No, right now it does not look like a good time to short $DASH USDT perpetual futures — the setup actually leans more toward caution for shorts or even potential upside continuation in the very short term.

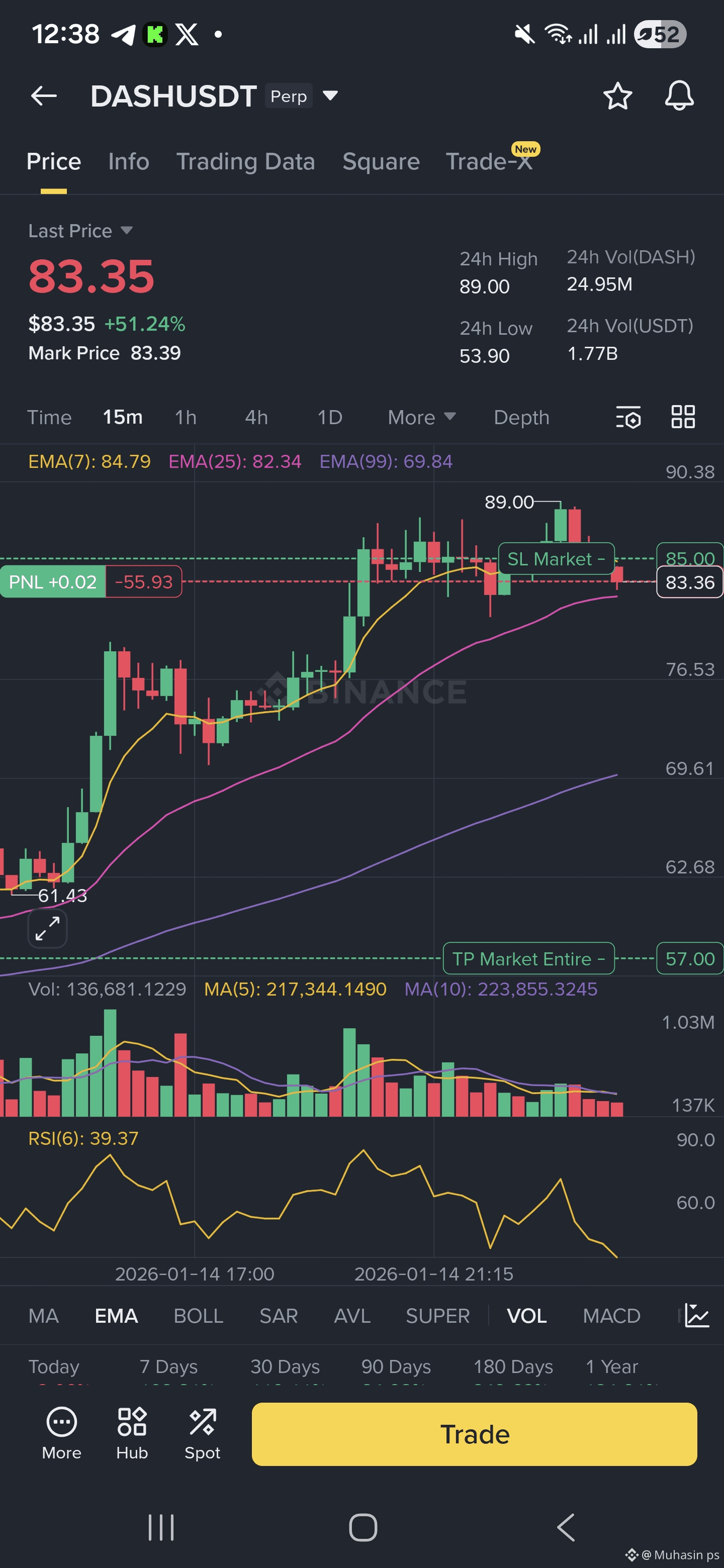

Here's a breakdown based on the chart you shared (around ~83.35 USDT on Jan 15, 2026, with +51% in 24h):

Key Observations from Your Chart

Massive pump: +51% in the last day, pushing from ~54–56 area (previous recent low/TP zone) straight to 83.35, hitting a 24h high of 89.00.

EMAs: Price is well above EMA(99) (~70), EMA(25) (~82), and just below EMA(7) (~85). This shows strong bullish momentum on the timeframe you're viewing (likely 15m–1h–4h candles).

Recent structure: It broke and closed above a previous resistance/SL area around 85, turned it into support briefly, then pulled back slightly to ~83.

RSI(6): ~39 — not overbought at all (still room to run before hitting 70+), actually quite neutral/low after the violent move up.

Volume: Decent spike on the way up, but the volume bars are declining recently — classic sign the pump might be losing steam short-term.

Other levels:

Resistance tested at 89 (24h high).

Potential next resistance near 90–95 if it reclaims.

Lower supports at ~76–80 (previous candles), then deeper at 69–70 (EMA99 zone).

Current Market Context (mid-Jan 2026)

Recent reports show DASH has been in a very strong short-term rally:

Multiple sources list current spot/futures around $80–$86+ (very close to your 83.35 mark).

24h gains reported in the 40–55% range in several places, with high volume (often $1B+ across exchanges).

Sentiment is bullish/short-term momentum-driven, often linked to privacy coin rotation or broader altcoin strength.

No major bearish news or reversal catalyst visible right now.

Why Shorting Looks Risky Here

Still in momentum phase — +50% pumps rarely reverse immediately into big shorts without overextension first (RSI is low, not 80+).

RSI has plenty of room — at ~39 it's not screaming overbought → more upside likely before real exhaustion.

Failed short setup — if you shorted near 85–89 (previous SL/resistance), you'd already be underwater or stopped out.

Perp funding — in huge pumps, funding rate on Binance perps usually turns very positive (longs pay shorts) — but if it's still pumping, shorts get squeezed hard.

Realistic Scenarios Right Now

Bullish continuation (higher probability short-term): Retest 89 → possible push to 95–100+ if volume picks up again.

Healthy pullback (most likely next): 83 → 76–80 zone (previous body/EMA25 area) → then decide whether to hold or fade.

Actual reversal/short opportunity (lower probability yet): Only if it clearly breaks back below 80–76 with strong volume + RSI diving under 30 + negative news.

Suggestion

Avoid shorting aggressively at current levels (83–85 area) — high risk of squeeze back to 89+.

If you're bearish longer-term, wait for a clear rejection at 89–92 + signs of exhaustion (RSI >70–80, shooting star/doji on high volume, funding rate extremely positive).

Safer play right now: either stay flat, or consider small long scalps on dips to 80–81 with tight stop below 76–78 (but very risky after +50% move).

Always use low leverage (1–5x max) on perps in these violent alt moves — liquidation cascades happen fast.

This is momentum-driven altcoin action — very whippy. Trade small and protect capital. $DASH