The first time someone asked, "Can this really replace the old registrar books?" a ripple ran across the team. The XSC tokens weren't just code they were claims, rights, and obligations. DUSK (@Dusk ) on the Dusk Foundation wasn’t a ledger; it was a promise written in zeros and ones, but one that could clash with reality if someone lost a key or missed a compliance step.

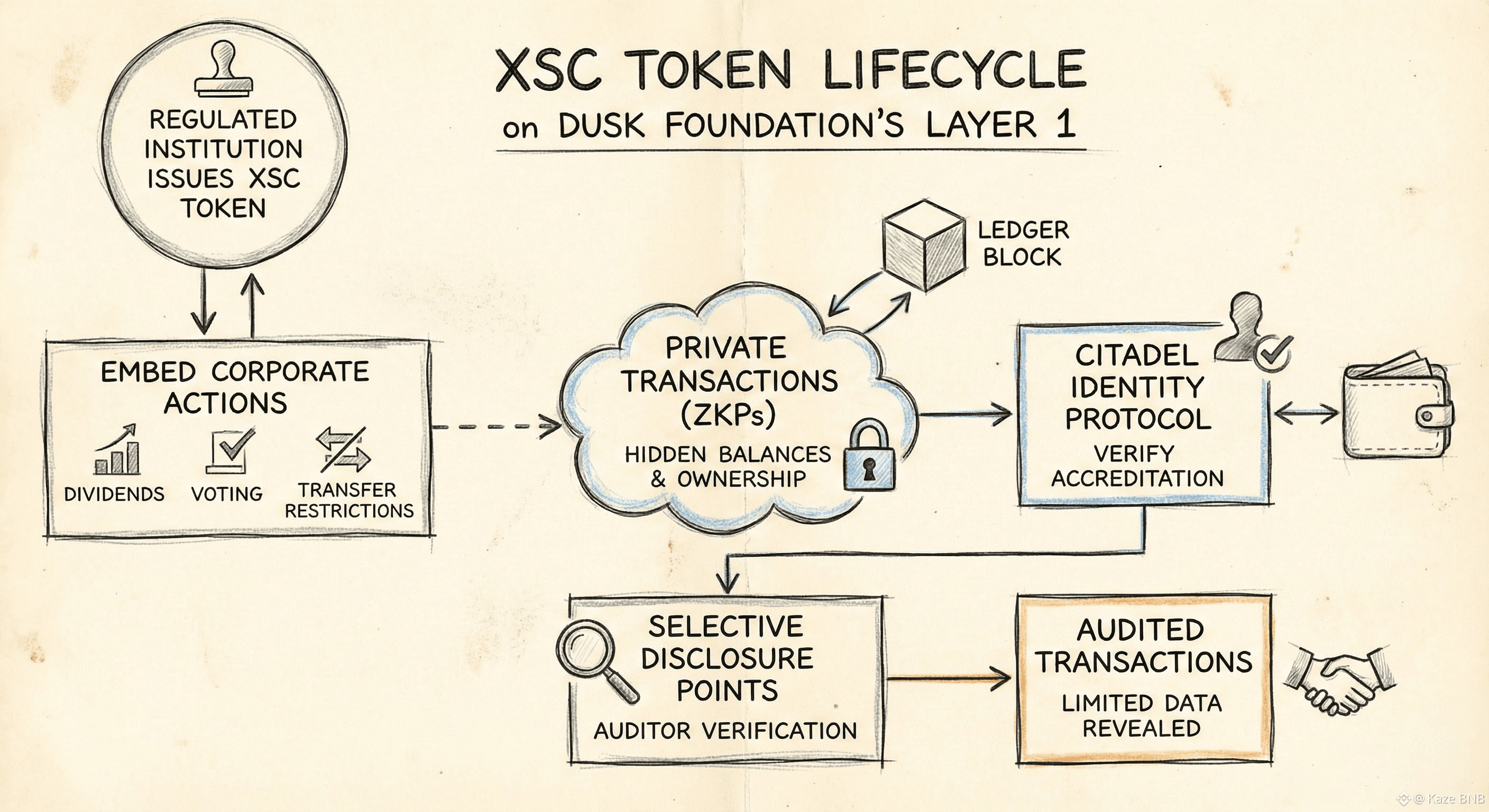

XSC, the Confidential Security Contract, looks simple on paper. Like ERC-20 but regulated, private, programmable. But “private” doesn’t just mean hidden. It means invisible until it shouldn’t be. One developer muttered, “We can hide balances perfectly… but then how do you explain a missing dividend when the CFO is breathing down your neck?”

ZKPs handle privacy, but every invisible number carries weight. Imagine a shareholder who can’t see the ledger but has a legal right to be made whole. The system must reconcile code with law—a tension that appears invisible until the wrong person tries to transfer an asset. Programmable corporate actions are elegant: dividends, votes, transfer rules. Yet each instruction is a tiny trap. One misstep and a token might refuse to move when it should, or move when it shouldn’t.

Then there’s compliance baked in. The Citadel Identity Protocol promises that a user can prove accreditation without exposing their data. But “promises” are fragile in practice. “I can confirm KYC,” one auditor said, “but what happens when multiple jurisdictions want to peek at the same record at once?” Selective disclosure is a lens through which privacy is optional, but the lens sometimes blurs. Decisions cascade. Errors propagate silently.

