When I first began exploring DuskDS, I was struck by how quietly transformative it is. Most people associate smart contracts with flashy DeFi dashboards, speculative tokens, or flashy automated apps—but DuskDS is different. Here, smart contracts are the backbone, the hidden engine, the unglamorous but indispensable layer that ensures assets move, rules are enforced, and settlements finalize without a single misstep. It reminded me of the quiet efficiency of a central bank’s settlement system: unseen by most, but vital to everything that happens on top.

DuskDS contracts are written in Rust and compiled to WASM, and this is no accident. Finance is unforgiving. A single miscalculation can cascade into billions in losses. Rust’s memory safety and deterministic behavior make logic errors far less likely. WASM ensures contracts run predictably across nodes. In my mind, it’s like building a skyscraper on reinforced concrete instead of clay. The structure may not look flashy from the street, but every floor, every beam, every elevator works exactly as intended.

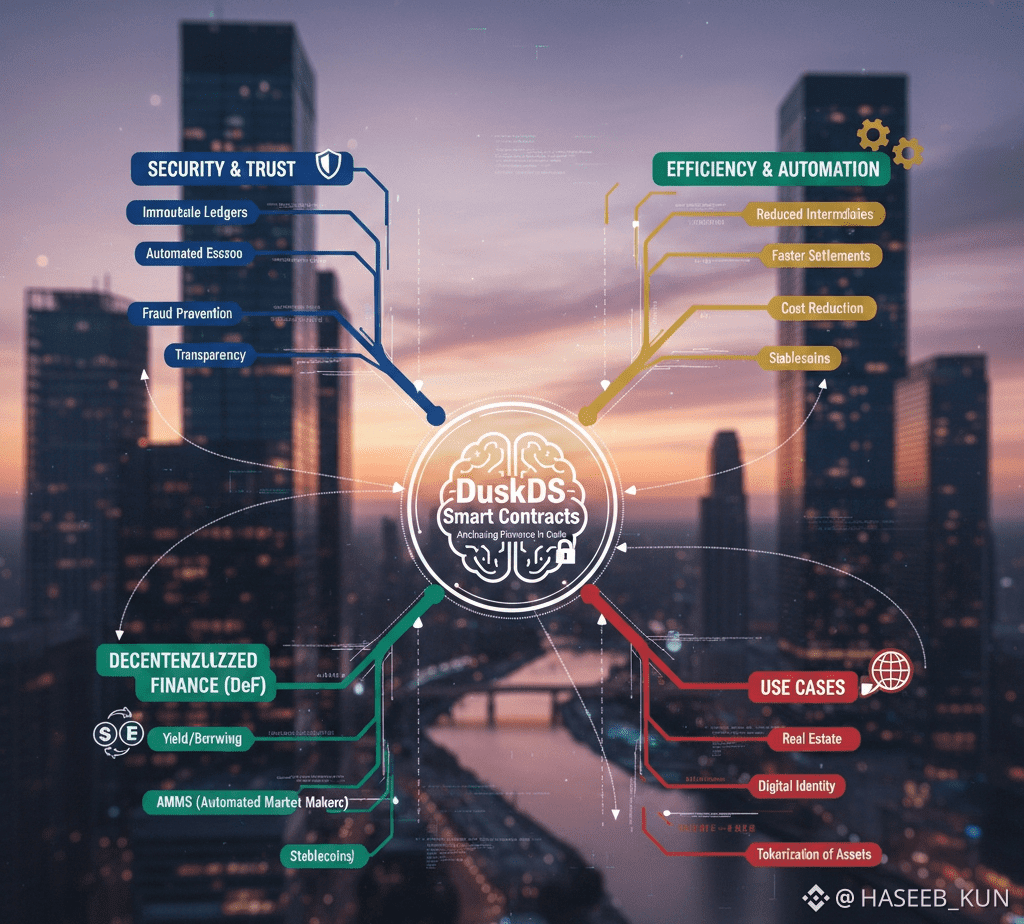

What fascinates me most is that DuskDS contracts operate at the settlement layer, where precision is everything. In traditional finance, the settlement process—the moment when ownership legally changes hands—is often slow, fragmented, and vulnerable to human error. Banks, custodians, clearinghouses—all of them exist to prevent mistakes, but they also introduce friction and risk. DuskDS replaces these middlemen with code that can’t be bribed, delayed, or misread. Ownership transfers, escrow conditions, and regulatory checks are executed exactly as written, every single time.

I like to think of DuskDS contracts as automated notaries for the digital age. A notary in the real world doesn’t negotiate terms; they verify identity, witness agreements, and preserve proof. On DuskDS, the contracts verify that conditions are met, enforce rules, and settle assets immutably. Whether it’s a tokenized bond, a confidential transfer, or an institutional equity issuance, the outcome is certain, final, and auditable. You don’t need to wonder if a transaction settled correctly—the protocol guarantees it.

