Because markets don’t reward knowledge alone — they reward discipline, psychology, and timing.

Here’s the hard truth most people ignore 👇

🔹 Overconfidence kills

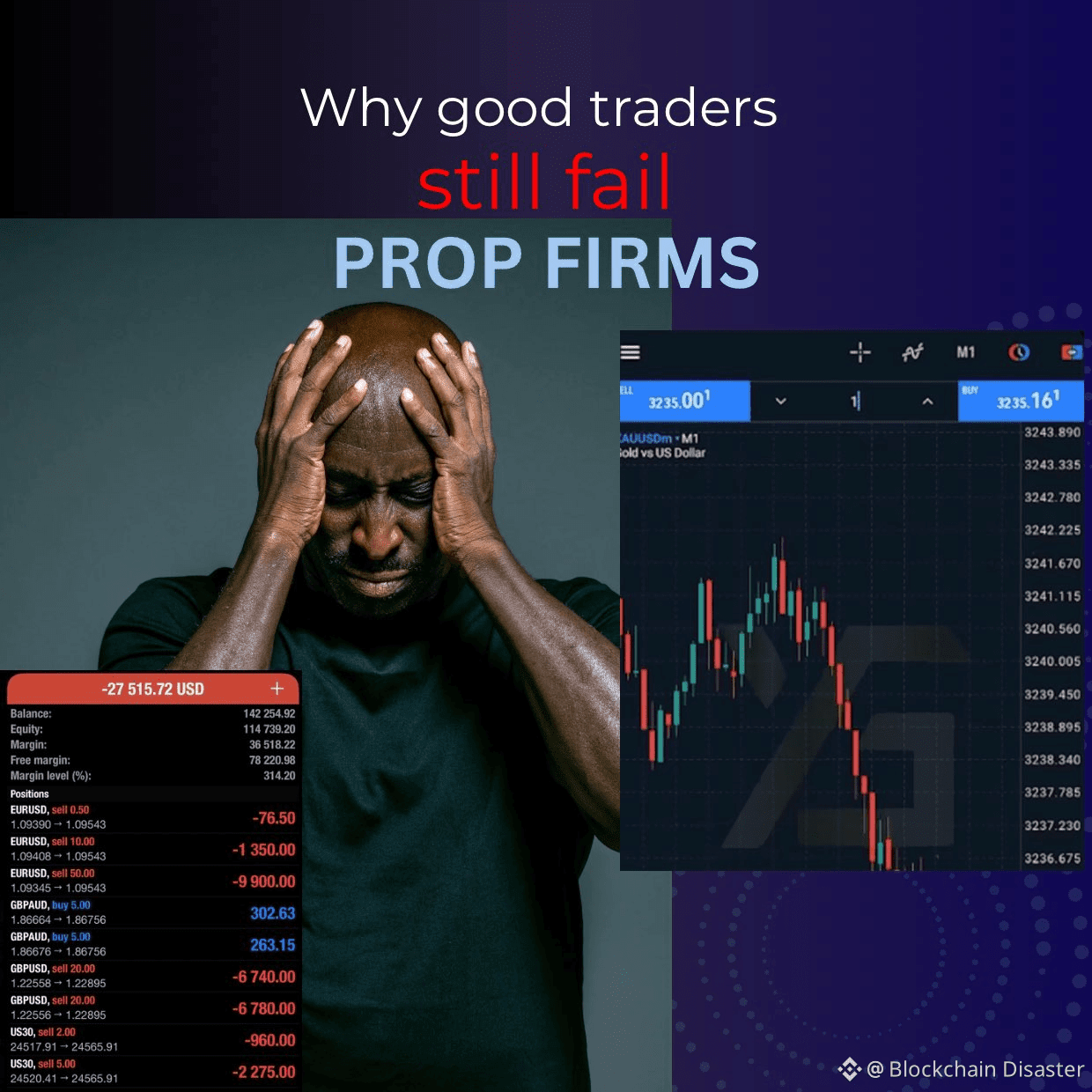

Experts trust their analysis too much and stop respecting risk. One oversized trade can erase months of wins.

🔹 Emotions never disappear

Fear and greed affect everyone. Experience doesn’t remove emotions — it only hides them better.

🔹 Markets change, egos don’t

What worked before may fail today. Many experts defend old strategies instead of adapting.

🔹 Information overload

Too much data leads to hesitation, late entries, or analysis paralysis.

🔹 No edge = no mercy

Being “smart” doesn’t mean you have an edge. Without strict risk management, the market will expose you.

💡 The market doesn’t care who you are

Beginner or professional — the rules are the same.

📌 Winners aren’t the smartest.

They’re the most consistent, disciplined, and patient.

If this hit you — you’re already ahead. 🚀