Bitcoin and major altcoins continued their upward momentum on January 14, supported by easing U.S. inflation data and renewed optimism around upcoming crypto regulation in the United States. A mix of improving macro conditions and regulatory clarity helped boost risk appetite across digital assets.

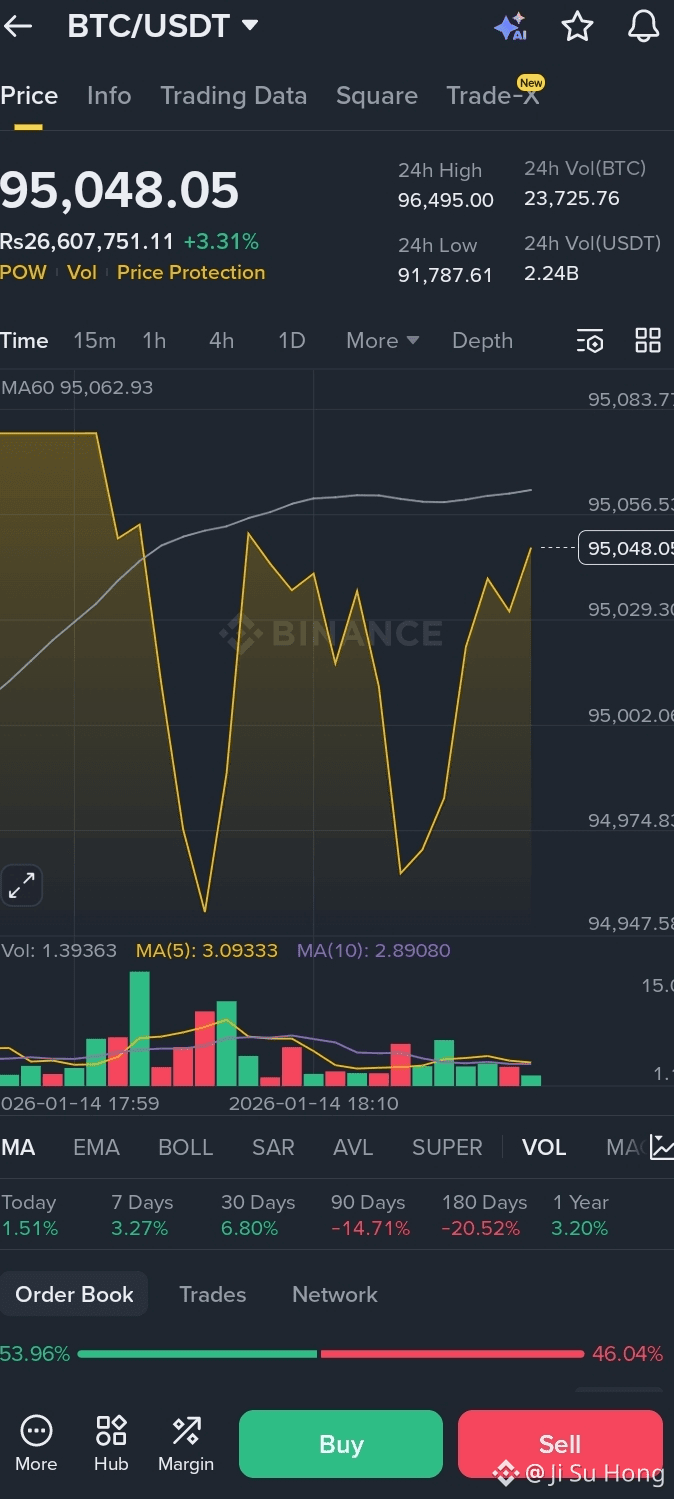

Bitcoin reclaimed levels above $95,000, while select altcoins saw notable price action as traders responded to these positive developments.

Market Overview (January 14)

Bitcoin (BTC) $BTC traded above $95,500, extending gains for a third straight day

Ethereum (ETH)$ETH remained steady above $3,300

Total crypto market cap climbed toward $3.25 trillion

Crypto Fear & Greed Index moved into the mid-40s, signaling improving but still neutral sentiment

Cooling U.S. Inflation Supports Risk Assets

One of the main drivers behind today’s rally was the latest U.S. Consumer Price Index (CPI) report, which reinforced the view that inflation pressures continue to ease.

👉🏻Headline CPI: 2.7% year-over-year (unchanged)

Core CPI: 2.6%, down from 2.7%

Monthly CPI: 0.3% for both headline and core, matching expectations

The data suggests that recent tariffs have not reignited inflation, while lower fuel prices and easing mortgage rates point toward further moderation ahead.

With inflation cooling, expectations are building that the Federal Reserve could begin cutting rates later in 2026 — a scenario that has historically favored risk assets like cryptocurrencies. Gold also moved higher alongside Bitcoin, highlighting continued demand for inflation hedges.

CLARITY Act Advances, Boosting Regulatory Confidence

Crypto markets also reacted positively to progress on the Digital Asset Market Clarity Act of 2025, commonly known as the CLARITY Act.

The proposed legislation aims to:

Clearly define regulatory roles between the SEC and CFTC

Place most non-security digital assets under CFTC oversight

Reduce uncertainty around token issuance and secondary market trading

The Senate Banking Committee released the bill text, with markup expected later this week before it moves closer to a full Senate vote. For investors, this signals a potential shift away from regulation-by-enforcement toward a clearer and more predictable framework — a key demand from institutions.

Bitcoin Breaks Higher as Positioning Improves

Bitcoin pushed above $95,000, breaking out of a recent consolidation zone as futures open interest rose beyond $138 billion.

BTC has traded between $88,500 and $95,500 over the past week

Holding above $94,000–$95,000 could open a path toward $98,000–$100,000

Key support remains near $91,000, followed by $89,800

Despite the breakout, overall trading volumes remain moderate, suggesting the move is being driven more by macro relief and positioning shifts than speculative excess.

Altcoins Show Mixed Performance

Altcoin price action remained active but uneven, reflecting ongoing capital rotation rather than a broad altcoin rally.

Top performers:

Monero (XMR) $XMR surged amid renewed interest in privacy-focused coins

Dash (DASH) posted strong gains driven by speculative momentum

Select mid-cap tokens outperformed on rotation flows

Underperformers:

XRP lagged after its strong start to the year

Dogecoin (DOGE) and Cardano (ADA) remained weak on a weekly basis

ETF Inflows Remain a Positive Backdrop

U.S. spot Bitcoin ETFs continued to record net inflows, reinforcing steady institutional participation despite ongoing volatility.

Bitcoin ETF inflows continued to rise cumulatively

Ethereum spot ETFs saw modest but positive net flows

ETF holdings now represent a meaningful share of circulating supply

While flows vary by issuer, overall demand remains a structural support for the market.

Sentiment Improves, But Caution Persists

Market sentiment has recovered from late-2025 lows but remains far from euphoric.

Fear & Greed Index: around 45 (neutral)

Traders remain cautious following November’s sharp correction

Current positioning suggests accumulation rather than aggressive leverage

This cautious tone may help limit downside volatility while allowing upside momentum to build.

What Traders Are Watching Next

Key factors to monitor in the coming days include:

Additional U.S. inflation and labor market data

Federal Reserve signals on the timing of rate cuts

Further progress on the CLARITY Act in the Senate

Whether Bitcoin can hold above $95,000 on daily closes