The world of centralized cryptocurrency exchanges (CEXs) continues to evolve rapidly, but one name remains at the forefront: Binance. According to the latest 2025 CEX Annual Report compiled by WuBlockchain, Binance solidified its position as the leading centralized exchange globally, maintaining dominance in both spot and derivatives trading volumes. While other exchanges like MEXC, Bitget, and Gate showed strong growth, Binance’s market leadership remains unchallenged.

This article dives into the key findings from the WuBlockchain report, explores what these numbers mean for the industry, and highlights the emerging trends in user behavior and market dynamics.

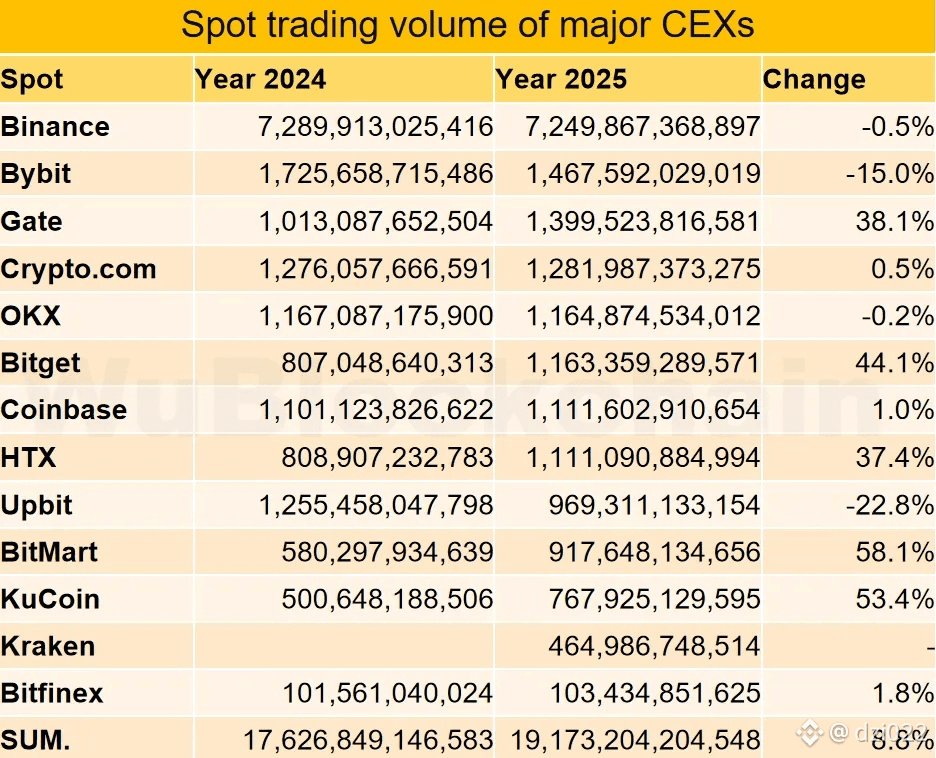

Binance’s Spot Market Supremacy

In the 2025 spot trading volume rankings, Binance dominated with nearly five times the volume of Bybit, fueled primarily by $BTC and $ETH pairs. Gate and Crypto.com completed the top four, but neither came close to Binance’s massive scale.

Binance: The undisputed leader, Binance processed more spot trading volume than all other exchanges combined in several key months of 2025.

Bybit: Maintained a strong position, but its volume was just a fraction of Binance’s.

Gate: Showed notable growth, particularly in emerging markets.

Crypto.com: Remained a top contender, especially in regions with strong regulatory compliance.

This overwhelming dominance in spot trading is a testament to Binance’s robust infrastructure, wide range of supported assets, and global reach. The exchange’s ability to attract both retail and institutional traders has set a high bar for competitors.

