For years in crypto, we have actually been stuck with a false choice. On one side, you have the transparent, compliant chains where every transaction is an open book for regulators and competitors alike. On the other, privacy protocols that feel like stepping into a black box, raising immediate red flags for any institution with a legal department. The narrative has been that you must choose one or the other, auditability or confidentiality. My review of DUSK's approach suggests they are built from the ground up to reject that compromise entirely. Their core proposition is not just adding a privacy feature, it is engineering a new financial layer where privacy and compliance are not opposites, but integrated, dependent functions.

What really caught my attention when I first dug into their whitepaper was the foundational logic. Most projects start with a technology and seek a problem. DUSK started with a specific, institutional grade problem, how to conduct confidential transactions that can still be proven valid and selectively disclosed to authorized parties, and then architected a suite of technologies to solve it. They are not trying to hide everything, they are creating a system where everything can be verified without being unnecessarily exposed. This shifts the paradigm from "privacy versus compliance" to "privacy enabling compliance". In a climate where regulatory scrutiny is the dominant theme, not a side plot, this is not just a technical novelty. It is a potential prerequisite for the next phase of institutional capital and complex financial instruments on-chain.

The magic, as it were, is not magic at all. It is a deliberate application of zero knowledge proofs (ZKPs) within a purpose built Layer 1. DUSK's platform uses what they call the "Citadel" protocol. To me, this is the crucial piece. It does not just obscure data. It allows a participant to prove they are following the rules, that a transaction is solvent, that a user is accredited, that a security law is being obeyed, without revealing the underlying sensitive information that proves it. Think of it not as a curtain, but as a notarized, sealed envelope. The notary's stamp on the outside (the zero knowledge proof) verifies the contents are legitimate and orderly, but you need the right key and legal authority to open it and see the details. This makes their technology particularly relevant for tokenized real world assets (RWA), confidential DeFi, and even voting, where you need to prove eligibility and prevent double counting without exposing individual choices.

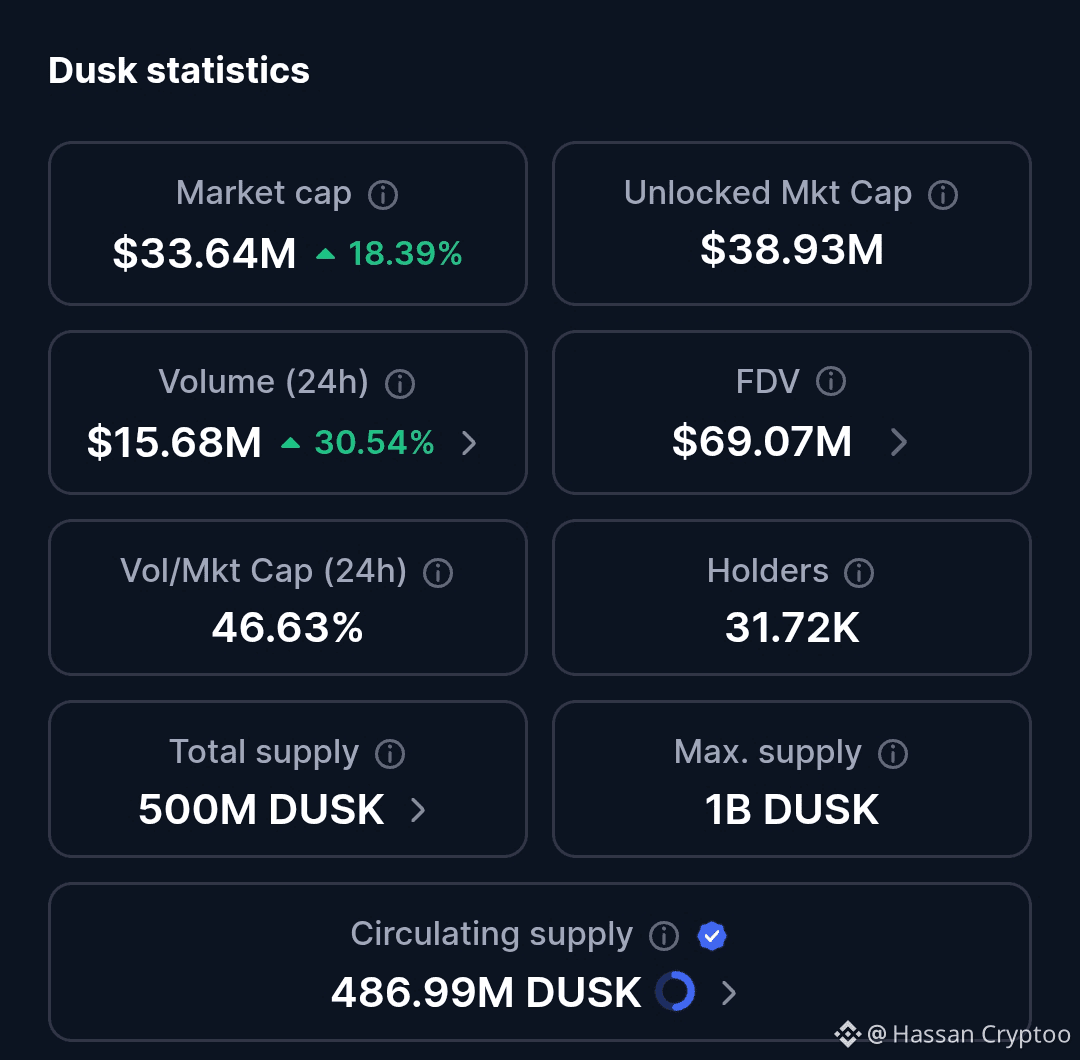

Analyzing the DUSK token's position on CoinMarketCap as of today offers a grounded view of its market standing. With a market capitalization hovering around $90 million, it sits outside the top 200 cryptocurrencies. This places it firmly in the infrastructure specialist category rather than the mainstream medium of exchange narrative. The circulating supply is notably high against its maximum, indicating the major inflation events are likely in the past. What stands out to me is the correlation between its stated niche and its valuation. Rather than pursuing the trend of meme coins or consumer payment systems, DUSK’s core worth is fundamentally tied to the integration of compliant, confidential financial services on a blockchain. The network’s token, DUSK, functions as both its essential resource and a mechanism for governance. It is used to secure the chain through staking, pay for transaction fees, and participate in reaching network consensus. In my analysis, its price trajectory will depend less on general market mood and more directly on actual adoption of the protocol by businesses and financial entities.

