Active crypto markets can be exciting, but they also create one of the most common pitfalls for investors: overtrading. Rapid price movements, constant news updates, and social media noise often push people into making too many decisions, too quickly. For many, especially beginners, this behavior leads to poor timing, higher fees, emotional stress, and weaker long-term results. Building a simple crypto strategy is not about predicting every move; it is about creating a clear framework that reduces mistakes and supports consistency over time.

Why Overtrading Hurts Most Investors

Overtrading typically stems from the belief that being constantly active improves performance. In reality, frequent buying and selling often amplifies emotional decision-making. Traders chase short-term price spikes, react to headlines, or exit positions prematurely out of fear. Each trade introduces friction in the form of fees, slippage, and opportunity cost.

Studies across traditional and digital markets consistently show that investors who trade less tend to outperform those who trade more, particularly after costs are considered. In crypto, where volatility is already high, unnecessary activity increases risk without guaranteeing better returns. A simple strategy aims to filter out noise and focus on high-quality decisions.

Start With a Clear Objective and Time Horizon

The foundation of any effective crypto strategy is clarity. Investors should first define why they are participating in the market and over what time frame. Short-term trading, medium-term positioning, and long-term investing each require different approaches. Mixing them often leads to confusion and impulsive behavior.

For beginners, a longer-term perspective is usually more appropriate. This reduces the pressure to react to every price fluctuation and aligns decision-making with broader market trends rather than short-term volatility. Once the time horizon is defined, it becomes easier to ignore distractions that do not align with the original objective.

Focus on a Small, High-Quality Asset Set

Another key principle of simplicity is limiting the number of assets in a portfolio. Holding too many cryptocurrencies increases complexity and encourages constant monitoring and adjustment. Instead, focusing on a small selection of well-established assets allows investors to understand what they own and why they own it.

Large-cap cryptocurrencies with strong liquidity, clear use cases, and long track records tend to be more suitable for simple strategies. Concentration does not mean lack of diversification; it means thoughtful selection. By narrowing the focus, investors reduce the temptation to chase every new narrative or trending token.

Market data and performance comparisons for major assets can be reviewed at [Link].

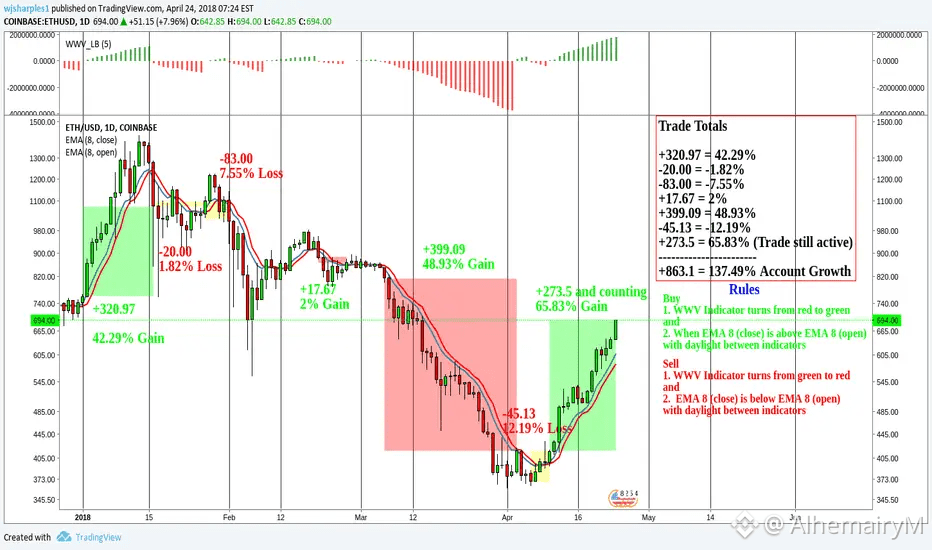

Use Rules, Not Emotions, to Guide Decisions

Simple strategies rely on predefined rules rather than feelings. These rules might include how often to invest, when to rebalance, or under what conditions to exit a position. For example, some investors use dollar-cost averaging, investing a fixed amount at regular intervals regardless of price. This approach removes the need to time the market and naturally reduces overtrading.

Others set clear thresholds for rebalancing, such as adjusting allocations quarterly or when an asset deviates significantly from its target weight. The key is that decisions are made in advance, during calm conditions, rather than in response to market stress.

Educational resources explaining structured approaches to investing can be found at [Link].

Accept That Missing Moves Is Part of the Process

One of the psychological drivers of overtrading is the fear of missing out. Investors often believe they must capture every rally or avoid every dip to succeed. In reality, no strategy captures all opportunities. Successful investing is about capturing enough of the right moves while avoiding major mistakes.

A simple strategy accepts that some opportunities will be missed. This acceptance reduces stress and prevents impulsive trades made solely to feel involved. Over time, consistency and discipline tend to outweigh the benefits of occasional perfect timing.

Track Performance, Not Activity

Many investors mistakenly equate activity with progress. Checking prices constantly or making frequent trades can feel productive, but it does not necessarily improve outcomes. A better approach is to evaluate performance periodically against the original objective.

Reviewing a portfolio monthly or quarterly helps investors assess whether the strategy is working without encouraging constant adjustments. If changes are needed, they should be deliberate and based on clear reasoning, not short-term price action.

Keep Risk Management Simple and Visible

Risk management does not need to be complex to be effective. Simple measures such as limiting position size, avoiding excessive leverage, and maintaining a cash or stablecoin buffer can significantly reduce downside risk. Overtrading often increases exposure unintentionally, as multiple overlapping positions amplify losses during market corrections.

By keeping risk rules simple and visible, investors are less likely to violate them during periods of excitement or fear. This discipline supports long-term sustainability in volatile markets.

Conclusion: Consistency Beats Constant Action

Building a simple crypto strategy is ultimately about reducing unnecessary decisions and focusing on what matters most. Clear objectives, limited asset selection, rule-based investing, and disciplined review processes help investors avoid the trap of overtrading. Especially for beginners, fewer decisions often lead to better outcomes by minimizing emotional errors and transaction costs.

Crypto markets will always be dynamic, but success does not require constant action. In many cases, patience, structure, and consistency are the most powerful tools an investor can use.

Disclaimer: This article is for educational and informational purposes only and does not constitute financial, investment, or trading advice. Cryptocurrency markets are volatile, and readers should conduct their own research and consult with qualified financial professionals before making any investment decisions.

Written by: Dr. Moh’d al Hemairy @AlhemairyM