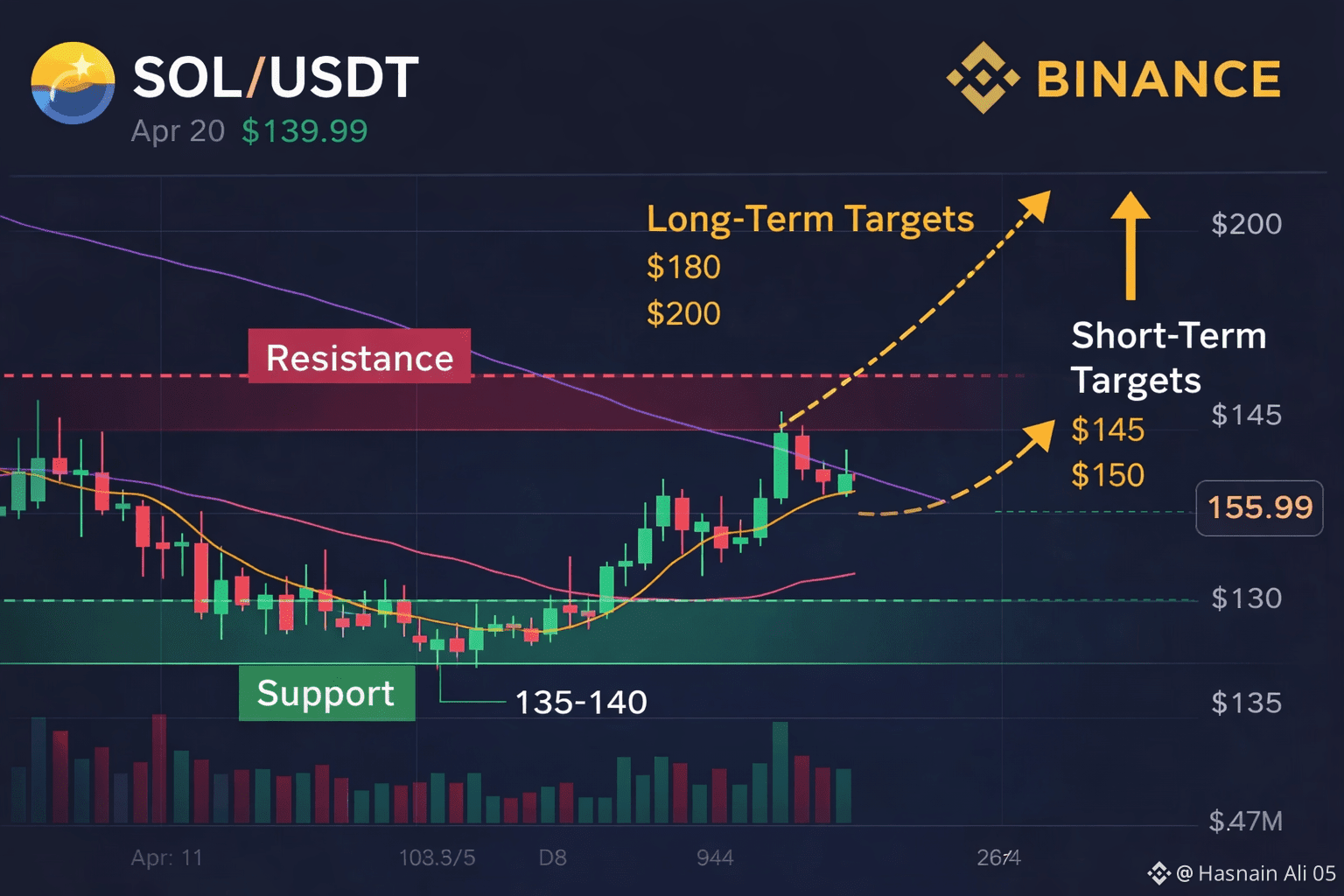

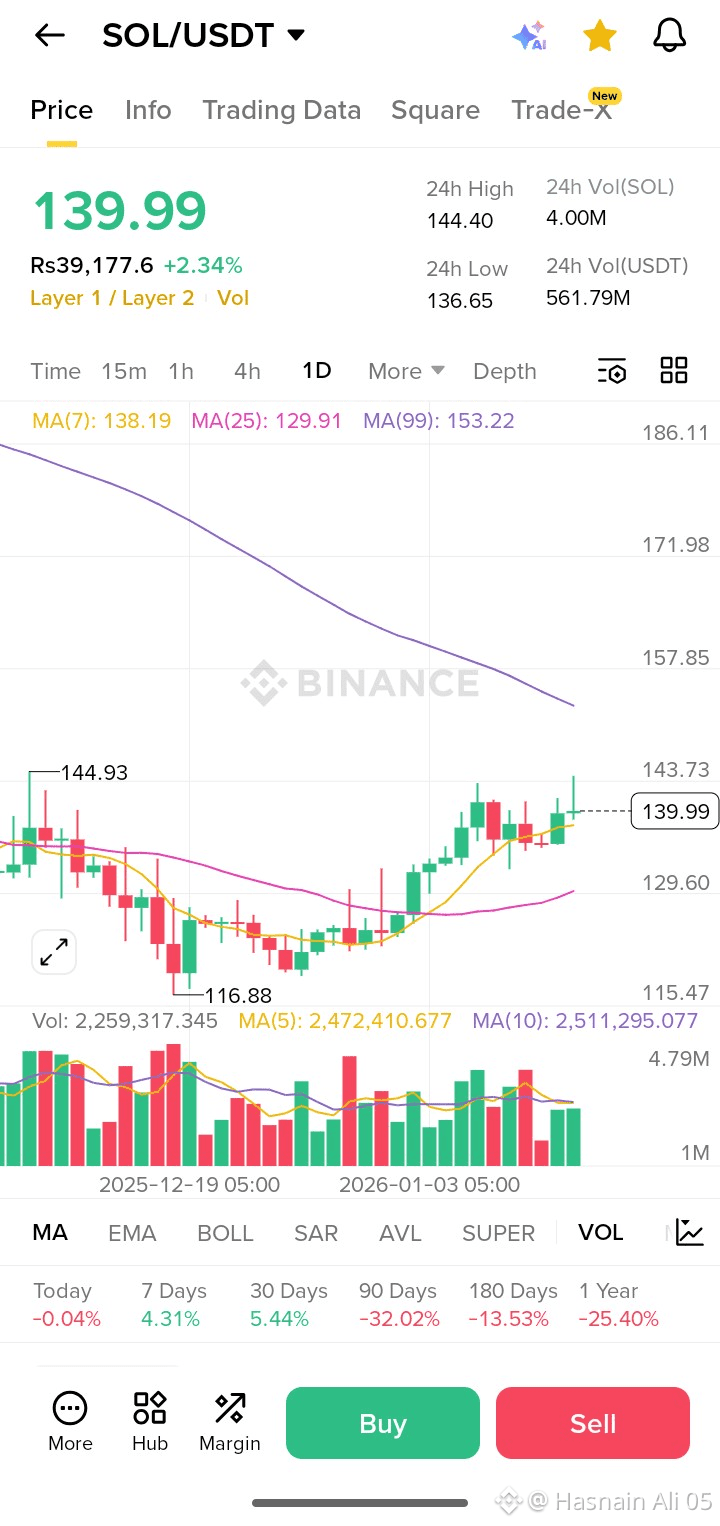

Solana (SOL/USDT) is currently trading around 139.99 USDT, based on the latest Binance daily chart. The price is showing early signs of recovery after forming a recent low near 116.88, indicating that selling pressure has weakened at lower levels.

From a technical perspective, SOL is trading above its short-term moving average (MA 7 ≈ 138.19), which suggests short-term bullish momentum. Price is also stabilizing above the 135–138 support zone, a level that previously acted as resistance and has now flipped into support, confirming a positive structure shift.

However, the price is still trading below the long-term MA (MA 99 ≈ 153.22), which means the broader trend remains neutral to slightly bearish until SOL reclaims the 150–155 resistance area. A daily close above this zone could open the door for stronger upside continuation.

Volume data shows steady participation without extreme spikes, suggesting organic buying rather than speculative pumps. This improves the reliability of the current price recovery.

From a fundamental standpoint, Solana continues to benefit from its high-speed, low-cost Layer-1 infrastructure, which supports DeFi, NFT, and real-world asset experimentation. Network activity and developer engagement remain key long-term strengths for the Solana ecosystem.

Recent market behavior also shows that large-cap altcoins like SOL are attracting attention whenever overall crypto sentiment stabilizes, especially alongside Bitcoin holding key support levels. This supports a constructive medium-term outlook.

Short-Term Outlook (1–2 weeks):

If SOL holds above the 135 support level, the next upside targets are 145 and 150. A rejection from this zone could lead to consolidation between 135 and 145.

Long-Term Outlook (3–6 months):

If broader market conditions improve and SOL reclaims the 150–155 range, long-term targets may extend toward 175–200. Failure to hold 130 would weaken this outlook and shift sentiment bearish.

This analysis is based on real-time Binance price data, moving averages, and volume behavior observed on the daily timeframe. Market conditions can change rapidly, so risk management remains essential.

Disclaimer:

This content is for educational and informational purposes only and does not constitute financial advice. Cryptocurrency markets are volatile, and readers should conduct their own research before making any investment decisions.