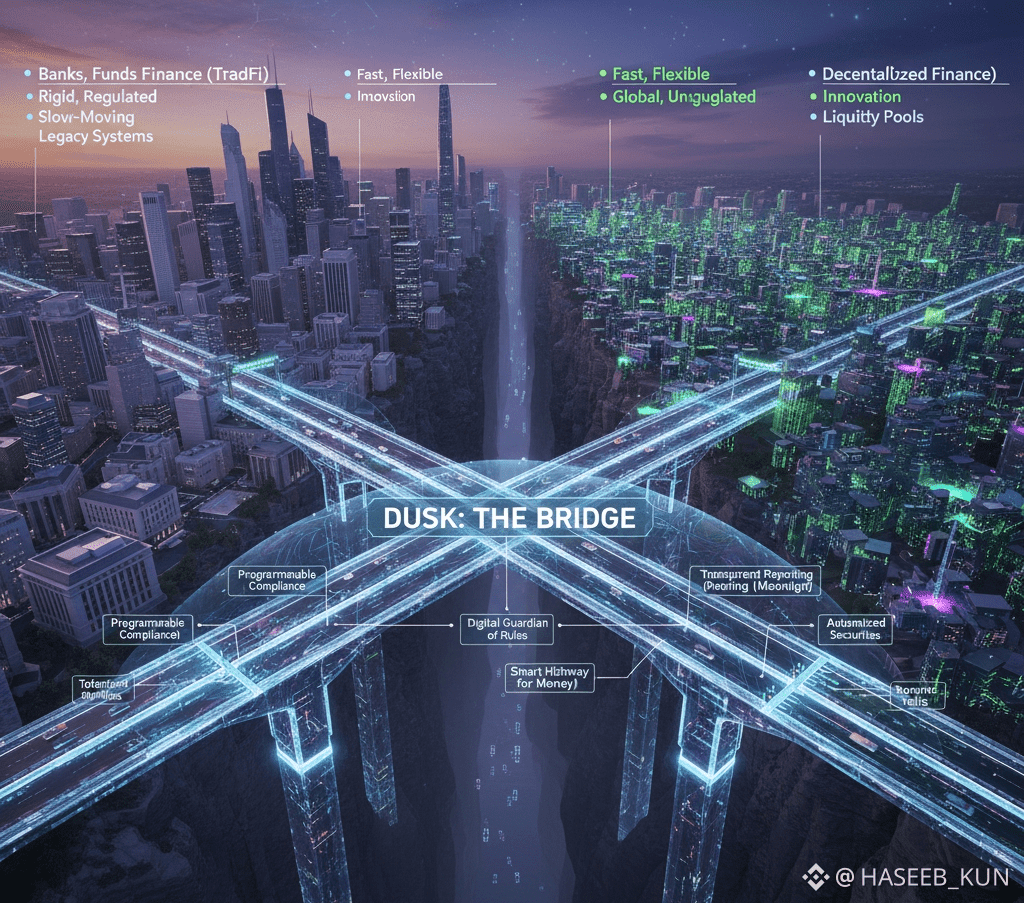

When I first tried to explain the gulf between traditional finance and DeFi to a colleague, I used a bridge analogy. On one side, you have traditional banks, funds, and institutions—rigid, highly regulated, slow-moving, yet the backbone of the global economy. On the other, there’s DeFi: fast, flexible, global, but often chaotic and unregulated. For most financial institutions, stepping into DeFi feels like trying to cross a chasm in the dark. Dusk, in my experience, is that bridge—carefully engineered, sturdy, and intuitive, letting institutions cross into programmable, compliant on-chain markets with confidence.

Dusk isn’t just another blockchain. From the start, it was built with the realities of institutional finance in mind. Banks and funds cannot afford mistakes or ambiguities. They operate under intense regulatory scrutiny, with strict compliance requirements and heavy operational processes. At the same time, they want to explore automation, efficiency, and liquidity—benefits DeFi promises but rarely delivers in a secure, auditable way. Dusk brings these worlds together, providing a modular, privacy-conscious, and legally aware infrastructure that allows institutions to leverage DeFi capabilities without abandoning their operational and regulatory comfort zones.

I like to think of Dusk as a smart highway for money. Traditional finance feels like a sprawling network of local roads: reliable, but congested and slow. DeFi on most blockchains is like off-road travel: exciting and fast, but unpredictable and risky. Dusk gives you the smooth highway experience: high-speed, regulated lanes with automated toll booths and checkpoints ensuring every asset moves correctly and legally. Transactions settle with precision, sensitive data remains private when necessary, and compliance is baked into the rules, not tacked on as an afterthought.

Take tokenized securities, for instance. Issuing a corporate bond in the traditional world requires underwriters, custodians, transfer agents, and weeks of coordination. On Dusk, that same bond can be issued natively on-chain, with programmable rules governing ownership, transfer restrictions, and settlement timing. The bond’s lifecycle—from issuance to coupon payments—can be automated entirely, yet still fully auditable and compliant. It’s the difference between mailing a stack of paper cheques across banks and watching a perfectly timed, self-executing digital process unfold.

