📊 🚀 Bitcoin ($BTC ) – Latest Update & Analysis

📌 Price Action

BTC trading near ~$94k–$95k levels recently with positive momentum visible.

Markets are volatile with drops after gains — analysts warn of profit-taking and broader risk asset weakness.

📍 Key Levels

Support

Near $90,000 (important short-term support)

$86,000–$87,000 zone (historical retracement support)

Resistance

$100,000 psychological level

If broken, next target ~$110,000–$120,000+

📍 Example Entry Strategy

(For educational purposes only)

Aggressive Buy: On dip near $90,000

More Conservative: After reclaiming $100,000 with good daily close

Stop-Loss: Below $87,000 to manage downside

📊 Market Outlook

Long-term forecasts into 2026 suggest bear, base and bull scenarios exist — volatility expected.

🧠 Ethereum ($ETH ) – Latest Update & Analysis

📌 Price Action

ETH trading above $3,300 (depending on exchange) with varied momentum.

It’s shown resilience, supported by ETF inflows and broader DeFi activity. Analysts see potential to climb higher.

📍 Key Levels

Support

$3,000–$3,100

$2,800 psychological support

Resistance

$4,000

Breakouts above $4,500–$5,000 could fuel further gains.

📍 Example Entry Strategy

Dip Entry: Around $3,000–$3,200

Momentum Entry: After break + daily close above $4,000

Stop-Loss: Below $2,900

📊 Outlook

Analysts predict ETH could target higher ranges in bull scenarios, even toward $5k+ long-term.

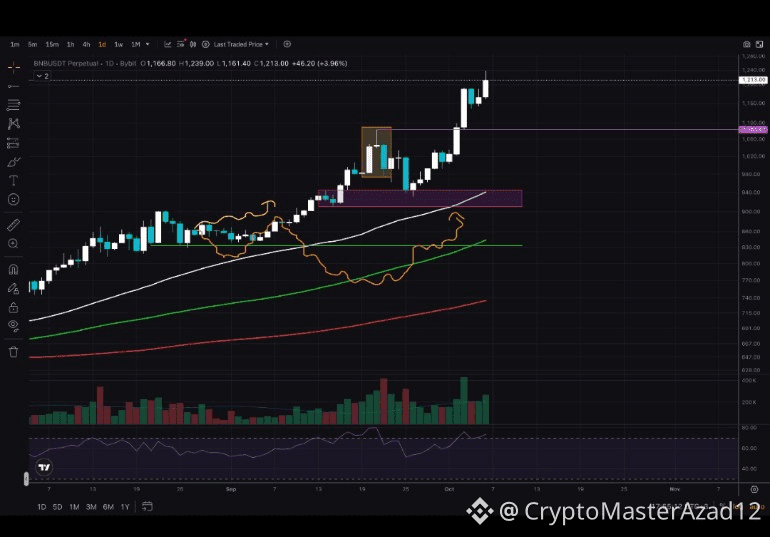

🛡️ $BNB (Binance Coin) – Latest Update & Analysis

📌 Price Action

BNB roughly around $930–$950 in recent sessions and showing resilience.

BNB supply dynamics + corporate demand hinted bullish potential in 2026 forecasts.

📍 Key Levels

Support

$880–$900 short-term

$830 deeper zone from previous technical clues

Resistance

$1,000 psychological

Above that, next major zones at $1,050+

📍 Example Entry Strategy

Buy the Dip: Near support $880–$900

Breakout Entry: If BNB closes above $1,000 daily

Stop-Loss: Below $850

📊 Outlook

BNB strength hinges on broader market trends and utility adoption within Binance ecosystem. Long term could breach higher resistance with sustained demand.

🧠 Technical & Market Sentiment Notes

Market remains volatile — BTC and Ethereum can swing fast based on macro cues (e.g., ETF flows, risk assets).

Traders often watch support and resistance zones plus trend breaks before committing.

Keep an eye on BTC dominance, which influences altcoin strength (like ETH & BNB).

📉 Risk Reminder

Cryptocurrencies are highly volatile. Use risk management (stops, position sizing), and this is not financial advice. Always DYOR (do your own research).