Dusk Network is forging a new category of financial infrastructure—Regulated Decentralized Finance (RegDeFi)—by converging the privacy and transparency of blockchain with the strict compliance required by global capital markets. Unlike projects that treat compliance as an afterthought, Dusk embeds it into the protocol's core, leveraging advanced cryptography and unique regulatory partnerships to create the first blockchain that is truly fit for institutional finance.

The Core Innovation: Privacy as the Engine of Compliance

For most blockchains, transparency and compliance are in tension. Dusk redefines this relationship, arguing that privacy is not the enemy of transparency, but the essential prerequisite for compliance.

In traditional finance, confidentiality is non-negotiable: corporate treasuries, investor strategies, and market maker activity cannot be public. Dusk’s technology resolves this by moving from radical transparency to selective disclosure. Its privacy engine, Hedger, enables institutions to prove regulatory adherence (like AML/KYC checks) without exposing sensitive transaction details, using a hybrid of Homomorphic Encryption (HE) and Zero-Knowledge Proofs (ZKPs). This “Zero-Knowledge Compliance” ensures that while asset holdings and trade details remain encrypted, they are fully auditable by authorized parties, meeting the stringent demands of European regulations like MiFID II and MiCA.

The Technical Foundation: A Modular Stack for Regulated Scale

Dusk's architecture has evolved into a sophisticated three-layer stack, designed for performance and compliance. This separation allows each layer to be optimized for its specific function.

· DuskDS (Data & Settlement Layer)

· Core Function: Consensus (via Succinct Attestation), data availability, and final settlement.

· Key Benefit: Provides the secure, regulatory-compliant base layer for the entire network.

· DuskEVM (EVM Application Layer)

· Core Function: Executes standard Solidity smart contracts, featuring the Hedger privacy engine.

· Key Benefit: Full Ethereum compatibility allows developers to use tools like MetaMask and Hardhat, accelerating institutional application deployment.

· DuskVM (Privacy Application Layer)

· Core Function: Executes fully privacy-preserving applications using Dusk's native Phoenix transaction model.

· Key Benefit: Dedicated environment for the most demanding privacy-centric financial instruments.

