The first time an institution suggested moving corporate bonds onto a public blockchain, eyebrows rose. The promise of transparency clashed with the instinct for discretion. No one wanted the trade to become a public spectacle. "If our positions show up in the ledger, everyone will know our strategy before we even finish the quarter," muttered a compliance officer, sipping cold coffee in a dimly lit office.

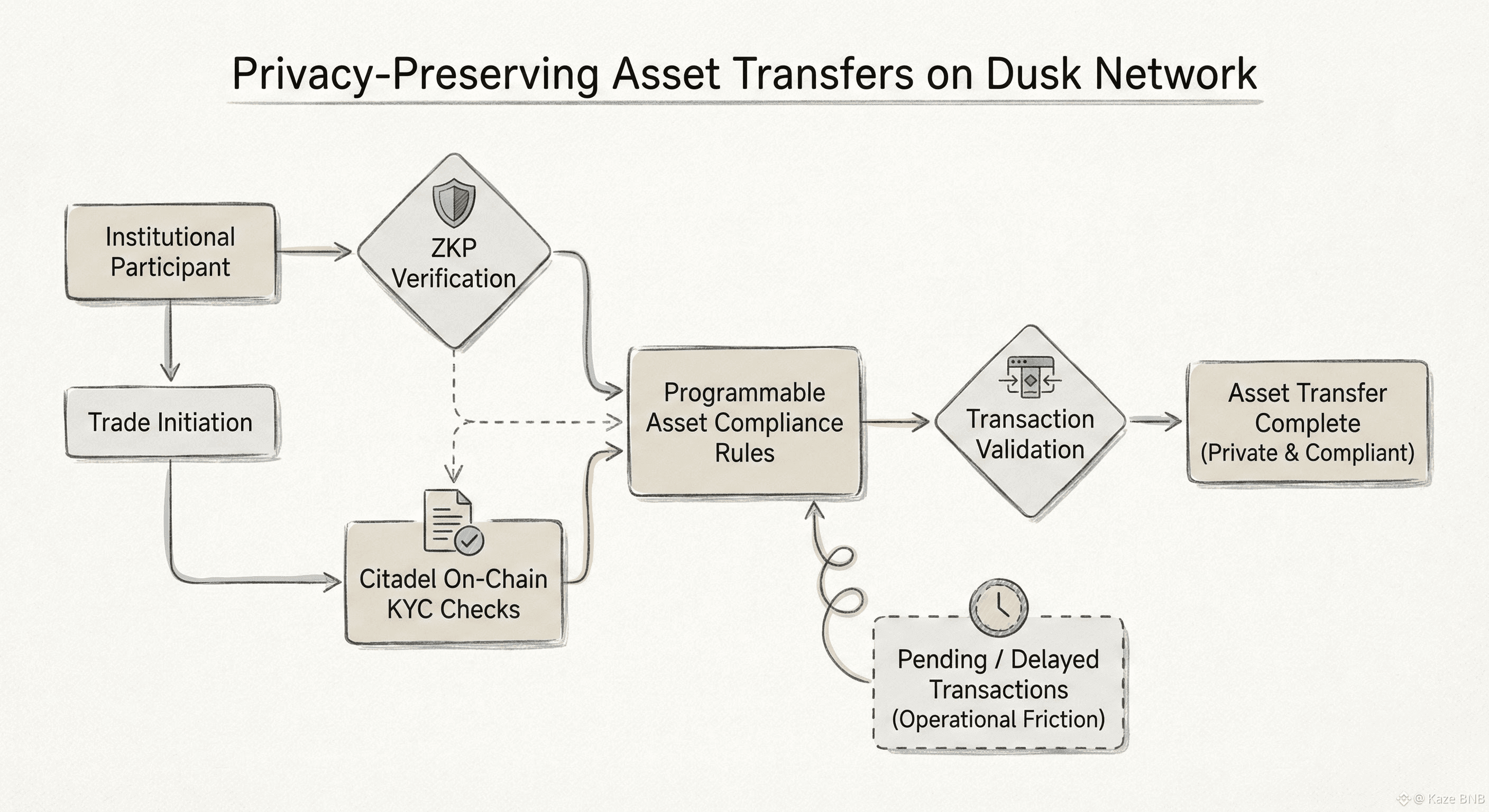

Dusk Foundation doesn’t hide behind slogans. It tries to solve the tension: How do you keep trades private while staying compliant? ZKPs are the first line of defense. On paper, they look neat—proofs that verify correctness without showing the underlying data. But the first week of live transactions revealed gaps. Some nodes lagged. Validation occasionally staggered. "I can see the logic," said a developer, scanning logs late at night, "but I still don’t trust every edge case." The ledger didn’t fail, yet uncertainty lingered, invisible yet palpable.

Citadel, the native compliance layer, introduces another layer of friction. On-chain KYC promises anonymity: prove eligibility without exposing sensitive documents. Programmable rules enforce holding periods or geographic limits automatically. Sounds ideal. Until a cross-border security token triggered an unexpected permission clash. Regulators in two jurisdictions disagreed, leaving the transaction pending, and participants staring at the waiting timer. Decisions about automation versus manual oversight became unavoidable.

