The recent acquisition of Semler Scientific by Strive (ASST) marks a fascinating shift in corporate strategy. While many firms are buying $BTC directly, Strive has chosen a different path: acquiring a company specifically for its Bitcoin treasury.

Key Highlights of the Deal:

Strategic Treasury: Strive is effectively absorbing Semler’s 5,048 $BTC through an all-stock transaction.

Increasing Position: In addition to the merger, they’ve added 123 $BTC to their holdings.

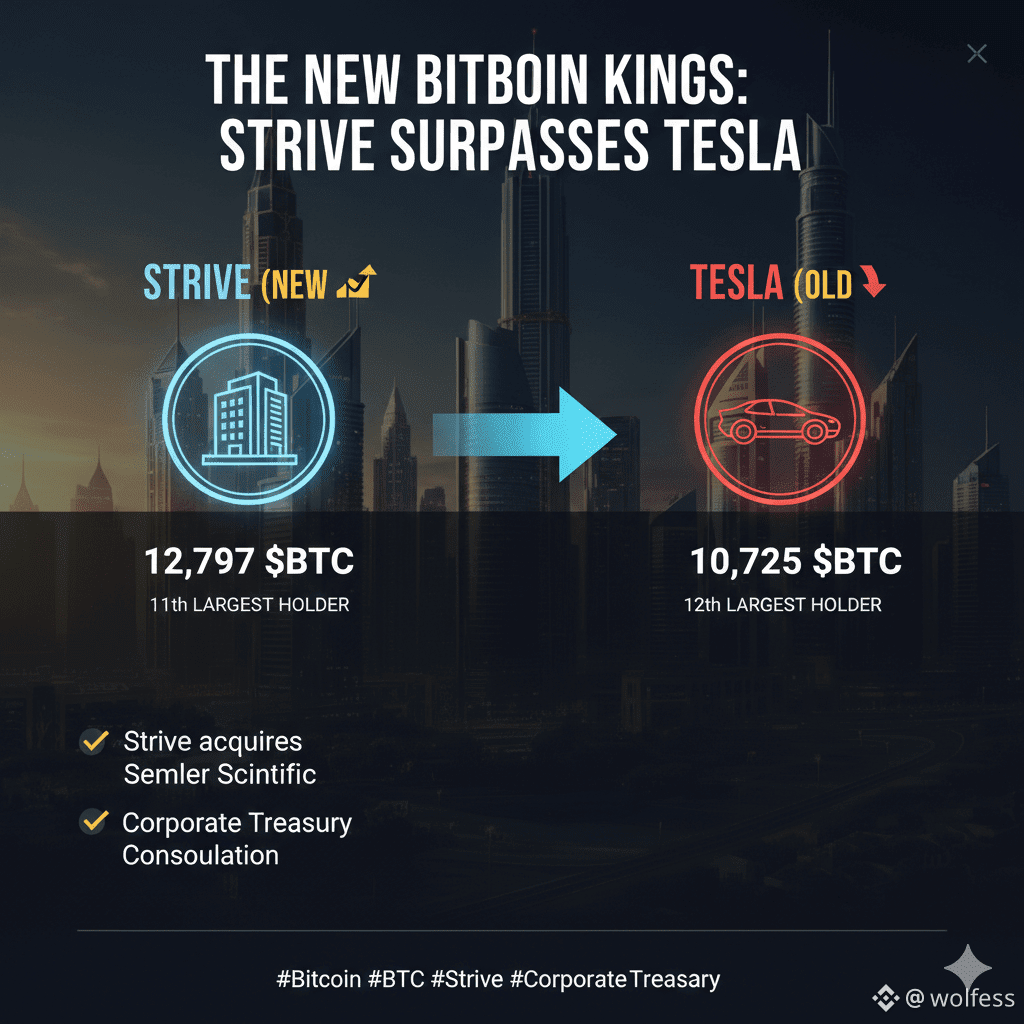

Institutional Ranking: This move is expected to bring their total to 12,797 $BTC, positioning them as the 11th largest corporate holder globally.

My Take: We are witnessing the birth of a new trend where Bitcoin is no longer just an asset on a balance sheet, but a primary driver for corporate Mergers and Acquisitions (M&A). This consolidation could lead to a future where companies are valued based on their "Bitcoin per share."

What do you think? Will we see more companies being acquired solely for their crypto reserves this year?

#bitcoin #BTC #CorporateTreasury