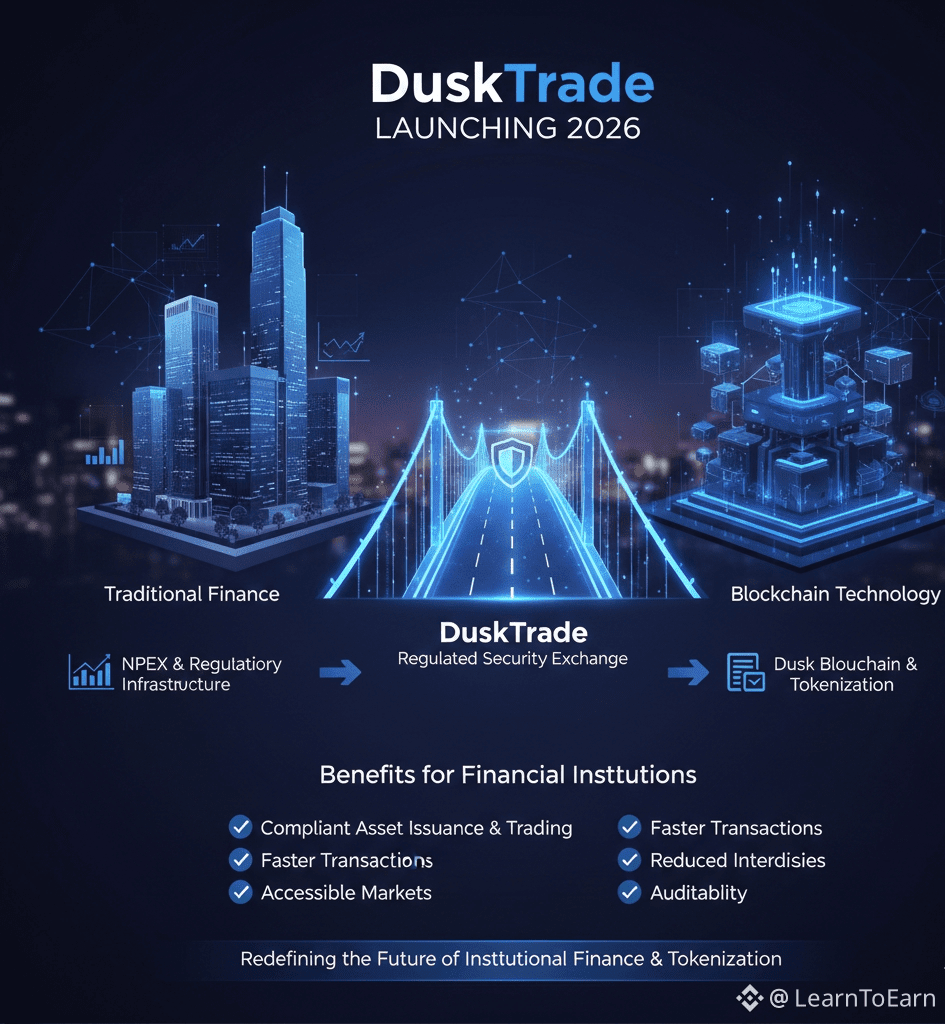

The Regulatory Edge: Protocol-Level Licensing via NPEX

Technology alone cannot bring regulated assets on-chain. Dusk's most significant differentiator is its partnership with NPEX, a fully licensed Dutch stock exchange.

Through NPEX, compliance is not just an application feature; it is a protocol-level characteristic. NPEX contributes a suite of financial licenses—Multilateral Trading Facility (MTF), Broker, European Crowdfunding Service Provider (ECSP), and an upcoming DLT-TSS license—that apply across the Dusk stack. This enables:

· Native Issuance & Trading: Regulated securities like equities and bonds can be legally issued and traded directly on-chain.

· Single-KYC Ecosystem: Users undergo compliance checks once to access all licensed applications on Dusk.

· Composable Regulated Assets: Licensed assets can be used across different DeFi applications (e.g., lending, derivatives) within the same legal framework.

Completing the Institutional Picture: Custody and Interoperability

For regulated institutions, robust custody is essential. NPEX selected Cordial Treasury, a self-hosted, on-premise wallet solution, to maintain full control over digital assets in compliance with strict regulations. This aligns with Dusk's launch of its own institutional-grade custody service, involving regulated banks and exchanges as partners.

Furthermore, Dusk integrates Chainlink's Cross-Chain Interoperability Protocol (CCIP). This ensures NPEX's tokenized securities can be securely transferred across blockchains, connecting this regulated asset pool to the broader DeFi ecosystem without losing their legal status.

DUSK Token: Fueling the RegDeFi Ecosystem

The DUSK token is the unified economic engine powering all network activity.

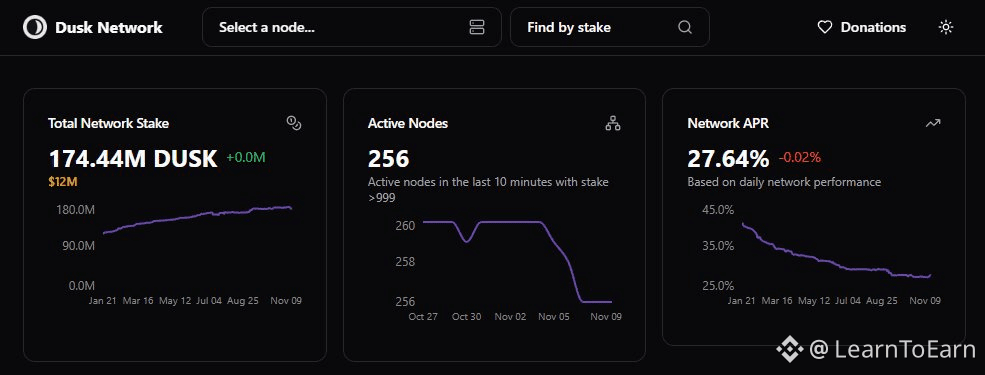

· Core Utility: Used for staking (minimum 1,000 DUSK), paying network gas fees, and rewarding participants.

· Tokenomics: The total maximum supply is 1 billion DUSK. Half was created at genesis, and the other half will be emitted over 36 years to reward stakers, following a halving model every four years to control inflation.

· Staking Model: Dusk uses a "soft slashing" mechanism for penalties. Instead of burning tokens, misbehaving nodes have their effective stake temporarily reduced, making the system more forgiving for genuine errors.

The Road Ahead and Strategic Positioning

Dusk has transitioned from development to deployment. The DuskEVM mainnet is a key milestone for 2026, which is expected to significantly boost developer activity. The first major application, a compliant trading platform developed with NPEX (DuskTrade), is slated to bring over €300 million in tokenized securities on-chain.

Dusk occupies a unique position by solving the trilemma of privacy, compliance, and usability. While the success of the NPEX partnership and broader institutional onboarding will be critical, Dusk is not just building another blockchain; it is building the Decentralized Market Infrastructure (DeMI) that could form the backbone of a new, more efficient, and inclusive global financial system.