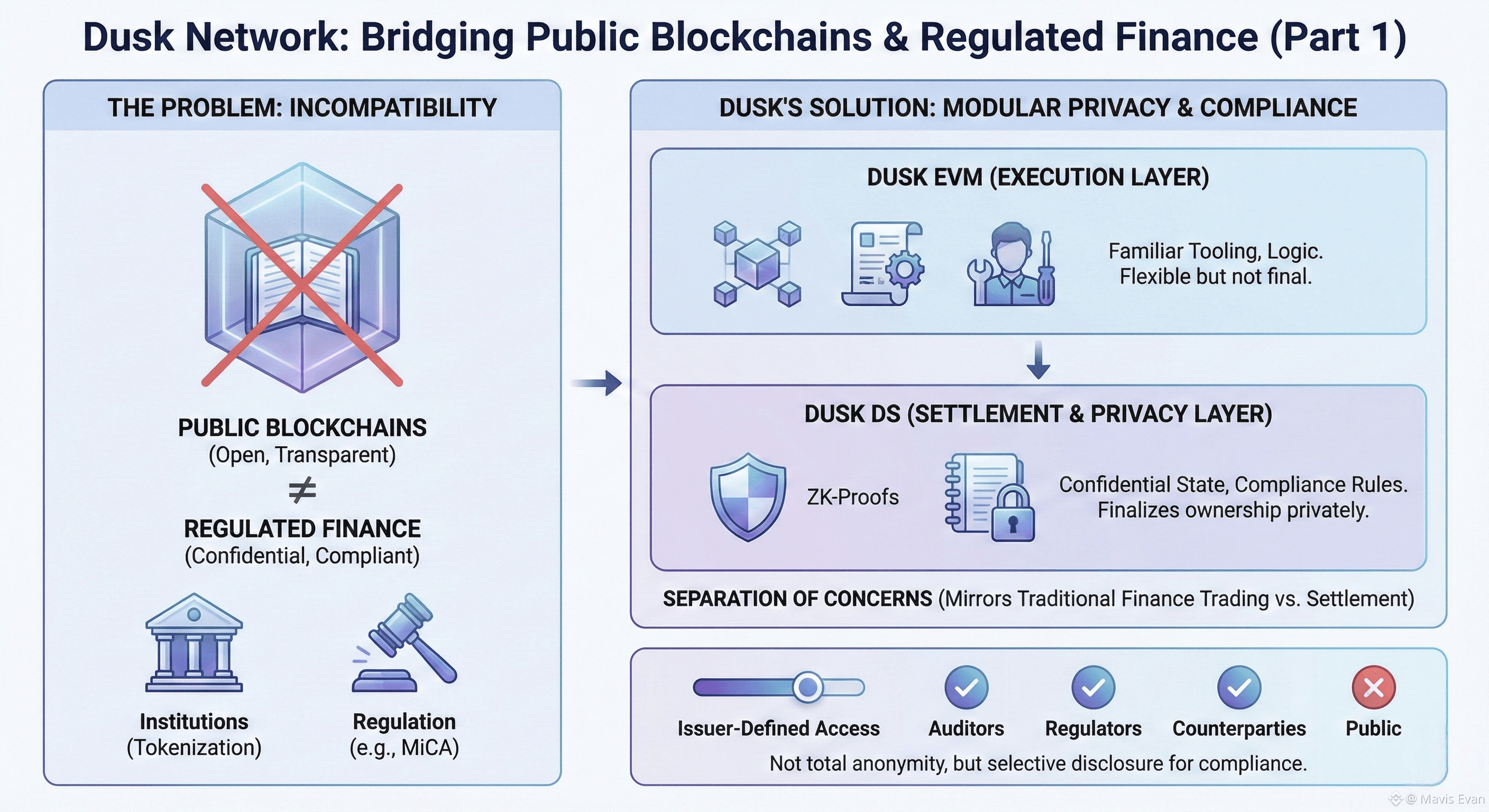

@Dusk Network was created in 2018 to answer a problem that has become harder, not easier, as crypto markets mature. Public blockchains are open by design. That openness makes them good for permissionless trading but almost unusable for regulated finance. Banks, asset managers, and licensed brokers operate under rules that demand confidentiality, selective disclosure, audit trails, and enforceable transfer restrictions. None of that fits well with ledgers where every balance and every contract state is visible to anyone who runs a node.

