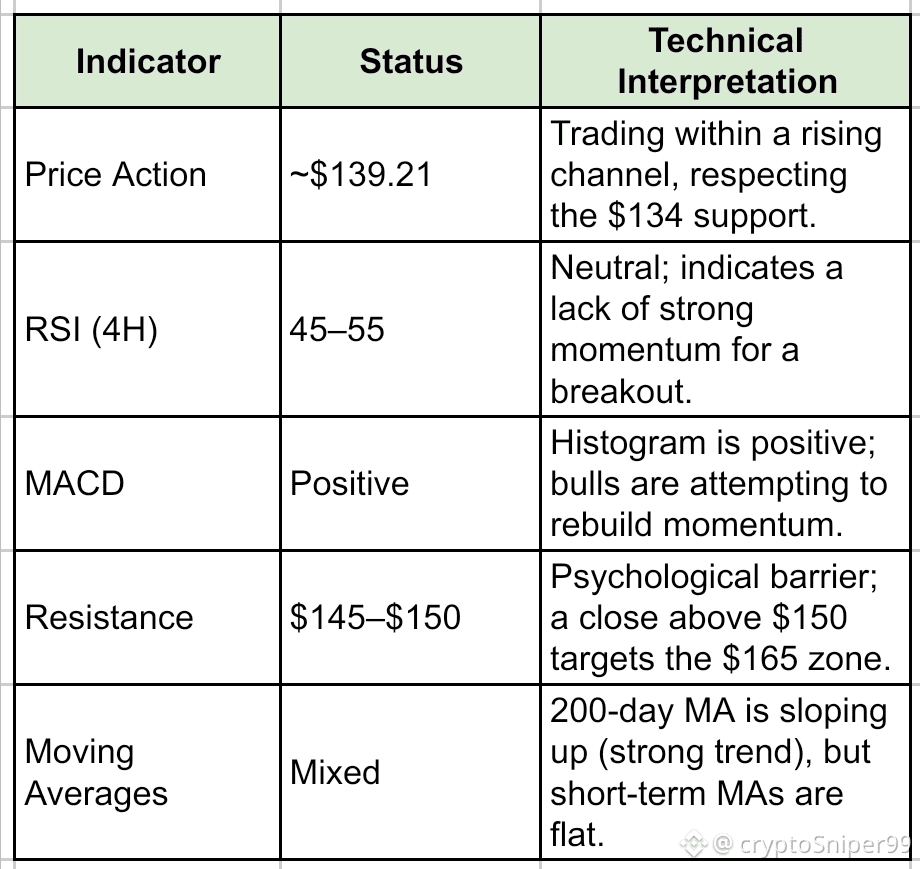

As of January 13, 2026, Solana (SOL) is trading at approximately $139.21, demonstrating a resilient recovery with a 2.46% gain in the last 24 hours. The token has recently found strong support in the $134–$136 demand zone, attempting to break through significant overhead resistance near the $145–$150 range.

1. Tokenomic Insights: The Productivity Premium

Solana’s economic model in 2026 has evolved from speculative asset to a "productive treasury staple".

* Staking Yield: SOL offers a native staking yield of approximately 7%, which has attracted massive institutional interest, including over 2.2 million SOL held by major firms.

* Deflationary Mechanics: The network balances ongoing issuance with fee-based burns that partially offset inflation, especially during periods of high on-chain activity.

* Institutional Vehicles: Spot Solana ETFs officially surpassed $1 billion in total Assets Under Management (AUM) in early January 2026, led by Bitwise (BSOL) and Grayscale (GSOL).