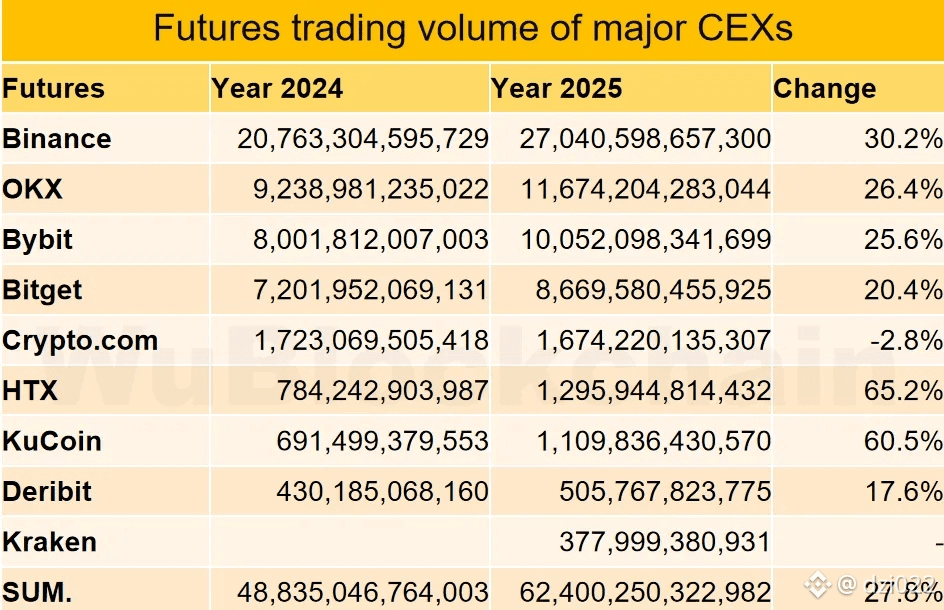

Derivatives Market: Binance Still on Top

The derivatives market tells a similar story. Binance, OKX, Bybit, and Bitget occupied the top four positions in derivatives trading volume for 2025.

Binance: Continued to lead, leveraging its advanced trading tools and liquidity.

OKX: Showed strong growth, particularly in options and perpetual contracts.

Bybit: Maintained a loyal user base with its aggressive marketing and user incentives.

Bitget: Experienced a surge in volume, especially among Asian and Russian-speaking users.

While OKX and Bybit have narrowed the gap in recent years, Binance’s derivatives platform remains the go-to for traders seeking high leverage and deep liquidity.

