In an era where the tokenization of real-world assets (RWAs) has skyrocketed by 125% in a single year, reaching nearly $20 billion, a fundamental tension has become increasingly clear: how can blockchain technology reconcile the demands of institutional finance—compliance, auditability, and regulatory oversight—with the core Web3 principles of privacy and decentralization? Dusk Network aims to solve this by engineering not just a blockchain, but a full Decentralized Market Infrastructure (DeMI), purpose-built from the ground up to bridge these worlds.

Unlike other blockchains that adapt existing architectures for financial use, Dusk was designed with a single mission: to bring regulated, real-world assets to everybody's wallet by creating a blockchain that is both private and compliant. This article explores how Dusk's unique modular architecture, its groundbreaking Hedger privacy engine, strategic partnerships with regulated entities like NPEX, and its long-term tokenomics are positioning it as a pivotal player in the future of global capital markets.

Part 1: A Modular Architecture Engineered for Performance and Compliance

Dusk’s approach is distinguished by its three-layer modular stack. This separation of concerns allows each layer to be optimized for a specific function, creating a system that is more efficient, scalable, and easier to maintain than monolithic blockchains.

DuskDS: The Secure Settlement Foundation

This is the secure base layer, responsible for consensus, data availability, and final settlement. It uses a Proof-of-Stake mechanism called Succinct Attestation (SA), which is a committee-based protocol designed for fast, deterministic finality suitable for financial markets. Unlike many other blockchains, DuskDS employs an innovative peer-to-peer protocol named Kadcast instead of traditional Gossip protocols. Kadcast uses a structured overlay network to direct message flow, which drastically reduces bandwidth usage and makes network latency more predictable and lower. Crucially, DuskDS provides a native, trustless bridge for moving assets between execution layers.

DuskEVM: The Accessible Application Engine

This is where most developer and user activity occurs. DuskEVM is a fully EVM-equivalent environment, meaning developers can deploy standard Solidity smart contracts using familiar tools like MetaMask and Hardhat. This layer settles its transactions on the secure DuskDS base, inheriting its compliance and security guarantees while offering massive developer accessibility. For developers, building on DuskEVM feels like building on Ethereum, but with the added benefits of Dusk's regulatory-ready infrastructure.

DuskVM: The Specialized Privacy Layer

This component is a highly optimized, ZK-friendly virtual machine built around a WebAssembly runtime. It is fundamentally different from many blockchain VMs in that it natively supports zero-knowledge operations and handles memory in a unique way. It's dedicated to executing fully privacy-preserving applications using Dusk's original Phoenix transaction model.

This modular architecture allows the network to support multiple specialized execution environments, each optimized for distinct use cases, from Fully Homomorphic Encryption for confidential transactions to full EVM equivalency, all while inheriting the secure, compliant settlement guarantees of DuskDS.

Part 2: Hedger: The Cryptographic Bridge Between Privacy and Auditability

The standout innovation enabling Dusk's vision for regulated finance is Hedger, a new privacy engine purpose-built for the DuskEVM layer. Hedger is designed to bring confidential transactions to mainstream DeFi using a novel combination of advanced cryptographic techniques.

Core Cryptographic Design

Unlike systems that rely on a single technology, Hedger combines two powerful techniques:

· Homomorphic Encryption (HE): Based on ElGamal over Elliptic Curve Cryptography, HE allows computations to be performed directly on encrypted data. On Dusk, this enables operations like checking a balance or executing a trade without ever revealing the underlying numbers.

· Zero-Knowledge Proofs (ZKPs): These generate cryptographic proofs that verify a transaction is valid (e.g., proving a user has sufficient funds) without revealing any details about the sender, receiver, or amount.

This hybrid approach is designed specifically to meet the non-negotiable demands of regulated markets.

Key Institutional Capabilities

· Confidential Asset Ownership: Holdings, balances, and transfer amounts remain encrypted end-to-end, preserving privacy.

· Regulated Auditability: Despite the privacy, transactions are fully auditable by design. Authorized entities like regulators can be granted access to view transaction details when necessary for compliance, a critical feature for operating within legal frameworks.

· Obfuscated Order Books: Hedger lays the groundwork for hiding trading intent and exposure on-chain, a vital feature for institutional trading to prevent front-running and market manipulation.

