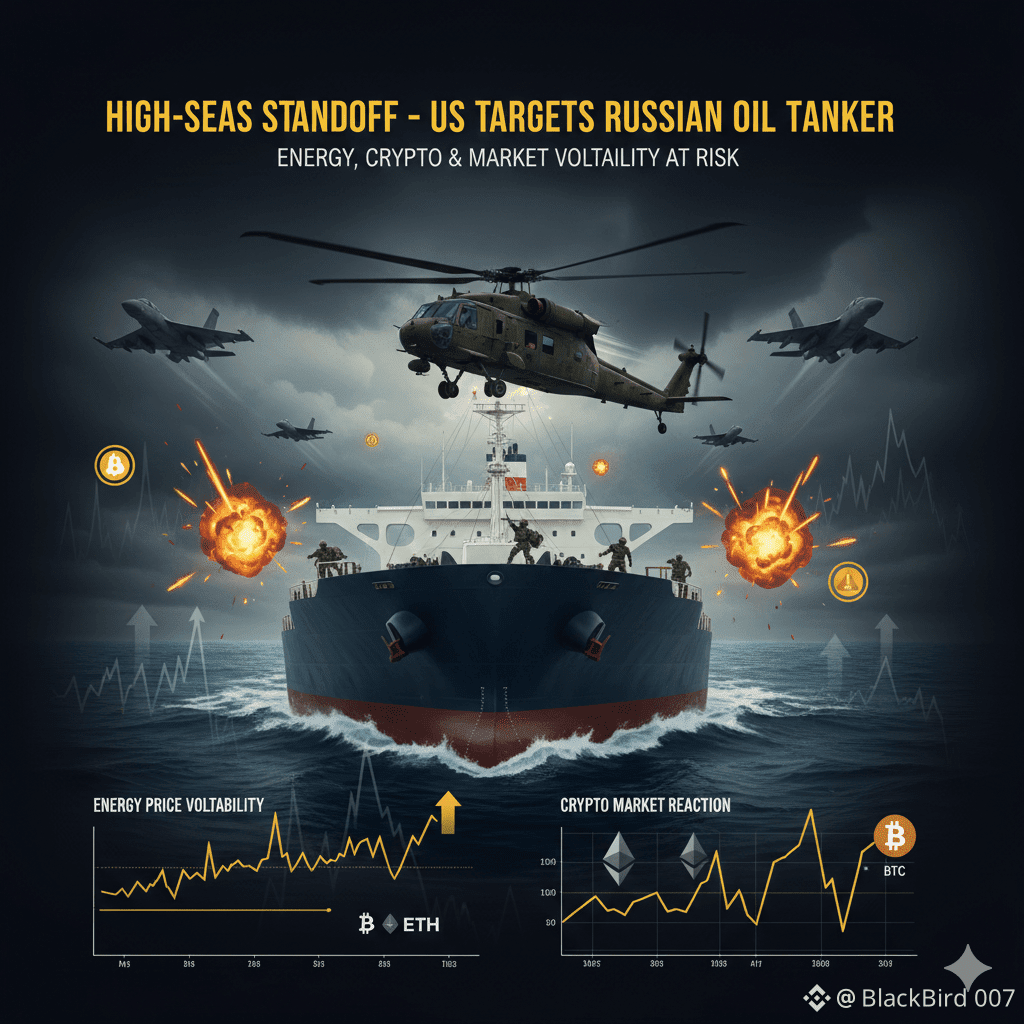

A major geopolitical standoff is unfolding in the Atlantic Ocean. Reports indicate that under Trump’s leadership, the U.S. allegedly attempted to seize a Russian oil tanker, with a helicopter reportedly trying to land troops on board. Flight data shows 4 U.S. Air Force planes circling the area.

Key Takeaways

Strategic Significance: Oil tankers are critical global assets. Control over them sends a strong geopolitical message.

Potential Risks: Escalation could affect energy prices, military tensions, and crypto markets, triggering volatility across risk assets.

Market Impact: Energy commodities may spike; equities and crypto could experience rapid swings.

Market Outlook

Traders and investors should monitor the situation closely. Short-term volatility is likely in:

Crude oil & energy markets

Equities sensitive to geopolitical risk

Cryptocurrencies, especially BTC and ETH

Assets to watch: $BTC $ETH $BREV

⚠️ The world is watching, and any misstep could spark major market reactions.

👉 FOLLOW @BlackBird_007 for urgent updates 📢.