$XAG is currently experiencing a strong bullish trend, with prices trading around $84.25 to $84.50. This rally is supported by several factors, including safe-haven demand, expectations of Fed rate cuts, and geopolitical tensions.

Technical indicators suggest continued upward momentum:

Ascending Channel: Silver is trading within an ascending channel pattern, indicating a sustained bullish bias.

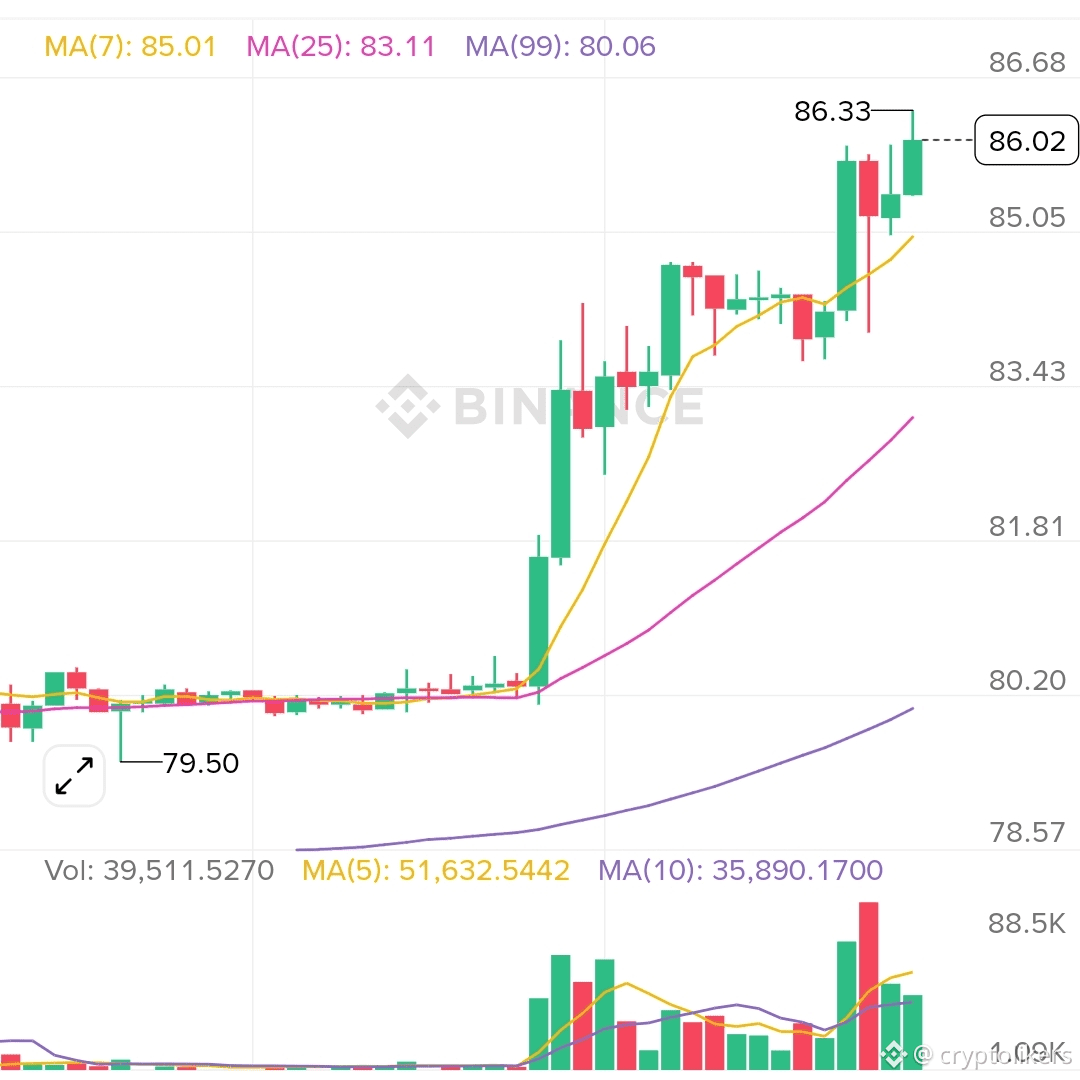

Moving Averages: Prices are well above the 50-EMA and 200-EMA, both of which are sloping upward, confirming the bullish trend. The short-term moving average is also rising above the medium-term moving average.

RSI: The Relative Strength Index (RSI) is currently around 70.66, signaling overbought conditions. While this might suggest a potential for near-term consolidation or a brief pause, the strength of the uptrend could see the RSI reach even higher levels before a significant correction.

Key Resistance and Support Levels:

Resistance: Immediate resistance is seen around $85.66 to $85.87, which is a recent all-time high. A break above this level could open the way for targets around $88.73, and potentially $92 based on Fibonacci resistance. If XAG/USD clears $86.00, the next resistances are $86.50 and then $87.00.

Support: The nine-day EMA at $77.94 serves as primary support. Further support is found around $82.03, which was a previous breakout level, and then $79.77. A decline below $85.50 could see support at $85.00. A breakout below the 65.05 area would cancel the upward trend, potentially leading to a decline below $57.45.

Forecasts and Predictions:

Some analysts predict that silver prices could continue to rise with a target above $96.75.

Long-term projections suggest an average price of around $126.74 by the end of 2030 and approximately $140.12 by the end of 2036.

Other predictions indicate a potential increase to $220.89 by mid-year, with a range between $191.11 and $267.37.

There are also discussions about the increasing demand for silver from industrial sectors, such as electric vehicle (EV) batteries and solar panels, which could significantly impact prices.

Factors to Watch:

US CPI data is being closely watched, as expectations of 0.3% monthly inflation could further reinforce gold's (and by extension, silver's) rate-cut driven momentum.

Geopolitical factors and central bank policies will continue to influence silver prices.#XAG