· Seamless User Experience: Lightweight circuits allow clients to generate the necessary ZKPs in under 2 seconds directly in a web browser, ensuring the privacy features do not come at the cost of usability.

Part 3: Strategic Partnerships and Tokenomics: Building a Licensed Ecosystem

Technology alone cannot bring regulated assets on-chain. Dusk is actively building a licensed ecosystem through strategic partnerships and a carefully designed native token.

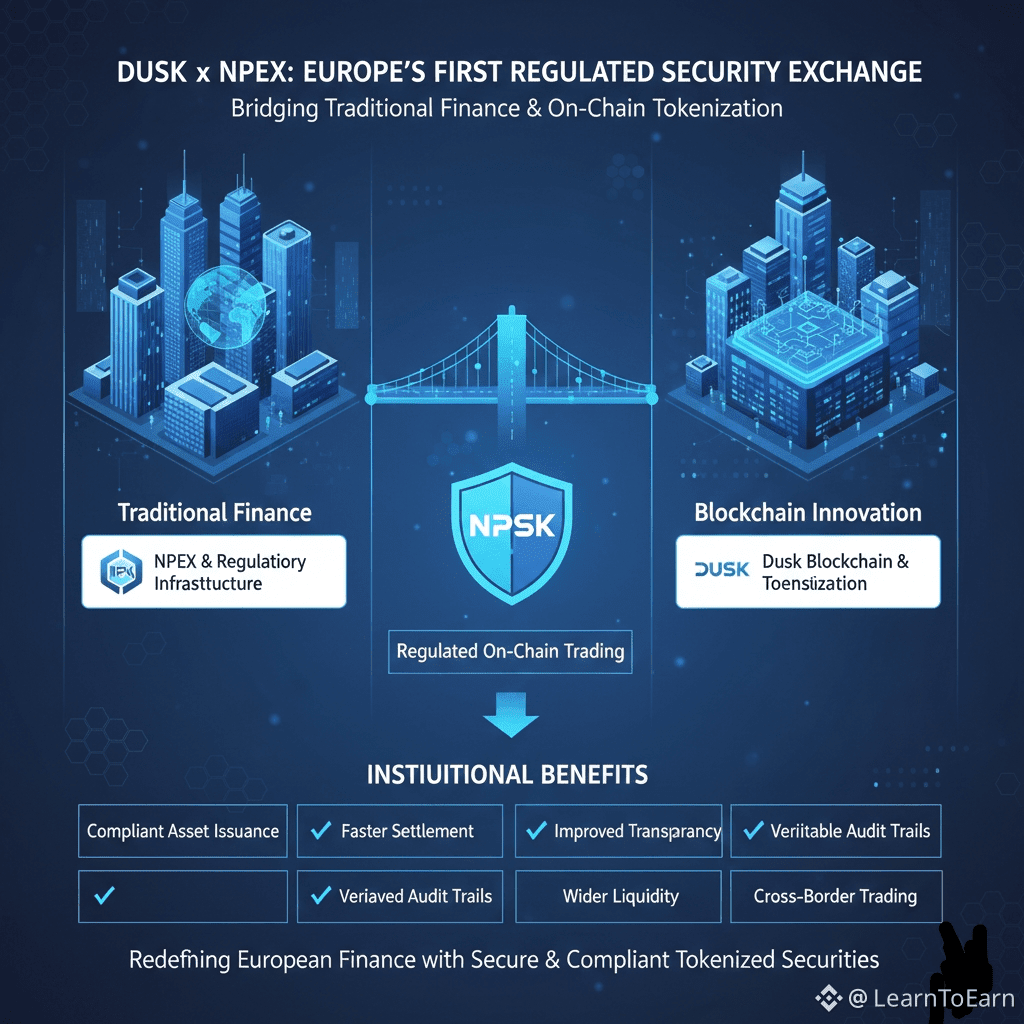

The NPEX Partnership: A Bridge to Regulated Markets

Dusk's most significant partnership is with NPEX, a fully regulated Dutch stock exchange. NPEX holds a Multilateral Trading Facility (MTF) license and a European Crowdfunding Service Providers (ECSP) license. Through this collaboration, these licenses apply to applications built on the Dusk stack, creating a fully licensed environment for issuing, trading, and settling tokenized securities like equities and bonds. The first major application born from this partnership, a trading platform called DuskTrade, is designed to bring over €300 million in tokenized securities on-chain. To connect this regulated asset pool to the broader blockchain world, Dusk and NPEX are integrating Chainlink's Cross-Chain Interoperability Protocol (CCIP) and its Data Streams oracle solution.

