The DUSK token stands as the foundational asset in the Dusk Network, designed to balance economic incentives, secure consensus, and enable efficient operations. Unlike simple utility tokens, DUSK integrates directly into the protocol's consensus and fee mechanisms, ensuring participants are motivated to contribute reliably while the network maintains integrity.

DUSK as the Native Currency for Fees and Gas

In the Dusk Network, every transaction requires payment in DUSK, functioning as the gas token to cover computational work. Gas is measured in LUX, where 1 LUX equals 10^-9 DUSK, and users specify a gas limit and price to execute operations. This setup covers deployment of smart contracts, privacy-preserving transactions, and interactions on DuskEVM, with fees collected and redistributed as block rewards. According to official documentation, failed transactions still incur charges for consumed gas, promoting efficient code while keeping Dusk's fee market responsive to demand.

Staking DUSK: Securing Consensus Participation

Staking DUSK allows holders to engage in the Succinct Attestation consensus of the Dusk Network, where a minimum of 1,000 DUSK is required to activate a stake after a 2-epoch maturity period (approximately 4,320 blocks). Stakers run nodes to propose or validate blocks, with selection probability tied to stake size relative to total network stake. This mechanism secures the Layer 1 settlement, as higher DUSK staking increases the likelihood of earning rewards and strengthens network decentralization in the Dusk ecosystem.

Reward Distribution and Emission Schedule

DUSK rewards incentivize active participation through a structured emission schedule spanning 36 years, with a total of 500 million DUSK emitted alongside the initial 500 million supply for a maximum of 1 billion. Emissions follow a geometric decay with halving every 4 years, starting at around 19.8574 DUSK per block in the first period. Block rewards combine new emissions with transaction fees, distributed as 70% to the block generator, 10% to the Dusk Development Fund, 5% to the validation committee, and 5% to the ratification committee. This design, per official sources, prioritizes early incentives while controlling long-term inflation in the Dusk Network.

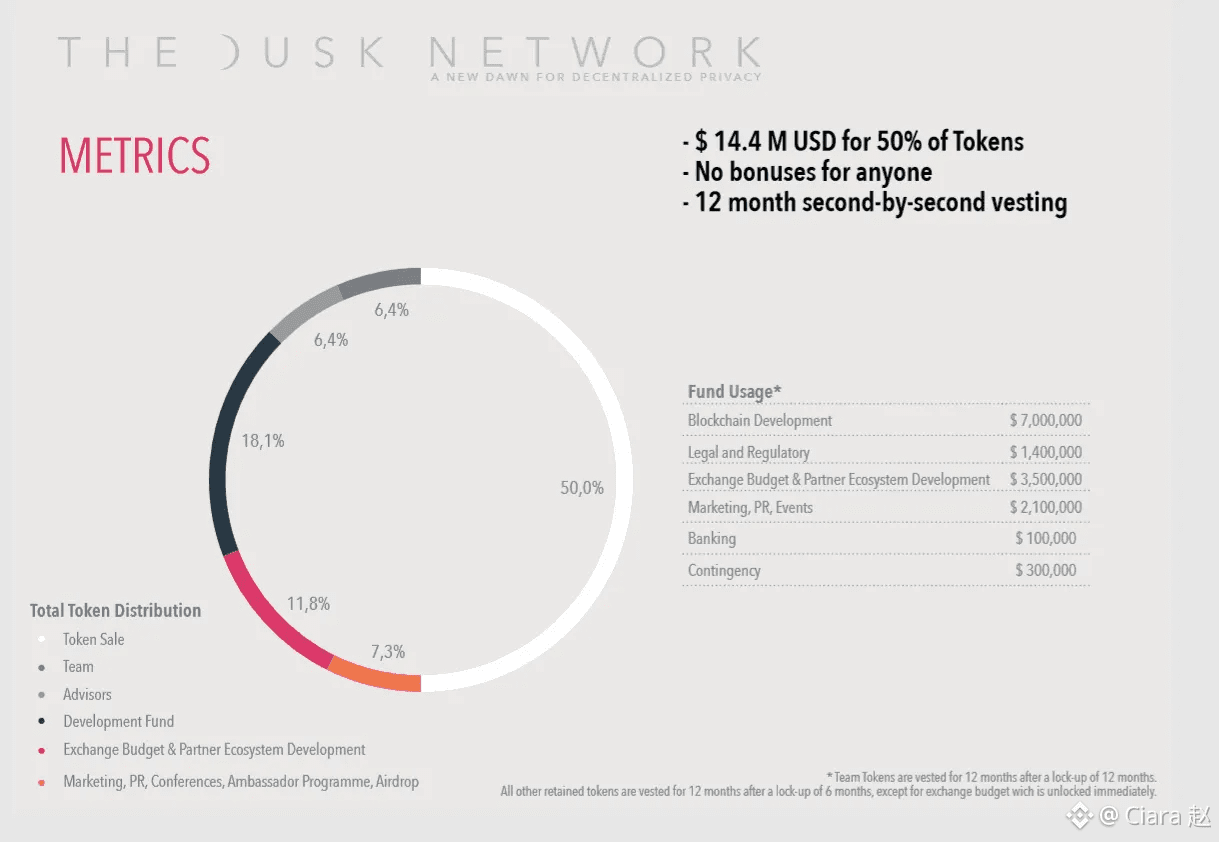

Allocation Breakdown and Initial Distribution

The initial 500 million DUSK supply was allocated across key areas: 50% to token sales, 18.1% to development, 11.8% to exchanges, 7.3% to marketing, 6.4% each to team and advisors. All vested fully by April 2022, ensuring no ongoing unlocks from these categories. This allocation supports ecosystem growth while directing resources toward building Dusk's infrastructure, with the development fund receiving ongoing 10% of block rewards for sustained protocol maintenance in the Dusk ecosystem.

Slashing and Security Constraints

Dusk employs soft slashing to enforce honest behavior without permanent token loss. Penalties trigger from downtime, outdated software, or missed duties, resulting in suspension (no rewards or committee eligibility) and progressive penalization (stake portion moved to a claimable pool, reducing effective stake). If effective stake drops below 1,000 DUSK, re-staking is required. This balanced approach deters misbehavior while preserving DUSK's utility for security in the Dusk Network.

DUSK's Role in Ecosystem Services and Governance

Beyond fees and staking, DUSK powers deployment of applications on DuskEVM and payment for services within the ecosystem. It also supports governance decisions, allowing holders to influence protocol upgrades. In regulated applications like RWAs, DUSK fees enable confidential transactions while funding the validators that secure Dusk's privacy features, creating a closed-loop economy.

The DUSK token is meticulously designed to align incentives with the Dusk Network's security needs and operational demands. Through staking rewards, fee redistribution, and controlled emissions, it fosters sustained participation and robustness. This structure positions Dusk as a focused Layer 1 for privacy and compliance.