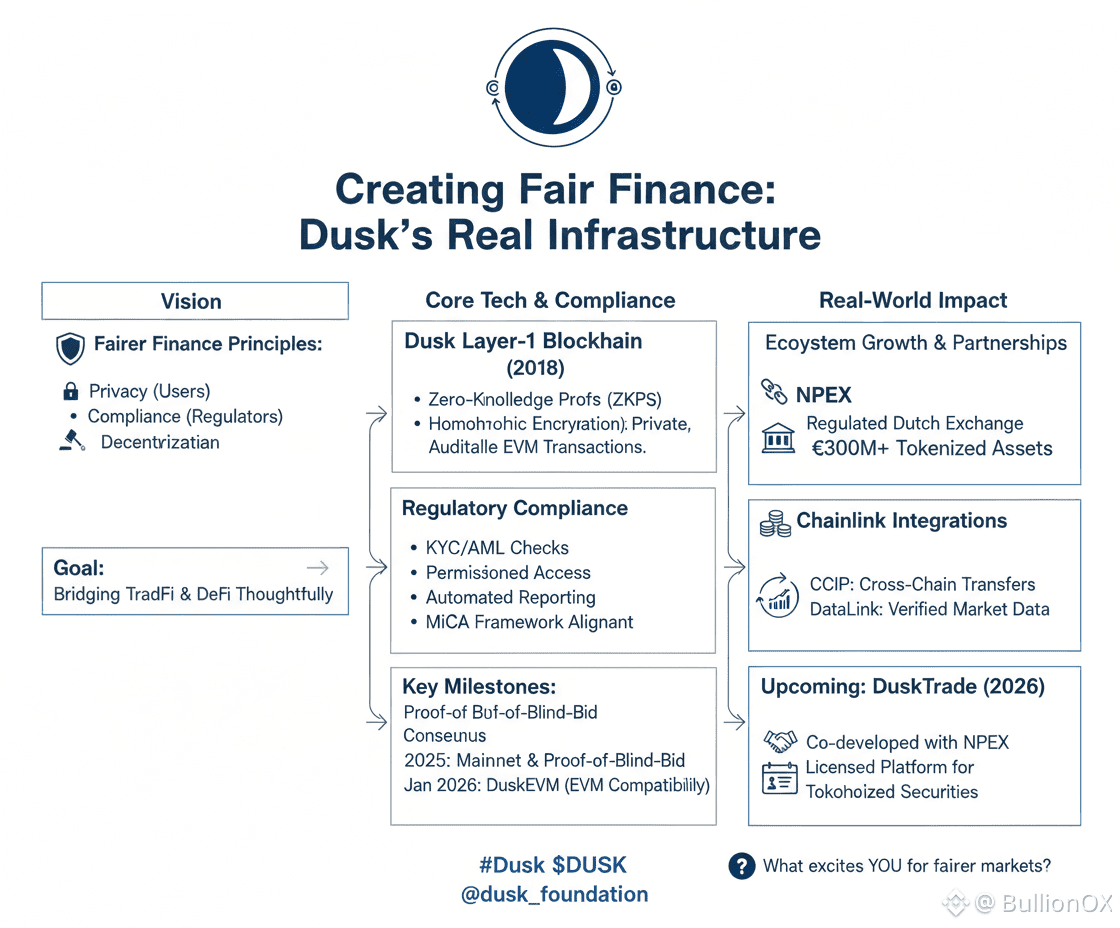

let's sit down and talk about this properly like we're mapping out how real change happens in finance. @Dusk has always aimed to make finance fairer: privacy for users and institutions, compliance for regulators, and true decentralization without shortcuts. What impresses me is how they're turning that vision into working infrastructure, piece by piece, no shortcuts or overpromises.

Dusk started in 2018 as a Layer-1 blockchain focused on regulated environments. The goal was simple yet ambitious: build a network where privacy preserving tech meets real regulatory standards. They use zero knowledge proofs (ZKPs) and homomorphic encryption to keep transaction details confidential while allowing full auditability. Hedger (Alpha live now) is the key tool here it enables private yet provably correct transactions on EVM chains, perfect for institutions handling sensitive data.

Compliance runs deep in the design. Native features include KYC/AML checks, permissioned access, and automated reporting. This aligns with Europe's MiCA framework, so tokenized real world assets (RWAs) like equities or bonds can be issued and traded on chain with built in legal guardrails. No need to retrofit rules later; they're part of the protocol.

The ecosystem is growing through deliberate steps. Mainnet launched in early 2025 with Proof-of-Blind-Bid consensus, which keeps staking anonymous and secure via ZKP-verified bids preventing attacks while ensuring fairness. DuskEVM (mainnet rollout in January 2026's second week) brings full EVM compatibility. Developers can deploy standard Solidity contracts that settle on Dusk's Layer-1 with privacy intact no major rewrites needed.

Partnerships make this tangible. NPEX, a fully regulated Dutch exchange (MTF, Broker, ECSP licenses), has tokenized over €300 million in assets on Dusk. This brings traditional products on-chain under licensed conditions. Chainlink integrations (CCIP for cross chain transfers, DataLink for verified market data) add secure interoperability, letting tokenized RWAs move compliantly across ecosystems.

Upcoming milestones keep the momentum. DuskTrade, co developed with NPEX, launches phased in 2026 as a compliant platform for issuance, trading, and investment in tokenized securities the waitlist is open now. This isn't just talk; it's licensed infrastructure enabling real financial activity on chain.

Dusk shows how fair finance emerges: through modular architecture, regulatory partnerships, and privacy that survives audits. It's building tools that bridge TradFi and DeFi thoughtfully.

What part of this infrastructure excites you most for fairer markets?

Have you followed the NPEX integration or Hedger tool? Share your insights i'm interested in your perspective!