The DUSK Token: Fueling the Ecosystem

The DUSK token is the unified economic engine across all layers of the network.

· Token Utility: DUSK is used for:

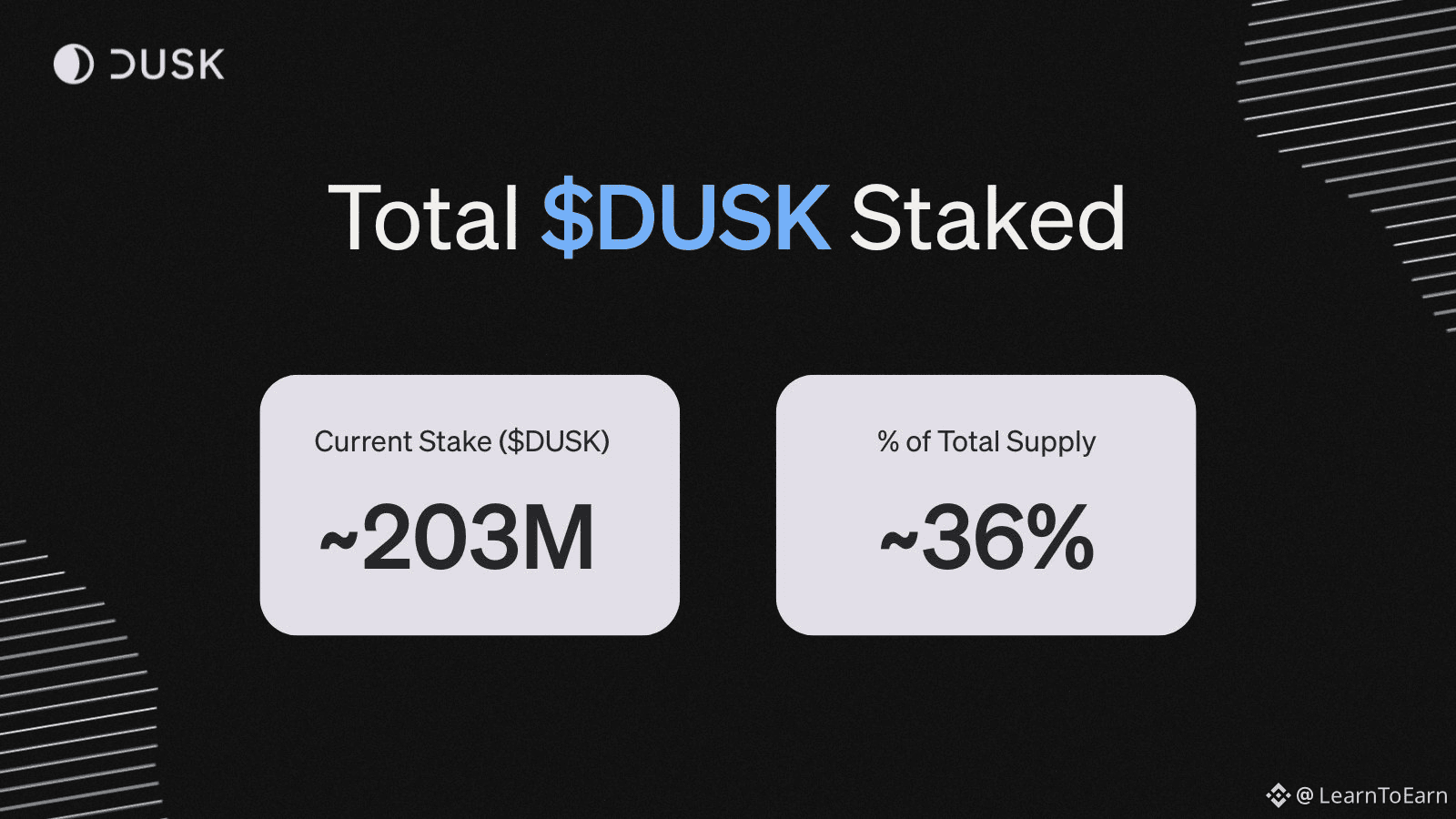

· Staking: A minimum of 1,000 DUSK is required to stake and help secure the network.

