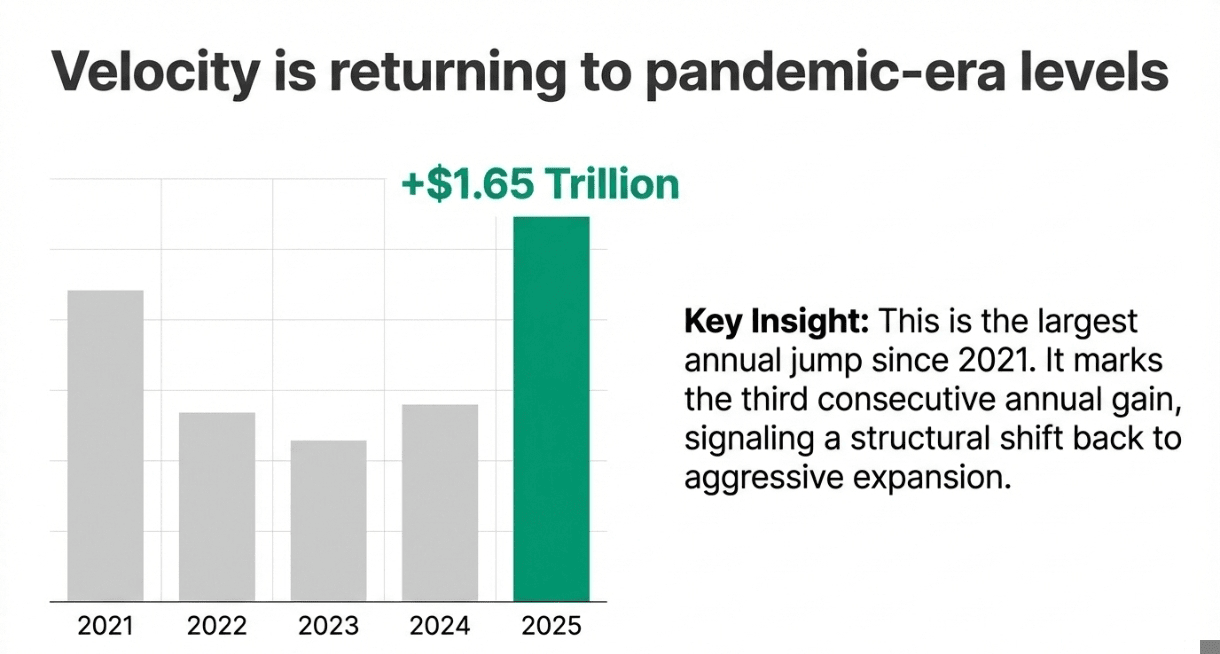

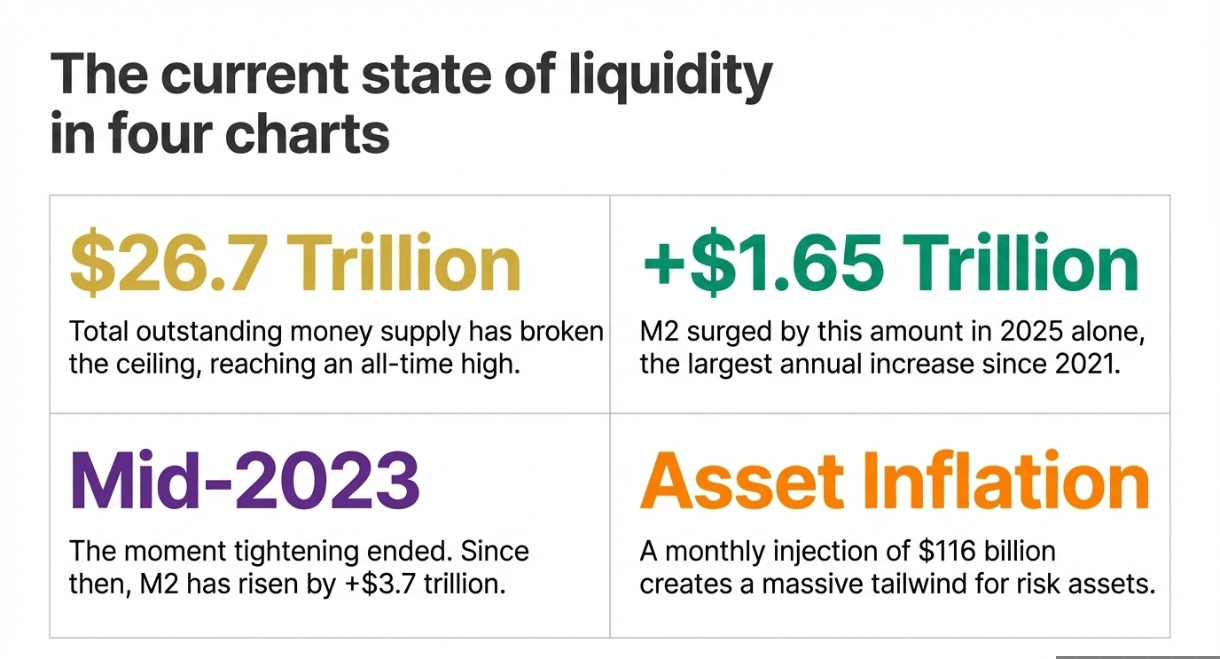

The United States money supply is expanding at a velocity reminiscent of the pandemic era stimulus. New data reveals that M2, the broad measure of cash and cash-like assets, surged by +$1.65 trillion in 2025. This massive injection of liquidity has pushed the total outstanding money supply to a record $26.7 trillion, signaling that the era of monetary tightening has been decisively replaced by aggressive expansion.

❍ Largest Jump Since 2021

The scale of this increase highlights a major shift in monetary conditions.

A New Record: The $1.65 trillion jump marks the largest annual increase since 2021.

Sustained Growth: This represents the 3rd consecutive annual gain for M2, confirming that the liquidity spigot is fully open.

The Drivers: The surge is being fueled by rapidly rising bank deposits and massive inflows into money market funds as investors seek yield and safety.

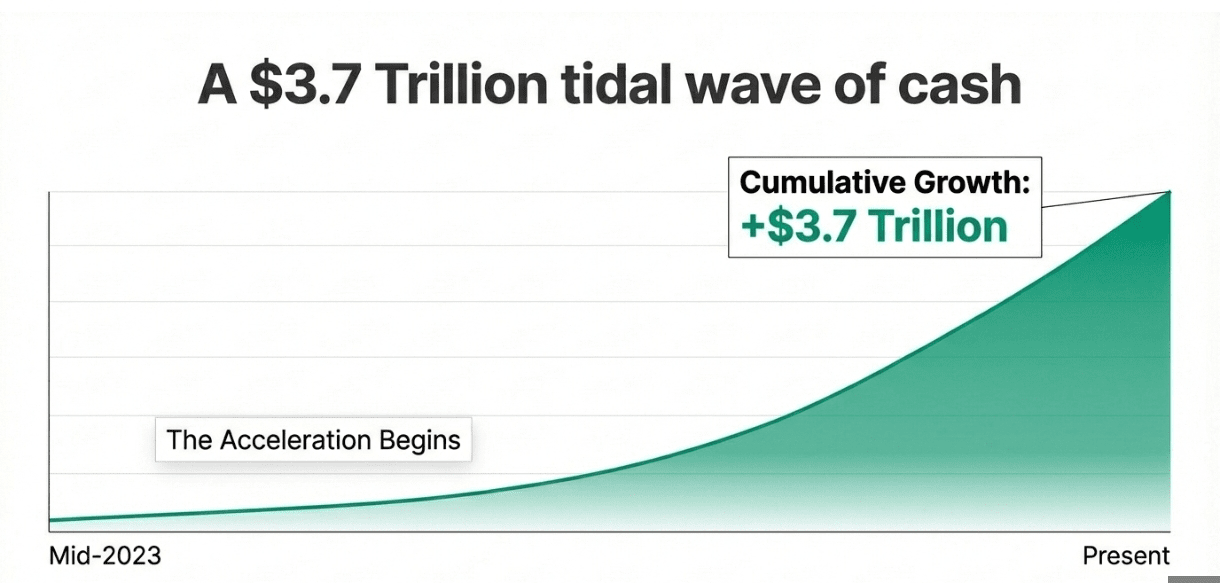

❍ A $3.7 Trillion Tidal Wave

The acceleration began in earnest midway through 2023. Since that pivot point, M2 has risen by a staggering +$3.7 trillion.

Monthly Pace: This equates to an average growth rate of +$116 billion per month over this period.

Relentless Liquidity: This consistent monthly injection provides a powerful tailwind for asset prices, as excess liquidity typically finds its way into financial markets.

❍ A Stark Reversal from 2022

To understand the magnitude of this shift, we must look at the brief period of contraction that preceded it. From January 2022 to April 2023, the Fed managed to shrink the money supply.

The Contraction: During that window, M2 contracted by -$450 billion.

The Pace: This represented a withdrawal of roughly -$28 billion a month.

The Pivot: The current expansion pace of +$116 billion a month completely overwhelms the previous tightening efforts, effectively undoing the contraction many times over.

Some Random Thoughts 💭

The data from The Kobeissi Letter suggests that "Quantitative Tightening" is practically a myth at this stage. While interest rates may be higher than they were a few years ago, the sheer volume of new money entering the system tells a different story. A monetary expansion of $116 billion every month creates a buoyant environment for risk assets and inflation.

It is difficult to argue that financial conditions are restrictive when the money supply is growing at a crisis-level pace during an economic expansion. The "money printer" is not just running. It is sprinting.