This mismatch is not academic. Over the last few years, the industry has moved from speculative token trading toward tokenized bonds, equities, funds, and settlement rails for real businesses. Regulators now expect crypto platforms to meet the same standards as traditional financial infrastructure. At the same time, institutions want the automation benefits of smart contracts without exposing client positions or internal logic. This shift in expectations is why networks like Dusk exist at all. It is not trying to replace open finance. It is trying to build the plumbing that lets regulated markets operate on a blockchain without breaking their own rules.

The relevance of this approach has increased as Europe finalizes MiCA and similar frameworks emerge in Asia and the Middle East. These frameworks are not banning crypto. They are forcing it to look more like regulated finance. The main challenge is that most blockchains were never designed to support confidentiality and compliance as core features. They treat privacy as a bolt-on and governance as an afterthought. Dusk inverts this model by placing privacy, identity, and settlement logic at the base layer.

At the center of Dusk is a modular design that separates execution from settlement. This is not a cosmetic distinction. The system is built around two main layers. DuskEVM provides an execution environment that behaves like the Ethereum Virtual Machine. Developers can write contracts in familiar languages and use existing tooling. On its own, this would be unremarkable. What makes it different is that this execution layer does not handle final ownership, compliance rules, or confidential balances.

Those sensitive tasks live in a parallel layer known as DuskDS. This settlement layer maintains the canonical state of assets using zero-knowledge proofs and selective disclosure. When a trade or transfer is initiated in the execution layer, the details are not finalized there. They are passed to DuskDS, which validates that the transaction complies with asset rules, identity requirements, and privacy constraints before it is committed.

This structure resembles how real financial markets work. Traders interact with trading venues and order books, but the legal ownership of assets is updated in separate clearing and settlement systems. Dusk replicates this pattern on-chain. The advantage is that the execution layer can remain flexible and developer-friendly while the settlement layer enforces strict rules without exposing private data.

Privacy on Dusk is not about hiding everything from everyone. It is about controlled visibility. Asset issuers can define who is allowed to see balances, how disclosures are made to auditors, and which transfers require identity verification. The cryptographic backbone that makes this possible is a suite of zero-knowledge proof systems integrated directly into the settlement logic. Rather than storing plain balances, Dusk stores commitments and proofs that demonstrate correctness without revealing amounts or counterparties.