· Paying Gas Fees: Transaction fees (gas) on the network are paid in DUSK.

· Rewards: Network participants are rewarded in DUSK for their role in consensus.

· Tokenomics & Emission: The total maximum supply is capped at 1 billion DUSK. Half (500 million) was created at genesis, and the other half will be emitted over 36 years to reward stakers, following a halving model every four years similar to Bitcoin's. This long-tail emission is designed to incentivize early participation while controlling long-term inflation. The distribution of block rewards is structured to benefit the network, with 70% going to the block generator, 10% to the Dusk Development Fund, and 5% each to the Validation and Ratification committees.

Part 4: Roadmap, Outlook, and Navigating a Competitive Landscape

Development Roadmap

Dusk is in an active phase of development. A key near-term milestone is the mainnet launch of DuskEVM, which will transition the EVM-compatible layer from testnet to full production, significantly boosting developer activity. Looking further ahead, 2026 will see the rollout of the NPEX trading dApp (DuskTrade) and the full implementation of the Hedger compliance module on the mainnet. The project maintains a detailed, publicly available roadmap that guides its progression toward becoming infrastructure capable of supporting the scale and rigor of the financial services industry.

Growth Drivers and Market Position

Dusk’s potential is tied to several key growth drivers:

1. Real-World Asset Tokenization: The RWA market is exploding, with tokenized U.S. Treasuries alone growing 125% to $8.86 billion in one year. Dusk's compliant pipelines position it to capture a share of this institutional activity.

2. Privacy-Compliance Primitives: Its unique blend of confidentiality and auditability could lower KYC/AML frictions for regulated issuers if accepted by authorities.

3. EVM Interoperability: Full compatibility with Ethereum's tooling makes it accessible to the largest developer community in Web3.

However, Dusk operates in a competitive and challenging environment. It faces regulatory uncertainty, particularly around evolving frameworks like the EU's MiCA, and must successfully onboard institutional partners to realize its vision. The RWA space is also competitive, with Ethereum holding a dominant 64.5% market share and other chains like Stellar growing rapidly.

Market Outlook and Token Performance

The future price of DUSK, like any cryptocurrency, is highly uncertain and subject to market volatility. Based on simulations and models (which are not financial advice and do not guarantee future results), here are potential scenarios for DUSK's price trajectory.

Potential Price Scenarios for DUSK (EUR)

· Bullish Scenario (High Growth)

· 2026 Year-End: ~€0.0523

· 2027 Year-End: ~€0.0771

· 2028 Year-End: ~€0.1375

· Neutral Scenario (Moderate Growth)

· 2026 Year-End: ~€0.0243

· 2027 Year-End: ~€0.0247

· 2028 Year-End: ~€0.0269

· Bearish Scenario (Market Challenges)

· 2026 Year-End: ~€0.007

· 2027 Year-End: ~€0.0051

· 2028 Year-End: ~€0.0045

Note: These figures are illustrative simulations from various prediction models and should not be construed as financial advice. The crypto market is inherently volatile.

Conclusion: A Foundation for the Future of Finance

Dusk Network is not merely creating another blockchain for speculative DeFi. It is engineering a new foundational infrastructure for global capital markets. By tackling the core dilemma of modern financial blockchain applications—privacy versus transparency—with its innovative modular stack and Hedger engine, Dusk provides a viable on-chain home for regulated assets.

Its success will ultimately be determined by its ability to execute its technical roadmap, navigate the complex regulatory landscape, and attract institutional partners to its DeMI. If successful, Dusk could play a central role in making the issuance and trading of everything from corporate bonds to equities as seamless and composable as trading cryptocurrencies, all within a framework that respects both individual financial privacy and societal regulatory requirements. In doing so, it moves beyond the crypto sandbox to build the verifiable, efficient, and accessible market infrastructure that the future of finance demands.