This leads to the practical question: "what are they currently doing?" question. A review of their official X account and news feed reveals an emphasis on foundational development rather than hype. Their most recent developments, including the partnership with "Hyaliko" in March to explore asset tokenization in the automotive industry, along with ongoing progress on their confidential DeFi suite, act as concrete validations of their real-world use. Rather than advancing vague "integrations," they are showcasing actual tests of their core technology built for compliant financial operations. In a technical update, the team underscored advances on their "Siebren" testnet, which is expressly customized for evaluating these confidential smart contracts. This methodical, builder centric communication is what you would expect from a project targeting a B2B and institutional audience, not a retail trading crowd.

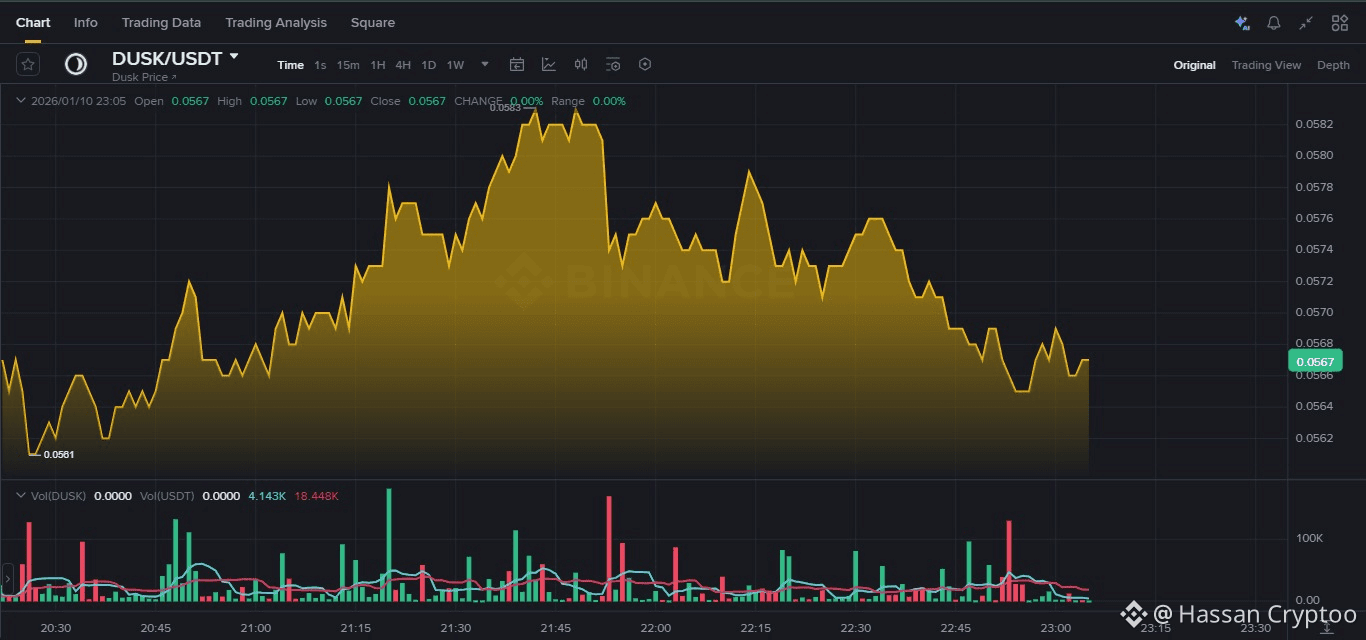

Let us talk about the chart perspective from Binance Spot. The price action for $DUSK over the past year tells a story of consolidation after the volatility of previous cycles.The price action has remained confined to a specific range, missing the powerful, consistent directional momentum seen in assets fueled by strong narratives. When analyzing longer-term charts, clear support and resistance levels become apparent, showing where the price has historically met reaction points. Volume behavior shows phases of quiet accumulation punctuated by sharp increases following updates on the network's progress or collaborative agreements. The current formation aligns with its core fundamental narrative. Based on this analysis, my evaluation suggests that DUSK is currently forming a foundation. Its next significant price movement will likely be driven by a major technical milestone or a key institutional alliance, rather than just a broad altcoin market rally.

For a project such as DUSK, the real challenge lies not only in sophisticated technology but in securing legal and market approval. Can their selective disclosure framework satisfy the specific demands of EU's MiCA, or the SEC's focus on investor protection. The whitepaper and their public discourse are clearly framed with these questions in mind. They are attempting to presolve regulatory objections by baking audit trails into the protocol's DNA. This is a high stakes, long term game. It is not about going viral next week. It is about patiently demonstrating to regulators and Fortune 500 treasuries that there is a viable, superior path forward. In my view, that makes DUSK one of the more consequential experiments in the space, a bet that the future of multi trillion dollar asset classes on-chain depends not on maximal privacy or maximal transparency, but on a sophisticated, programmable balance of both.

by Hassan Cryptoo