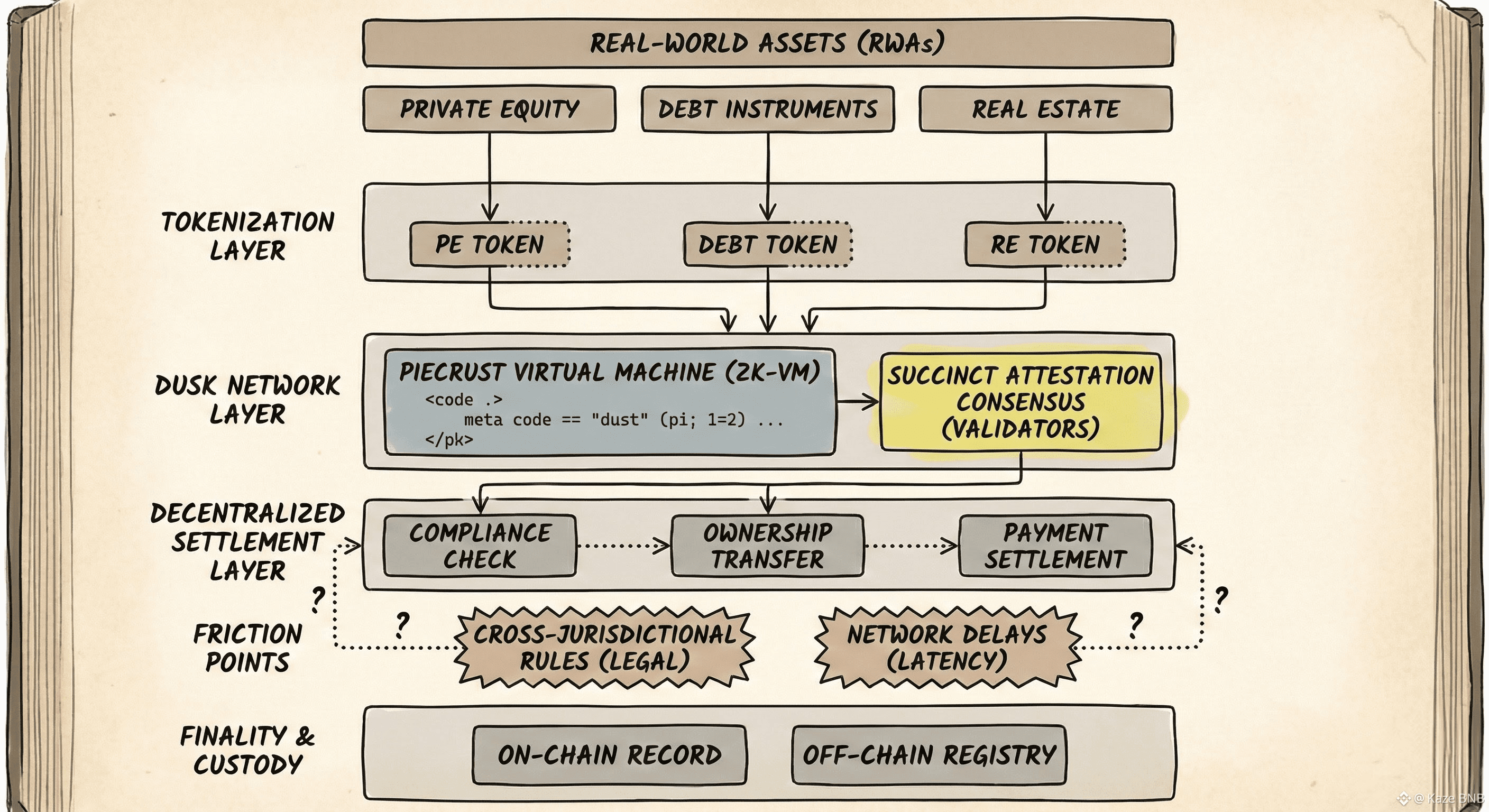

Real-world asset tokenization brought its own headaches. Fractionalizing private equity sounded elegant until microtransactions revealed how tiny ownership slices interacted with larger market movements. Debt instruments could settle faster than expected—but what about coupon calculations, accruals, and tax reporting? One observer noted, "It’s like trying to slice a loaf of bread with invisible blades; you know the shape, but the cut edges are never clean." Even real estate tokens, meant to simplify cross-border property investments, exposed gaps in off-chain verification. Ownership chains were clear on Dusk, yet local land registries still required human attention.

Clearing and settlement were supposed to be immediate. Piecrust virtual machine and Succinct Attestation consensus promised near-instant finality. Yet when a high-volume week arrived, minor network delays caused cascading effects. Trades confirmed on the ledger, but downstream participants questioned their internal accounting systems. "We’re faster, yes—but are we correct?" whispered a risk analyst into a muted call. Every second felt heavier because errors couldn’t simply be rolled back; the ledger kept its record, silent and immutable.

Institutional DeFi tested the boundaries further. Banks wanted exposure, liquidity pools wanted efficiency, and AML rules wanted clarity. The tension surfaced when liquidity routing and privacy-preserving mechanisms interacted. A simple lending transaction became a study in trade-offs: transparency for auditors, privacy for participants, speed for traders. Compromises were invisible yet tangible—participants didn’t fully know the network’s internal decisions, but the effects manifested in delayed settlements, cautious allocations, or subtle shifts in strategy.

Still, each challenge hinted at possibility. Dusk Foundation’s framework nudges TradFi and DeFi closer without erasing the distance. Invisible lines mark where privacy shields, compliance rules, and tokenized assets intersect. Questions remain. How far can automation go before human oversight is mandatory? How many jurisdictions can reconcile before friction becomes inertia? And at what point does privacy obscure operational clarity?

Transactions move, proofs are verified, yet each tick of the network clock carries the echo of decisions left unfinished. Participants adapt, anticipate, and sometimes hesitate. There’s no tidy resolution.