The Market Context

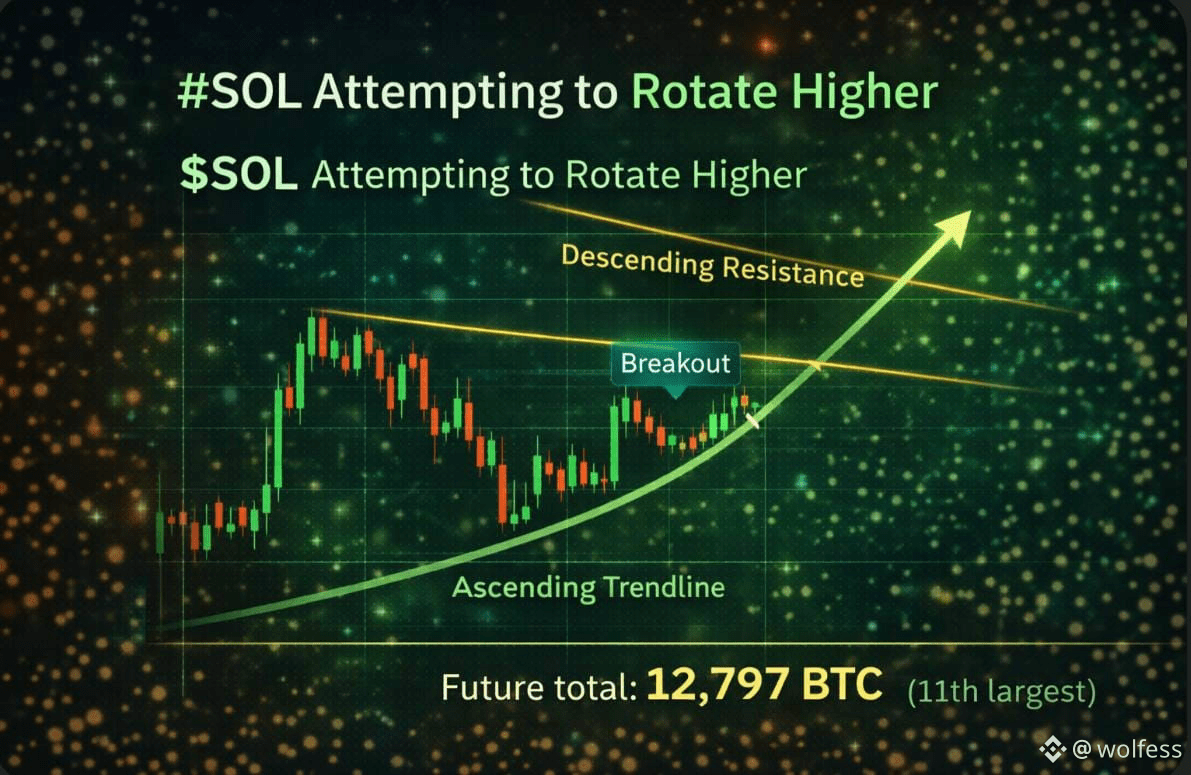

The $SOL ecosystem is showing renewed strength as price action begins to push higher, successfully breaking out of a tight, multi-week compression zone. This movement is a high-signal indicator that institutional interest might be rotating back into the Solana network.

Technical Deep Dive: The Ascending Triangle

After a prolonged corrective phase, $SOL is now carving out a classic Ascending Triangle pattern. This structure typically signals a continuation of the bullish bias, provided key levels are maintained.

The Bullish Scenario 🟢

Support: The bias remains firmly bullish as long as the price holds above the reclaimed trendline.

Momentum: Consistent respect for the rising support line is crucial for a build-up toward major descending resistance levels.

The Risk Factors 🔴

The Fakeout: If $SOL slips back below the breakout area and loses the trendline support, the current upside attempt will weaken.

Invalidation: A drop below the breakout zone would likely transition the market back into a boring, sideways accumulation phase.

Conclusion

We are at a pivotal retest zone. Watching the volume and candle closes on the 4H/Daily timeframe will be key for $SOL's next macro move.