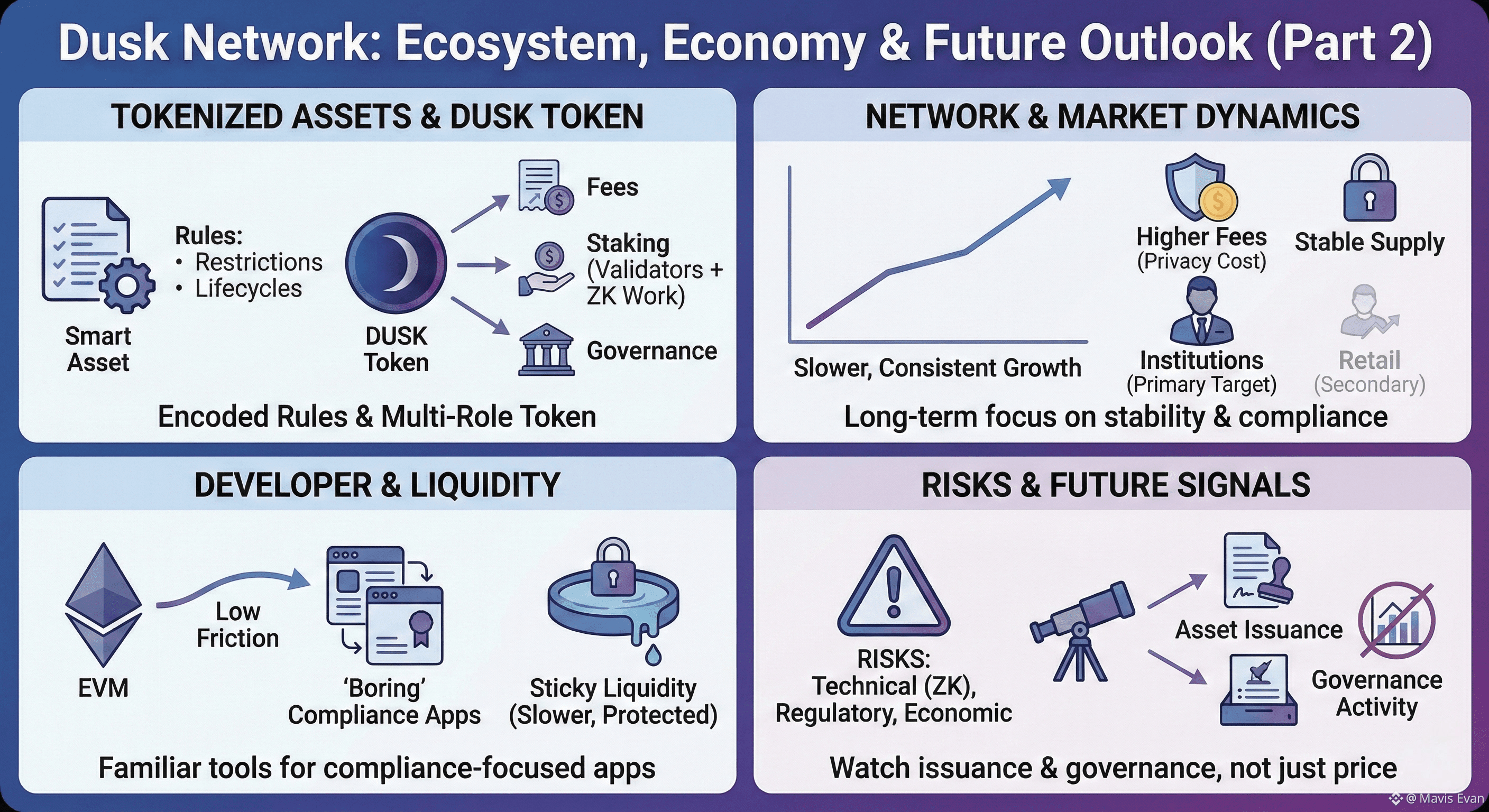

Tokenized assets on Dusk are not simple ERC20-style contracts. They are objects with lifecycles. An issuer can encode transfer restrictions, freeze conditions, and redemption rules at the protocol level. This is closer to how securities are issued in traditional markets, where a share or bond carries legal attributes beyond just a number in a wallet.

The DUSK token plays multiple roles inside this system. It is used to pay fees for transactions and settlement operations. It is staked by validators who participate in block production and proof verification. It also serves as the coordination tool for protocol governance, allowing stakeholders to vote on upgrades and parameter changes. This multi-use design is not accidental. In a network that targets regulated finance, incentives and accountability have to be aligned at the protocol level.

Validator behavior on Dusk is shaped by the additional complexity of zero-knowledge verification. Unlike standard proof-of-stake networks where validators mainly check signatures and state transitions, Dusk validators must also verify cryptographic proofs related to confidential transfers. This increases computational requirements and creates a natural barrier to low-effort participation. The network trades some openness for higher assurance.