What impresses me most is how Dusk balances privacy and transparency. DeFi often prioritizes openness, but institutional players require discretion. Dusk’s dual-layer system—Phoenix for private transactions and Moonlight for transparent reporting—lets financial institutions operate with the confidence that sensitive data is protected while regulators and auditors can still verify compliance. For me, this design represents a practical solution to a problem that has historically kept TradFi and DeFi worlds apart: how to innovate with speed while staying within legal boundaries.

Programmable compliance is another area where Dusk shines. In legacy systems, compliance is often manual, slow, and error-prone. With Dusk, Rust/WASM smart contracts encode rules directly into the protocol. They can enforce who is eligible to participate, under what conditions assets can move, and how reporting obligations are satisfied. It’s like having a compliance officer who works 24/7, never makes mistakes, and is entirely auditable—a digital guardian of the rules embedded into the system itself.

To make it more tangible, I often compare Dusk to airport security. Travelers (assets) must move from one terminal to another (market to market). There are rules: identification checks, boarding passes, baggage inspections. Dusk acts as the digital equivalent: assets move efficiently, rules are enforced automatically, and every step is recorded in a secure, verifiable way. Without this system, institutions attempting to navigate DeFi risked exposure, errors, or regulatory breaches. With Dusk, the journey becomes seamless, predictable, and safe.

Interoperability is another crucial element. Dusk supports Ethereum-compatible smart contracts alongside its native WASM execution. This allows institutions to tap into familiar DeFi tooling while still benefiting from privacy features, compliance enforcement, and settlement certainty. Essentially, it’s like being able to use your old navigation system while driving on a new, safer, and faster highway—the best of both worlds.

I’ve seen real-world use cases that bring this vision to life. A regulated investment fund could, for example, gain fractional exposure to tokenized real estate or corporate debt. Traditionally, this would involve multiple custodians, lengthy legal agreements, and manual reconciliation across systems. On Dusk, the process is seamless: the fund’s ownership is recorded on-chain, settlement is automatic, compliance checks are embedded, and sensitive investor information remains confidential. It feels like witnessing the modernization of decades-old processes without sacrificing legal certainty.

Risk reduction is another compelling benefit. Delays, human error, and counterparty default are endemic in traditional finance. Dusk mitigates these risks with cryptographic certainty, deterministic contract execution, and protocol-enforced rules. Assets move, settle, and adhere to regulatory requirements automatically. For institutional participants, this is not a marginal convenience—it is a transformative improvement in operational resilience.

Strategically, Dusk gives institutions a way to experiment with on-chain financial tools safely. They can explore tokenized assets, automated settlement, liquidity provision, and staking, without jeopardizing regulatory standing or exposing themselves to operational chaos. It’s like testing a new flight path in a simulator before committing to a real plane: controlled, observable, and entirely under management’s oversight.

What I find most fascinating is Dusk’s role as a translator between two worlds. TradFi speaks in regulations, legal frameworks, and operational discipline. DeFi speaks in automation, composability, and liquidity. Dusk interprets both languages, letting institutions and decentralized protocols interact seamlessly. For investors, this opens access to markets and instruments that were previously difficult or impossible to reach. For developers, it allows innovation without creating systemic risk.

Cross-border transactions are a prime example. Sending capital internationally through traditional banking is slow, expensive, and often opaque. On Dusk, smart contracts can enforce jurisdiction-specific regulations, automatically calculate reporting requirements, and ensure settlement happens efficiently and securely. It’s like replacing a slow, paper-heavy customs checkpoint with a digital system that validates identity, permissions, and compliance instantly, yet still preserves privacy where needed.

Another important aspect is how Dusk encourages safe experimentation. Unlike some DeFi platforms, where composability can lead to cascading failures, Dusk’s modular design allows institutions to combine smart contract primitives with predictable results. Escrow logic, compliance modules, settlement conditions—all can interact safely. This means that innovation can flourish without the fragility that often scares professional financial operators away from DeFi.

From my perspective, this is where Dusk truly stands apart. It does not merely replicate DeFi in a way that banks can tolerate. It adapts, secures, and extends it, creating a real bridge to mainstream finance. TradFi participants can enjoy the efficiency, transparency, and programmability of on-chain markets while staying fully compliant. Meanwhile, DeFi gains from deeper liquidity, higher-quality participants, and more robust infrastructure. It’s a mutually reinforcing ecosystem.

Ultimately, Dusk is about creating trust, predictability, and operational clarity in markets that historically struggled with all three. Its architecture, privacy layers, smart contract capabilities, and interoperability allow institutions to access programmable, compliant markets in a way that feels deliberate and safe. It’s not flashy, but it works. And in finance, working reliably is far more valuable than looking innovative.

Bridging TradFi and DeFi is not just about technology—it’s about reducing friction, embedding trust in code, and enabling institutions to act with confidence. Dusk achieves this quietly, elegantly, and effectively. From my perspective, it is the bridge we have been waiting for: one that allows the financial world to evolve, not break, while bringing the power of programmable, on-chain markets into reach for regulated institutions.