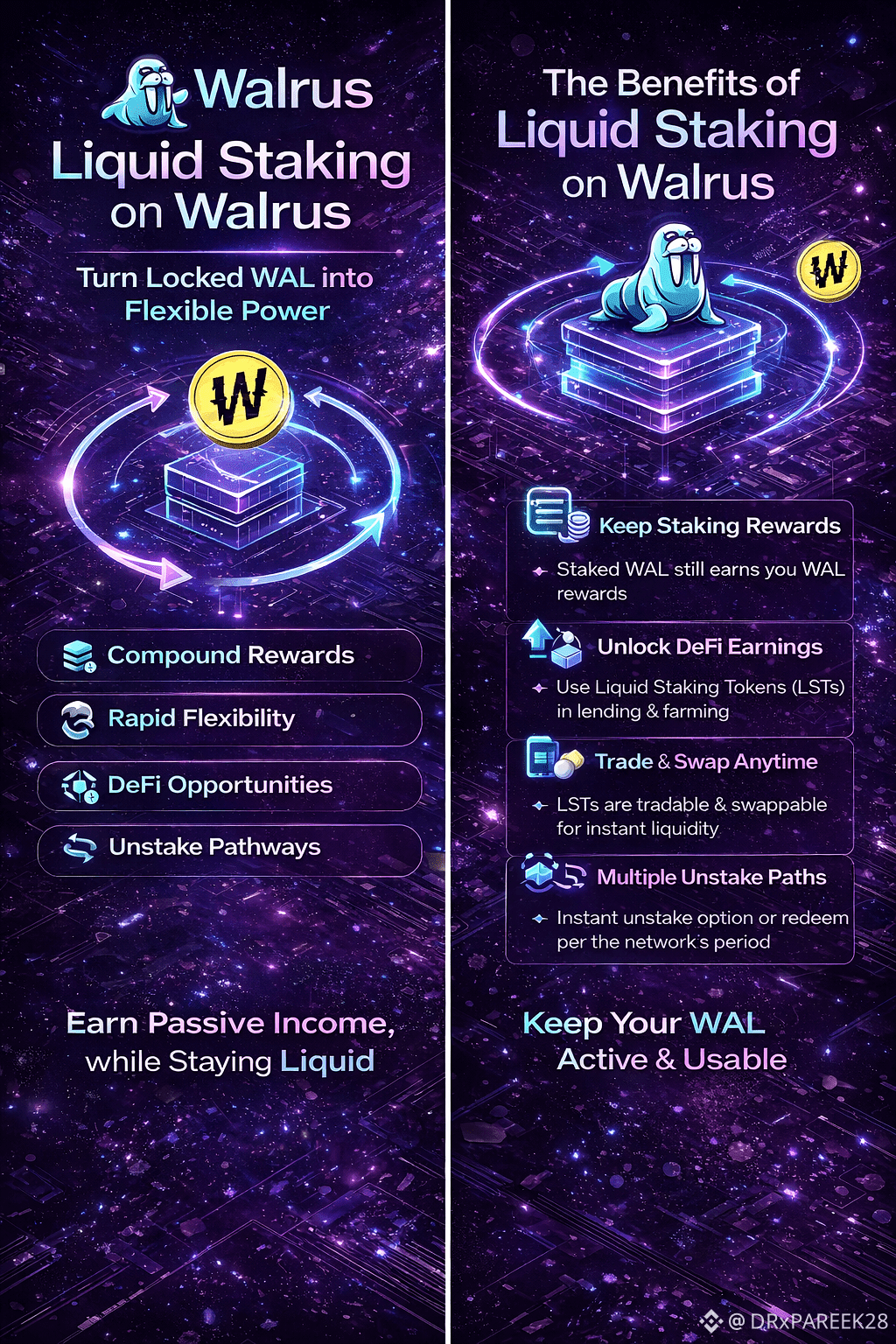

In most Proof-of-Stake networks, staking feels like the “safe” choice: you lock your tokens, support network security, and earn rewards over time. But there’s one big problem almost every staker experiences sooner or later — once you stake, your money becomes stuck. You can’t trade it quickly, you can’t move it freely, and you can’t use it for other earning opportunities while it’s locked.

That’s exactly the pain point Liquid Staking on Walrus solves.

Walrus uses a Delegated Proof-of-Stake model where token holders stake (delegate) WAL to storage nodes that help secure the network. Staking WAL strengthens the Walrus ecosystem and earns you WAL rewards. But the default method comes with a restriction: your staked WAL is illiquid, meaning it’s locked for a period, and you can’t use it in DeFi or other strategies.

This is where liquid staking becomes a game-changer.

Why staking WAL matters in the first place

Before jumping into liquid staking, it’s important to understand why WAL staking exists and why it’s valuable.

