The latest US Producer Price Index (PPI) for November has just been released, and the numbers are coming in HOTTER than expected. This is a critical signal for the crypto and traditional markets.

The Numbers You Need to Know:

Actual: 3.0% (YoY)

Forecast: 2.7%

Previous: 2.8% (Revised)

Why Does This Matter for Crypto?

The PPI measures the change in the price of goods sold by manufacturers. When wholesale prices rise, they usually pass those costs to consumers (CPI), leading to higher inflation.

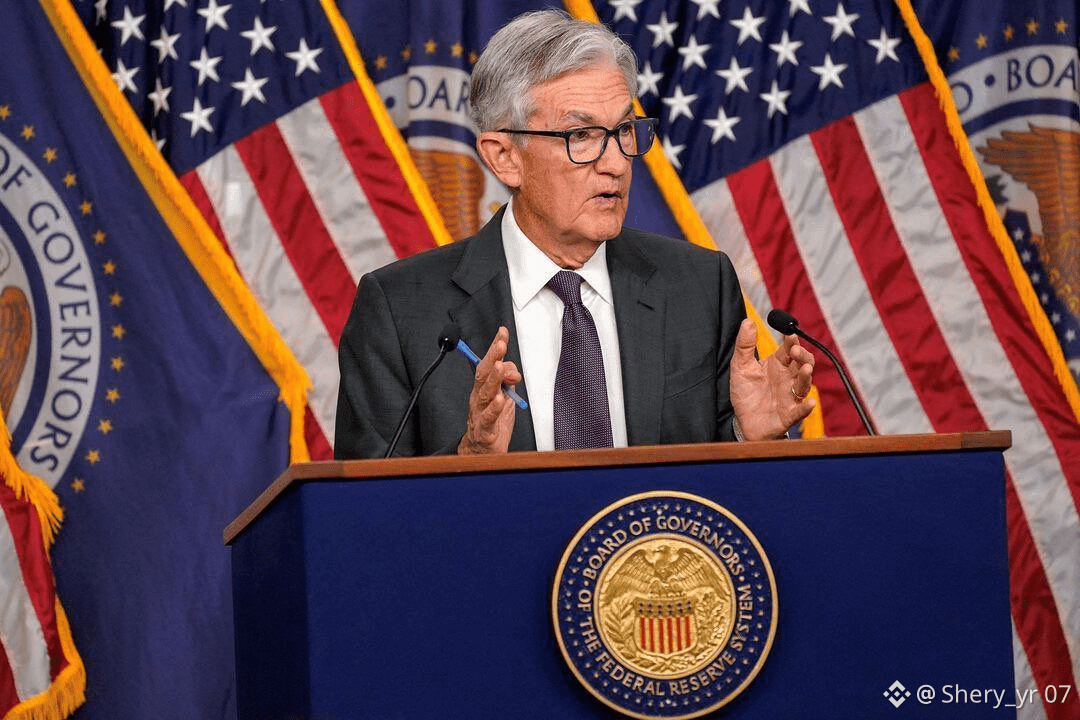

Fed Policy: This higher-than-expected data suggests that the Federal Reserve might stay "higher for longer" with interest rates. A "hawkish" Fed usually puts pressure on risky assets like Bitcoin ($BTC ).

DXY Strength: Typically, hot inflation data strengthens the US Dollar Index (DXY). When the Dollar goes up, Bitcoin often faces a temporary pullback.

Market Sentiment: Investors were hoping for a cooling trend. This 3.0% print creates uncertainty regarding future rate cuts in early 2026.

What to Watch Next:

Keep a close eye on the $BTC and $ETH charts. We might see some volatility in the coming hours as the market digests whether this is a temporary spike or a long-term trend.

Trade safe and manage your risk! 🛡️

Do you think BTC will dump or pump after this news 🚀🚀