The layer’s privacy-preserving architecture is another striking feature. I often compare it to a bank vault with transparent audit logs. Investors can verify their holdings, compliance officers can run reports, and regulators can check rules—all without exposing sensitive details publicly. Phoenix, Dusk’s shielded transaction model, allows this confidential execution. You can settle high-value trades, enforce restrictions, and move assets without revealing amounts, counterparties, or balances to the entire network. Meanwhile, Moonlight handles the transactions that need visibility, striking a balance between privacy and transparency.

I remember studying a tokenized bond issued on DuskDS. The smart contract automatically calculated interest, checked ownership, and triggered settlement on the right day—all while shielding investor data. There were no intermediaries, no manual interventions, and no reconciliation delays. Watching it execute felt like seeing a clockwork mechanism: precise, silent, and perfectly reliable. That’s the kind of predictability institutions crave but rarely get in traditional markets.

Another analogy that comes to mind is air traffic control. Pilots navigate the skies, but controllers keep planes from colliding and ensure timely arrivals. DuskDS smart contracts are the controllers of digital finance. They don’t speculate or innovate at the surface level; they enforce safety, timing, and rules in the background. Without them, applications could fail, settlement could stall, and risk could accumulate silently. With them, the ecosystem hums efficiently.

From a developer’s standpoint, Rust/WASM also reduces complexity. Traditional financial systems often rely on dozens of databases, reconciliation processes, and manually coded workflows. On DuskDS, the logic lives in one deterministic environment. Issuance, transfer, compliance, and settlement modules coexist in the same layer. There’s no patchwork. There’s no juggling multiple systems. For institutions and developers, this is not just convenient—it’s transformative.

I’ve also observed that DuskDS fosters modularity and reuse in financial primitives. Escrow logic, compliance modules, and settlement rules can be applied across multiple assets. Once a contract is tested and audited, it becomes part of the infrastructure rather than a one-off experiment. This reduces operational risk and builds confidence among stakeholders. Imagine a central bank’s clearing system that grows more reliable as more institutions use it—the code itself becomes the stabilizing backbone. That’s the kind of architecture DuskDS offers.

From an investor perspective, the implications are significant. When settlement-layer logic is built directly into the blockchain, counterparty risk shrinks. Transfers are final, rules are enforced automatically, and sensitive data is protected. You can participate in tokenized equity, bonds, or real estate without worrying that some intermediary will mismanage the transaction or introduce delays. The system’s design aligns incentives and trust mechanically, rather than relying on reputation alone.

Privacy, predictability, and compliance converge here. DuskDS smart contracts demonstrate that blockchain infrastructure doesn’t need to compromise between these three pillars. Transactions remain confidential where necessary, settlement outcomes are deterministic, and regulatory logic is enforceable. From my perspective, this is the kind of thoughtful design that makes institutional adoption realistic, rather than aspirational.

Another compelling aspect is composability in a controlled environment. Unlike experimental DeFi platforms where composability can amplify risk, DuskDS focuses on financial reliability. Modules can interact safely, contracts can call one another without unpredictable side effects, and critical operations remain isolated. I see this as a practical bridge between legacy financial rigor and the programmable potential of blockchain.

Real-world examples bring this vision into focus. Consider a fund managing multiple tokenized assets: equities, bonds, and private debt. Each asset has unique rules, settlement conditions, and privacy requirements. On DuskDS, these rules are encoded directly into contracts. Transfers are verified, ownership updated, and settlements executed automatically. Meanwhile, privacy shields sensitive investor data, and compliance modules ensure regulatory alignment. The result is a system that feels both futuristic and familiar, a blockchain that behaves like a trustworthy financial engine.

Finally, DuskDS is a reminder that good infrastructure is invisible. Nobody celebrates electricity when it powers a building, yet without it, everything fails. Nobody notices plumbing until it leaks. DuskDS smart contracts operate the same way: quietly, reliably, and with precision. They do not seek attention. They do not rely on hype. They ensure that assets settle correctly, rules are enforced, and participants can trust the system. That, in my view, is the true measure of blockchain maturity.

In conclusion, DuskDS smart contracts are not just code—they are the settlement backbone of a next-generation financial system. By combining Rust’s safety, WASM’s deterministic execution, and a privacy-first architecture, they empower specialized protocol logic and settlement-layer applications. They replace intermediaries with predictable, auditable infrastructure, reducing risk and operational complexity. For anyone exploring institutional-grade blockchain finance, DuskDS represents a quiet but profound revolution: a system where trust is embedded in code, settlement is immediate, and privacy and compliance coexist naturally.