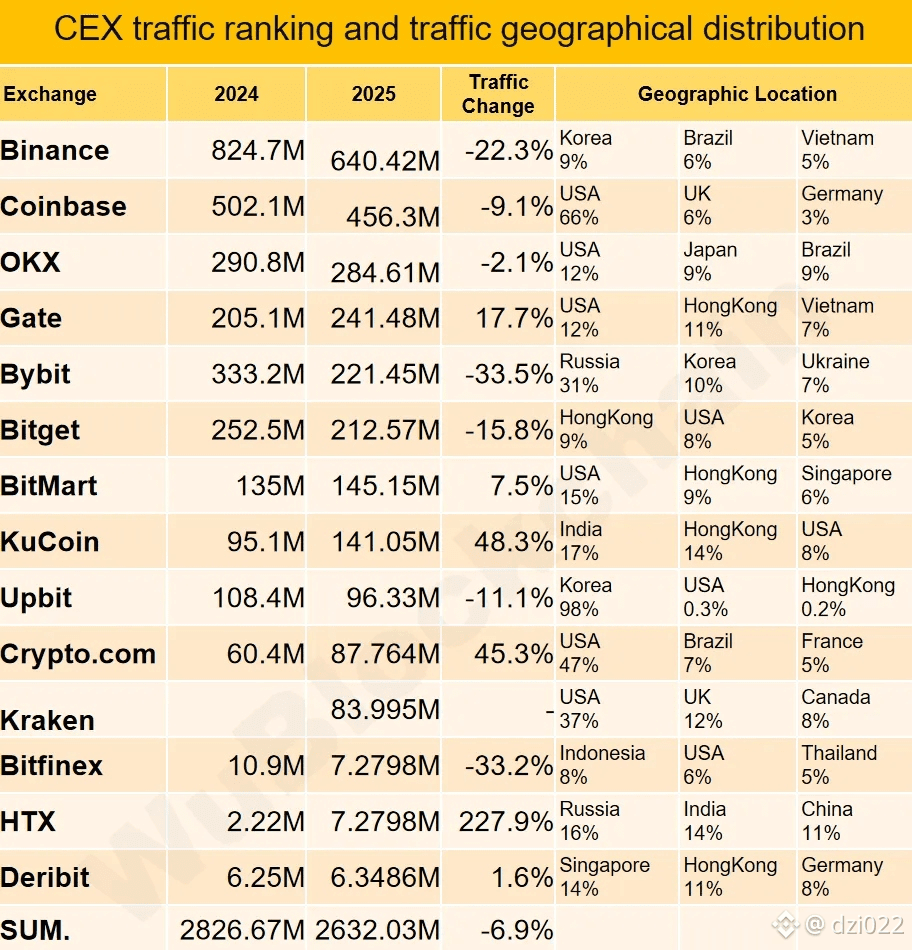

Traffic Insights: Where Users Come From

User traffic patterns offer additional insight into each exchange’s global footprint. Binance’s user base is notably diversified, with significant traffic coming from South Korea, Brazil, and Vietnam. This reflects Binance’s successful localization efforts and its ability to adapt to regional regulatory environments, as well as the broader ecosystem surrounding the platform, including $BNB .

South Korea: Binance has made inroads with Korean users by supporting local payment methods and offering Korean-language interfaces.

Brazil: The Brazilian market has seen explosive growth in crypto adoption, and Binance’s presence there is a major factor.

Vietnam: Binance’s aggressive marketing and educational campaigns have paid off in Vietnam.

In contrast, exchanges like Coinbase, Crypto.com, and Kraken receive the majority of their traffic from the United States. This highlights the regional differences in exchange popularity and regulatory acceptance.

Coinbase: Remains the top choice for US users, thanks to its compliance-first approach.

Crypto.com: Also sees most of its traffic from the US, but is expanding globally.

Kraken: Maintains a loyal US user base and is known for its security and transparency.

Several exchanges, including MEXC and Bitget, see most of their traffic originating from Russia and Russian-speaking regions. This suggests that these exchanges have tailored their services to meet the needs of users in those areas, possibly due to regulatory or language barriers.

Growth Trends: MEXC, Bitget, and Gate Shine

While Binance continues to dominate, the WuBlockchain report highlights strong growth among other exchanges. MEXC, Bitget, and Gate all showed impressive increases in both spot and derivatives trading volumes.

MEXC: Focused on emerging markets and niche assets, MEXC attracted a growing number of traders seeking alternative investment opportunities.

Bitget: Expanded its derivatives offerings and marketing, particularly in Asia and Russia.

Gate: Invested heavily in user acquisition and localization, resulting in significant volume growth.

These exchanges are proving that there is still room for competition in the CEX space, especially as new markets open up and user preferences shift.

Challenges and Caveats

It’s important to note that the data in the WuBlockchain report may involve significant wash trading or bot activity. Spot and derivatives data are sourced from Coingecko, while traffic data comes from Similarweb. While these sources are reputable, the presence of non-organic activity can distort the true picture of exchange performance.

Wash Trading: Some exchanges may inflate their volumes through wash trading, making it difficult to compare real user activity.

Bot Activity: Automated trading bots can also skew volume and traffic numbers.

Despite these challenges, the overall trends are clear: Binance remains the dominant force in the CEX landscape, but other exchanges are making significant strides.

What These Findings Mean for the Industry

The WuBlockchain report underscores several key themes for the crypto industry in 2025:

Consolidation: The top exchanges are pulling further ahead, making it harder for smaller players to compete.

Globalization: Exchanges are increasingly targeting international markets, leading to more diverse user bases.

Innovation: Growth among MEXC, Bitget, and Gate shows that innovation and localization can drive success even in a crowded market.

For users, this means more choices and better services, but also the need to be vigilant about exchange reliability and transparency. For exchanges, the report highlights the importance of building trust, adapting to regional needs, and investing in security and compliance.

The Future of Centralized Exchanges

As we look ahead, the dominance of Binance is likely to continue, but the landscape is far from static. Regulatory changes, technological advancements, and shifting user preferences will shape the future of CEXs.

Regulation: Exchanges will need to navigate an increasingly complex regulatory environment, particularly in major markets like the US and EU.

Technology: Innovations in trading platforms, security, and user experience will be critical for staying competitive.

User Trust: Building and maintaining user trust will be essential, especially as concerns about wash trading and bot activity persist.

In conclusion, the 2025 CEX Annual Report from WuBlockchain paints a clear picture of Binance’s continued dominance, but also reveals the dynamic and competitive nature of the centralized exchange market. As the industry evolves, exchanges that can adapt to change and meet the needs of a global user base will be best positioned for success.