$BTC Bitcoin has been trading in a consolidation phase since the beginning of 2026, with prices generally fluctuating between the high-$80,000s and mid-$90,000s. This suggests the market is processing previous movements and moving towards a more established price discovery phase.

Here's a brief analysis of recent Bitcoin activity:

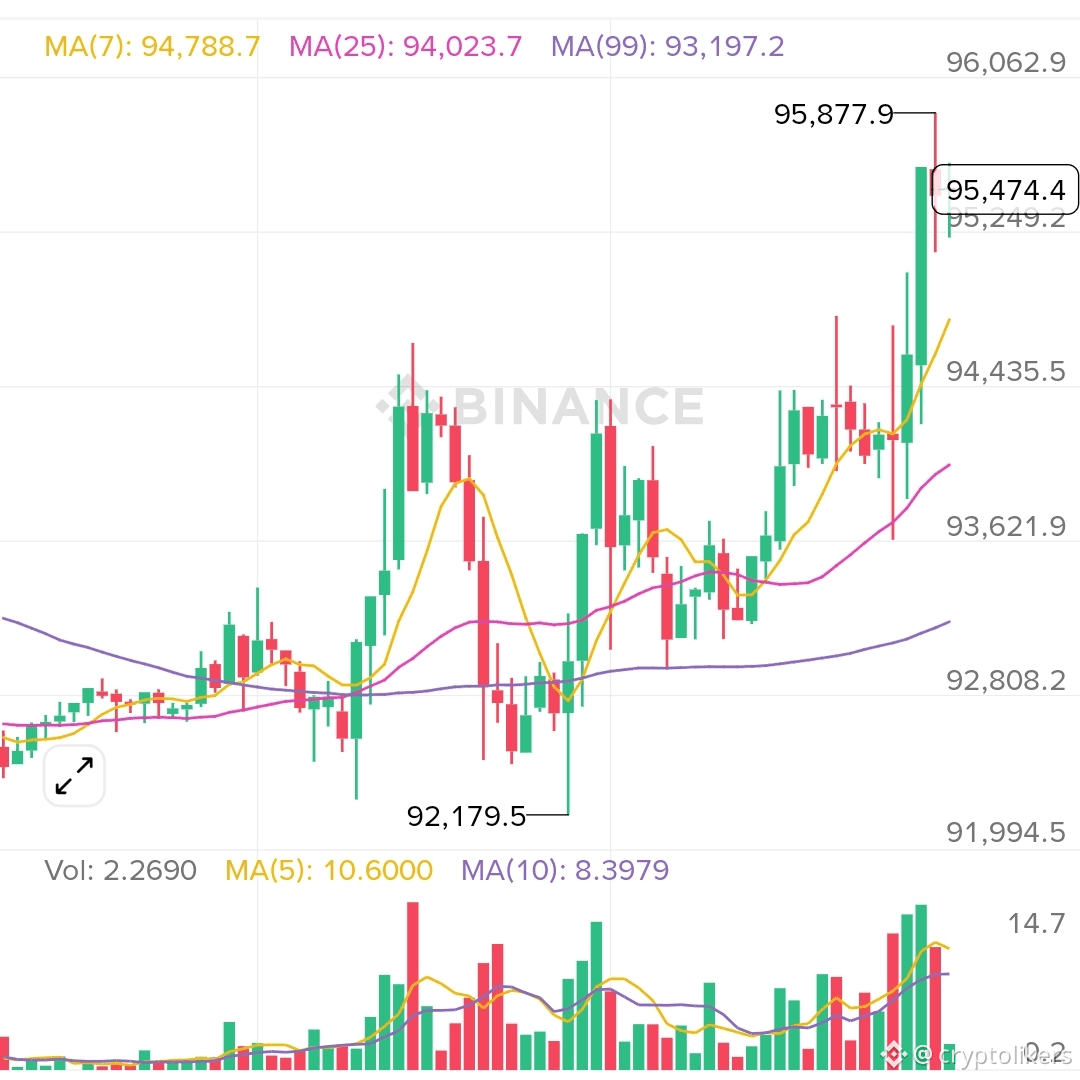

Price Action: Bitcoin is currently trading near $92,221, holding above a support level of $91,298, and is targeting the $93,471 resistance. A break above this resistance could lead to a move towards $95,000.

Technical Indicators:

Bitcoin is moving within a rectangle formation with support at $87,570 and resistance at $93,843. A decisive move beyond these levels would indicate a new direction.

The currency is in a short-term rising trend channel, indicating increasing optimism among investors.

The RSI (Relative Strength Index) shows a rising trend, supporting the positive short-term outlook.

However, Bitcoin has broken the floor of its long-term rising trend channel, suggesting a potentially weaker rising rate initially. Long-term, the RSI curve shows a falling trend, which could signal the start of a downward trend.

Key Resistance and Support:

Near-term resistance is at $93,000, and a break above this would be a positive signal.

A significant resistance area lies between $94,095.33 and $94,766.54, which has previously thwarted upside attempts. A daily close above $94,766.54 could lead to a rally towards $100,000.

Long-term support is at $74,000 and resistance at $107,000.

Market Sentiment: Investor sentiment has improved, with shrinking unrealized losses across the network. This suggests stabilization rather than exuberance and a greater willingness among holders to await further upside.

Macroeconomic Factors: Macroeconomic uncertainty, evolving institutional participation, and shifting investor sentiment continue to influence Bitcoin's performance. The US Senate's Digital Asset Market Clarity Act, with markup set for January 15, 2026, aims to establish a regulatory framework for Bitcoin, potentially enhancing oversight and transparency.