Walrus works as a network that relies on node operators for its infrastructure. To keep the system secure and reliable, the network uses staking incentives. When users delegate WAL tokens to storage nodes, those nodes gain more responsibility and capacity inside the network. In simple words:

✅ More stake = more trust + more role in the network

✅ Users earn rewards for supporting that network trust

So staking WAL is not just about “earning interest.” It’s about participating in network security while being rewarded.

But the issue starts with lockups.

The challenge with native WAL staking

Native staking has a classic limitation: your staked WAL gets locked.

That means:

you can’t freely trade or swap your staked WAL

you can’t quickly transfer it to another wallet

you can’t use it for lending, borrowing, or liquidity farming

your capital remains stuck, even if opportunities appear

And on top of that, unstaking isn’t instant. Walrus uses an unstaking period measured in epochs, which translates into a waiting time of roughly 14 to 28 days in many cases. So if you want your WAL back, you must plan ahead.

Another important point: when you stake, the protocol issues a unique object that represents your stake. This stake receipt is not like a normal token you can send anywhere. It is unique, like a digital receipt tied to your stake — which makes staking secure and trackable, but not flexible.

So the big question becomes:

How can we keep earning staking rewards while keeping our WAL liquid and usable?

That’s the exact reason liquid staking exists.

What is Liquid Staking?

Liquid staking is one of the smartest innovations in the PoS world.

It works like this: Instead of you staking and losing access to your tokens, a liquid staking protocol stakes on your behalf and gives you a liquid token in exchange — commonly called an LST (Liquid Staking Token).

This LST represents your staked position.

So now:

your WAL is still staked and earning rewards ✅

but you hold a liquid token that can be traded or used ✅

In simple terms, liquid staking turns staking from “locked earning” into flexible earning.

How WAL liquid staking creates liquidity (step-by-step)

Liquid staking on Walrus follows a smooth flow that anyone can understand. The process generally works in 4 simple steps:

1) Deposit your WAL

You deposit WAL tokens into the liquid staking protocol’s smart contract.

2) The protocol stakes WAL for you

The protocol delegates the WAL into the Walrus staking mechanism (meaning your tokens still help secure the network and generate rewards).

3) You receive a liquid token (LST)

To represent your ownership, the protocol mints a fungible token and sends it to your wallet.

This token is liquid, transferable, and usable in DeFi.

4) Rewards accumulate automatically

Here’s the magic: your rewards still generate in the background. Over time, the value of the LST increases relative to WAL (often through exchange-rate updates). So you don’t need to manually claim and re-stake. Rewards are typically auto-compounded inside the system.

This is why liquid staking is called capital efficiency. Your money is working in two ways:

securing the network & earning staking rewards

staying usable for other DeFi opportunities

Why liquid staking is a big deal for WAL holders

Liquid staking upgrades the entire experience of holding and staking WAL.

Instead of choosing between: ❌ staking rewards OR flexibility

you get: ✅ staking rewards AND flexibility

That means you can:

stake WAL without “locking your future”

use LSTs in DeFi opportunities

swap, trade, or move your stake exposure anytime

build strategies (staking + farming + lending)

This transforms WAL staking from a passive feature into an active financial tool.

Getting your WAL back: flexibility is key

The most important part of liquid staking isn’t only minting the LST — it’s how you can exit safely and conveniently.

Liquid staking protocols often provide multiple unstake pathways, which gives users choice based on urgency:

✅ The liquid advantage (fast exit)

Because LSTs are tradable, you can sell or swap your LST for WAL through market liquidity. This can be much faster than waiting through the full unstaking period.

✅ The express lane (instant unstake style)

Some protocols maintain liquidity buffers. So you can swap LST → WAL instantly, usually with a small fee and depending on available pool capacity.

✅ The standard path (safe unstake)

If you prefer the most protocol-native method, you can always redeem via the network’s normal unstaking cycle, waiting the usual 14–28 days for WAL to be released.

This is what makes liquid staking superior:

it gives freedom without removing security.

Liquid staking ecosystem on Walrus

One of the most exciting parts is that liquid staking solutions on Walrus are not limited to just one method. Multiple projects can build liquid staking services on top of Walrus and compete with different models.

Some provide a single-LST approach, meaning one main LST token represents staked WAL exposure.

Others focus on a multi-LST standard, meaning different LST types can exist with different strategies, parameters, node delegation methods, and liquidity plans.

This creates a healthy ecosystem because:

users can choose the protocol that matches their needs

competition improves safety and UX

DeFi integrations increase rapidly

Final thoughts: Liquid staking is the next stage of staking

Walrus liquid staking is more than just a feature — it’s a shift in mindset.

Traditional staking asks you to sacrifice flexibility for rewards.

Liquid staking removes that sacrifice.

It allows WAL holders to:

secure the network confidently

earn compounding staking rewards

keep liquidity alive

unlock DeFi access without giving up staking exposure

In the future, staking won’t be about locking tokens and waiting.

It will be about staking smartly — where your capital remains active, usable, and productive.

And that’s why liquid staking on Walrus is not just helpful…

it’s the beginning of a more powerful WAL economy.