Looking at on-chain activity, Dusk has not shown the explosive wallet growth typical of retail-driven chains. Instead, growth has been slower and more consistent. This is expected for infrastructure that targets institutions rather than meme traders. The number of active wallets and the pace of contract deployments reflect a network in a testing and integration phase rather than a hype cycle. Fee dynamics also differ. Transaction fees tend to be higher than ultra-low-cost chains because each transaction carries cryptographic overhead. This is not inefficiency. It is the cost of privacy and compliance baked into every state update.

Supply behavior of the DUSK token has been relatively stable, with inflation driven mainly by staking rewards. There has been no aggressive token burning or artificial scarcity schemes. This signals a preference for long-term validator sustainability over short-term price narratives. Staking participation rates provide insight into network confidence. A rising share of staked supply suggests that holders see Dusk as infrastructure worth securing, not just a trading asset.

The market impact of this design choice is subtle. Dusk is unlikely to attract large retail liquidity pools in the short term. Its primary audience is issuers and developers who want to bring compliant assets on-chain. When such projects choose a base layer, they value stability, legal clarity, and privacy controls more than raw transaction throughput. If Dusk succeeds in onboarding even a small number of institutional issuers, the economic weight of those assets could exceed the speculative volume seen on many consumer-focused chains.

For builders, the presence of an EVM-compatible layer reduces friction. Teams do not have to learn an entirely new programming model. At the same time, they gain access to a settlement system that would be extremely hard to build from scratch. This combination lowers the barrier to creating compliant financial products. It also means that applications on Dusk will likely look boring to retail users. They will resemble transfer agents, fund registries, and issuance platforms rather than yield farms and meme markets.

Liquidity on Dusk-native assets will depend heavily on integration with external trading venues and bridges. Because the network is not designed around constant high-frequency trading, liquidity formation will be slower but potentially stickier. Once a tokenized bond or equity is issued on Dusk, moving it to another chain is not trivial due to embedded compliance rules. This could lead to liquidity silos, but it could also protect issuers from the fragmentation seen on open chains.

Risks remain. The most obvious is technical complexity. Zero-knowledge systems are hard to implement and even harder to audit. Any flaw in the proof system could undermine trust in the entire settlement layer. There is also operational risk tied to validator performance. If verifying proofs becomes too resource-intensive, the network could face centralization pressure as only well-funded operators remain competitive.

Another risk lies in regulatory interpretation. Dusk is designed to be compliant, but compliance is not a static target. Rules evolve, and what is acceptable today may be questioned tomorrow. Embedding regulatory assumptions into a base layer is powerful, but it also reduces flexibility. Updating those assumptions requires governance processes that are slower than patching an application.

Economic risks are more mundane but just as real. Without a broad retail base, DUSK token demand depends on institutional adoption that may take years to materialize. During that time, the token is exposed to general market cycles without the cushion of speculative enthusiasm. This creates a long runway but also tests the patience of stakeholders.

There is also the question of competition. Other networks are experimenting with privacy layers, permissioned subnets, and hybrid compliance models. Some take a lighter approach by allowing optional privacy at the application level rather than baking it into settlement. Dusk’s fully integrated model is distinctive, but it is not the only path toward regulated on-chain finance.

Looking forward, the most important signal to watch is not token price but asset issuance. If regulated entities begin using Dusk to issue real financial instruments, even in pilot programs, it would validate the core thesis. Metrics such as the number of distinct issuers, the volume of assets under management on-chain, and the diversity of asset classes will matter more than daily transaction counts.

Another indicator will be governance activity. A living protocol evolves through proposals, debates, and parameter changes. If Dusk governance remains dormant, it may indicate a lack of engaged stakeholders. Conversely, active but measured governance would suggest that the network is adapting to real-world constraints rather than chasing trends.

Dusk Network is not designed to dominate social media or generate viral narratives. Its ambition is quieter and harder. It aims to turn the blockchain into something that a compliance officer could sign off on without flinching. Whether this vision will pay off depends less on developer excitement and more on whether regulated finance is ready to meet crypto halfway. The infrastructure is being built. The market will decide if it is needed.