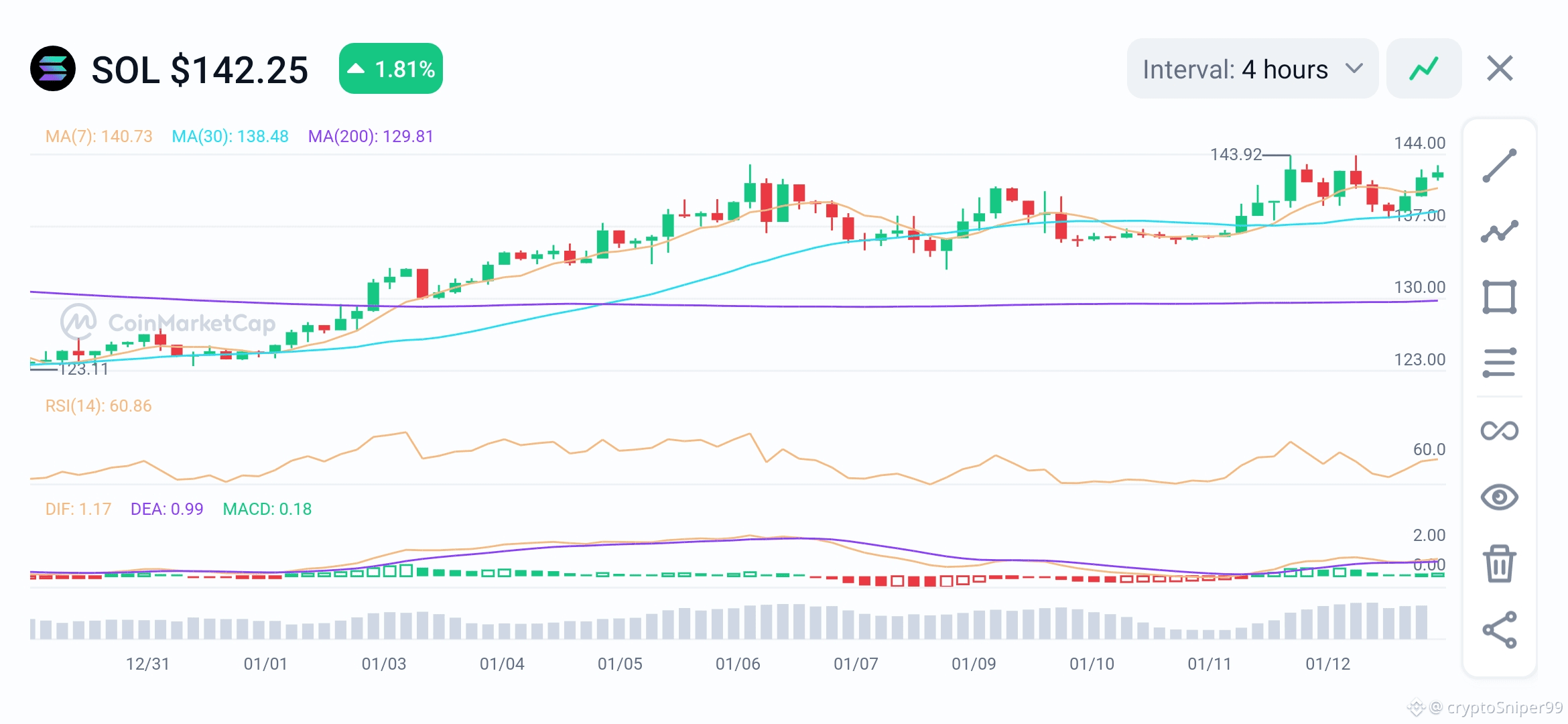

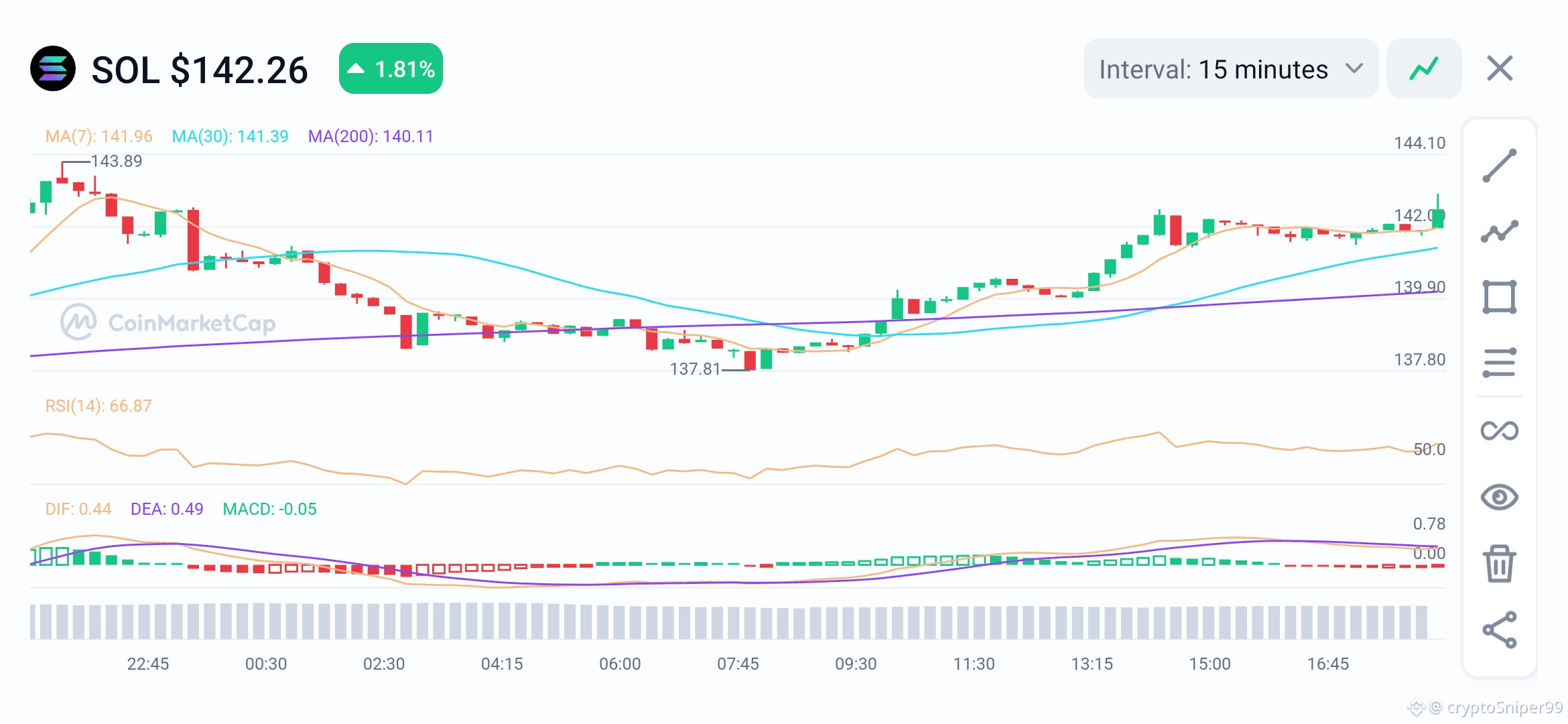

2. Technical Analysis: The Battle for $150

Current candle charts and indicators suggest a cautiously bullish but range-bound market structure.

The market is currently characterized by "builder momentum," with strong development activity contrasting against relatively muted price movement.

3. Profitable Trading Strategy for SOL/USDT

To navigate the current SOL/USDT landscape, traders should adopt a strategy that accounts for institutional accumulation and technical resistance.

The "Channel Bounce" Strategy (Short-term)

* Entry Zone: $132–$136. This area has been defended several times during recent pullbacks and aligns with the rising channel support.

* Target (Take Profit): $145–$149. This is the immediate "oversupply" zone where sellers have previously rejected price advances.

* Stop-Loss: Below $120. A decline under $120 would signal a breakdown of the short-term bullish structure.

The "Breakout Confirmation" Strategy (Medium-term)

* Entry Trigger: A decisive daily candle close above $150 with high volume.

* Target: $165–$180. Success here would open the door for a retest of early 2026 highs.

* Key Catalyst to Watch: Monitor news regarding the "Alpenglow" mainnet upgrade and new ETF filings, such as the one recently submitted by Morgan Stanley.