Dusk also acknowledges that code isn’t law. Force-transfers exist for a reason. Lost private keys shouldn’t mean frozen rights. The mechanics are clear: freeze, move, satisfy ownership. Yet in practice, someone’s mistake becomes another’s headache. “We coded authority in the contract,” an engineer noted, “but authority is only meaningful when the institution agrees it is meaningful.”

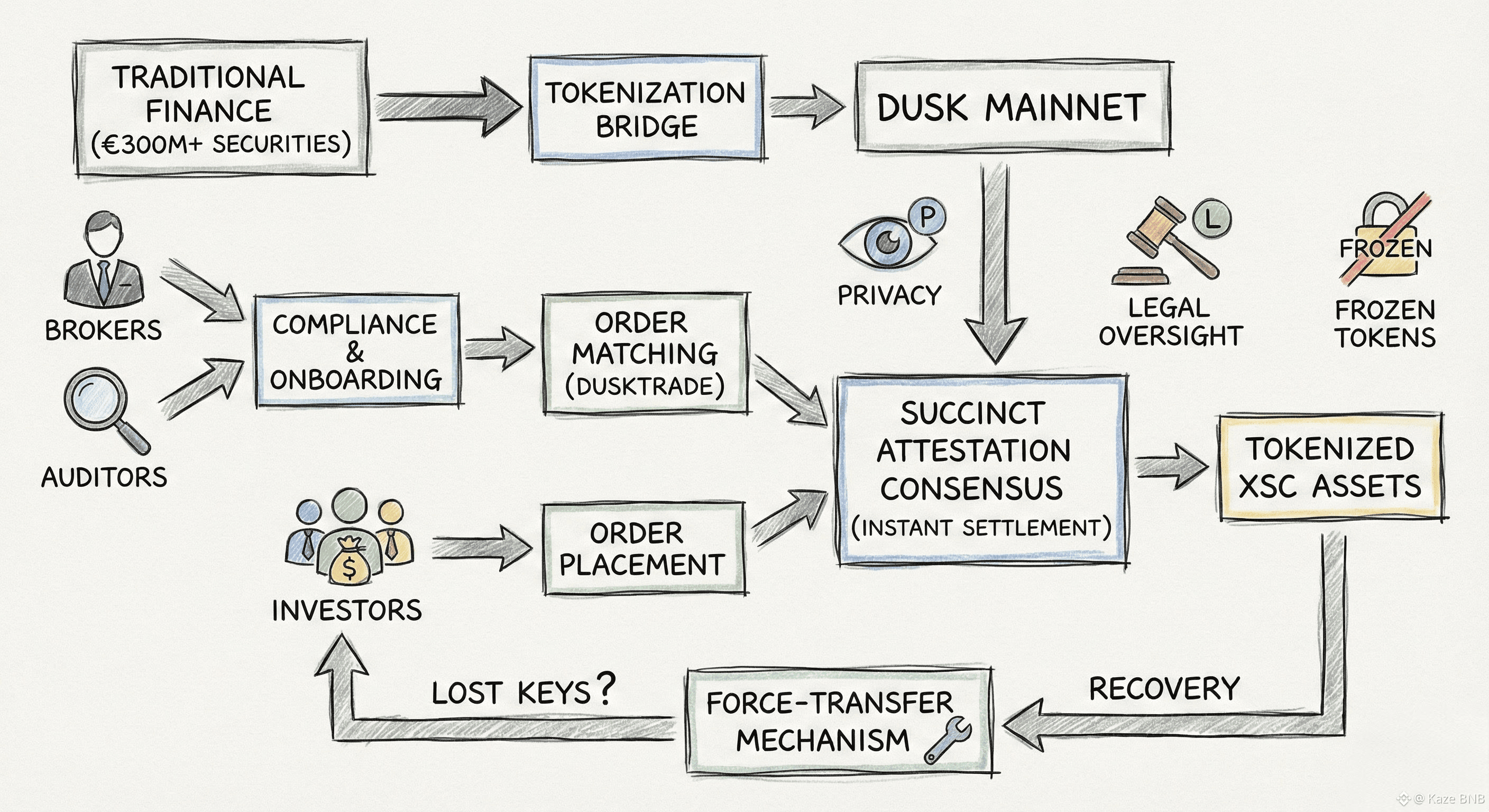

Instant finality is seductive. Succinct Attestation settles transactions irrevocably. But in high-volume trading, every block carries consequences before anyone can react. One small mistake in token issuance might ripple through the network before anyone notices.

DuskTrade brings the tension to the surface. Launching in 2026 with NPEX, it isn’t just a playground—it’s €300M+ in securities moving on-chain. Brokers, auditors, issuers, investors: every human interaction meets the algorithm, and the algorithm doesn’t pause. Trades execute; tokens settle. “It’s fast, but you notice the friction where law and code meet,” someone commented during the first week of operations.

The scenario multiplies: a token with a dividend schedule hits a blackout period. A shareholder loses a key. Compliance needs verification. The network hums along, irreversible. How does a system designed for privacy reconcile a legal dispute? Some answers are in the code. Others remain... waiting.

Questions linger in the background. Would you be confident running a node if a regulator wanted a selective view of all corporate actions simultaneously? How do edge cases lost keys, overlapping jurisdictions, complex dividends play out under real-world pressure? DUSK’s design anticipates many things, but the unknowns the untested interactions, the unexpected behaviors still occupy the margins.

The beauty of Dusk isn’t in perfection. It’s in the framework that forces trade-offs visible. Security, privacy, compliance all three, always, with no clean exit.