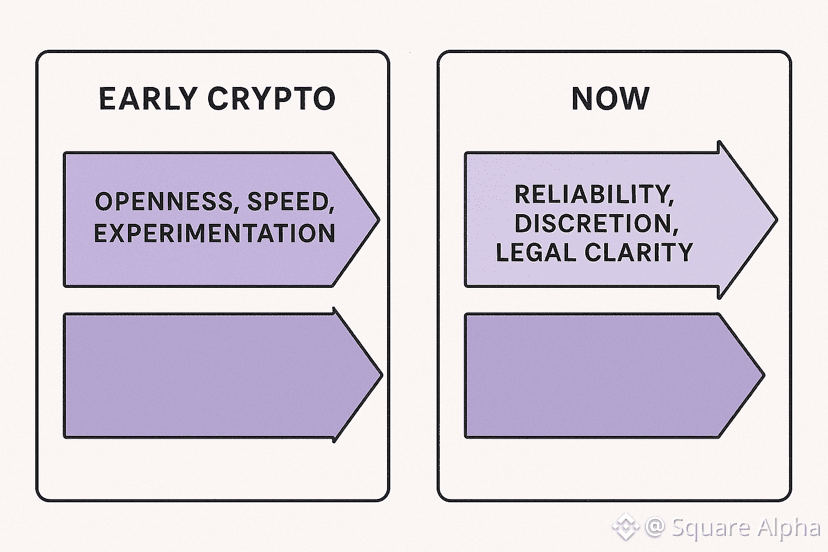

After watching this market cycle after cycle, one pattern keeps repeating: the projects that dominate attention early are rarely the ones that matter later. Early crypto rewarded openness, speed, and experimentation. The phase we are entering now is different. Reliability, discretion, and legal clarity are becoming more important than raw innovation. From my perspective, this is exactly the environment Dusk Network ($DUSK , @Dusk , #dusk ) seems designed for.

What draws my attention to Dusk is not a single product or headline, but how consistently it behaves like financial infrastructure rather than a startup chasing growth metrics. There’s a noticeable absence of narrative jumping. While many networks pivot from one theme to another depending on market sentiment, Dusk has stayed anchored to regulated finance and privacy-aware execution. That kind of consistency is rare in this industry, and it usually signals long-term intent.

From where I stand, privacy is the most misunderstood part of blockchain adoption. In crypto discussions, privacy is often framed as anonymity or resistance. In real finance, privacy is operational. Institutions cannot function if every position, transfer, or settlement is visible to the public. At the same time, they cannot operate in darkness. They need selective disclosure. Dusk’s approach reflects this reality. It treats privacy as a system requirement, not a philosophical stance.

Another reason Dusk stands out to me is how it approaches regulation. Instead of viewing regulation as an external obstacle, it treats it as a design constraint. That may slow progress, but it also prevents dead ends. Many projects accumulate users first and discover later that their architecture cannot survive regulatory scrutiny. Dusk seems to be doing the inverse: building within the rules first and letting adoption follow.

The collaboration with a licensed European exchange reinforces this perception. That kind of integration does not happen casually. It suggests that Dusk is being evaluated as infrastructure, not as an experimental platform. From a market perspective, that changes how I think about risk. Execution risk remains, but structural risk is lower when a project aligns itself with how financial systems actually operate.

Interoperability is another area where Dusk’s decisions feel deliberate rather than reactive. Instead of chasing multi-chain narratives, it focuses on preserving legal and operational context when assets move across systems. That might not excite retail audiences, but it matters deeply for institutions. Assets that lose their regulatory identity when crossing chains are unusable at scale. Dusk appears to understand this, and that awareness shows up in how it integrates external standards.

The $DUSK token itself fits into this framework. I don’t view it as a momentum asset. Its role is functional: securing the network, facilitating transactions, and supporting governance. That means its value proposition is tied to usage, not hype. This kind of token model often underperforms in speculative phases and becomes more relevant as activity grows steadily. From my perspective, that trade-off is intentional.

That doesn’t mean there are no risks. Adoption will likely be slower than many expect. Liquidity can remain thin. Regulatory processes are unpredictable by nature. From experience, I see this as a project that rewards patience and penalizes short-term expectations. Anyone approaching it with a quick-flip mindset is likely to be disappointed.

What keeps Dusk on my radar is timing. Crypto is moving out of its experimental era. Institutions are no longer asking what is possible — they are asking what is usable. That shift changes how value is assigned. Projects that were once overlooked for being “too conservative” are being reconsidered. Dusk fits that profile.

From my own perspective, Dusk is not about immediate upside. It is about alignment. Alignment with regulatory reality. Alignment with institutional behavior. Alignment with how financial infrastructure evolves in the real world. Whether or not it ultimately dominates its niche, it is clearly built to survive the transition crypto is going through.

In a market still obsessed with speed and spectacle, that may not look exciting. But from experience, those are often the systems that end up mattering long after the noise fades.