I did not really “get” Dusk until I stopped evaluating it like a normal layer 1 and started treating it like a settlement appliance that happens to be decentralized. Most chains chase adoption by maximizing composability first and hoping institutions will tolerate the transparency later. Dusk flips that order. It treats confidentiality, audit paths, and finality as the product surface, then bolts composability on in a way that does not contaminate the settlement layer with every incentive and disclosure problem DeFi has trained us to accept. That is why Dusk reads less like “another privacy chain” and more like an attempt to standardize what regulated markets actually need from a shared ledger, which is selective visibility, deterministic settlement, and integration primitives that look like back office plumbing instead of consumer crypto.

The easiest way to see Dusk’s competitive posture is to look at what it refuses to be. Ethereum’s base layer is a global disclosure machine. Even when you add privacy tooling, the default posture is public state with optional obfuscation. Solana’s design makes throughput the first class constraint, and privacy becomes something you do off to the side because the chain’s core value proposition is speed plus a single shared execution environment. Polygon and other scaling ecosystems tend to inherit Ethereum’s transparency posture, then let you segment activity across multiple environments, which helps with cost and performance but does not change the fundamental “everything is visible” expectation. Dusk’s posture is the reverse. It starts from a regulated finance assumption that counterparties, holdings, and certain flows must be confidential by default, while regulators and authorized parties must still be able to see what they are entitled to see. You can feel that assumption baked into the protocol choices, like the dual transaction model where the chain natively supports both transparent and shielded settlement rather than pretending one model can satisfy every regulatory workflow.

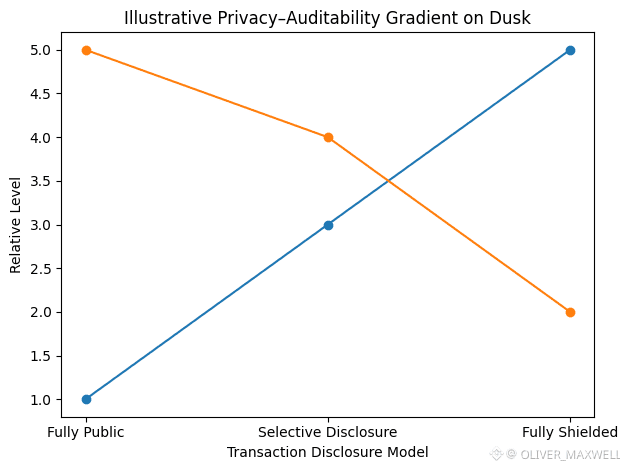

That dual model is not a marketing feature. It is Dusk’s most important piece of competitive differentiation because it turns privacy into a gradient instead of a binary switch. On DuskDS, Moonlight is the transparent account based path that looks familiar to anyone who has used a typical account model chain. Phoenix is the shielded note based path where funds exist as encrypted notes and transactions prove correctness with zero knowledge proofs without exposing amounts, linkable sender information, or the specific notes involved, while still allowing selective disclosure through viewing keys when auditing or regulation demands it. The novelty is not that shielded transactions exist. The novelty is that Dusk treats “public settlement” and “confidential settlement with controlled reveal” as peer native modes that converge on one chain state. That matters for regulated infrastructure because compliance teams do not want a parallel privacy universe that cannot be reconciled to reporting. They want a single settlement reality where disclosure is a permissioned action, not a separate chain choice.

Once you internalize that, the usual privacy chain comparisons become less useful. Privacy coins historically optimized for censorship resistance and fungibility, then left institutions with a compliance cliff. Dusk is explicitly trying to remove that cliff by making auditability a protocol level affordance rather than a policy layer bolted on later. Its docs are unusually direct about the target regimes, framing Dusk as “privacy by design, transparent when needed,” and explicitly calling out on chain compliance alignment with frameworks like MiCA, MiFID II, the EU DLT Pilot Regime, and GDPR style constraints. That framing is not just regulatory name dropping. It hints at something deeper: Dusk is treating privacy as a requirement for legal operation in securities style markets, not as a rebellious feature. In a world where regulated tokenization is moving from pilot language to operating language, that philosophical posture changes the set of things a chain must be good at.

The cryptography stack reinforces that posture. Dusk leans on modern ZK friendly primitives and explicitly anchors Phoenix style privacy to a proving system worldview, citing PLONK and a set of curve and hashing choices that make ZK circuits practical at the protocol layer, including BLS12 381, JubJub, Poseidon, sparse Merkle structures, and PLONK based proving. The part I think most analysts miss is what this implies for institutional operations. If privacy is not optional, then proving is not a niche developer hobby. It is operational infrastructure. Dusk’s node architecture even acknowledges this by treating proving as a specialized role and documenting prover nodes as a first class concept for Phoenix proof generation. That is a subtle but meaningful difference from ecosystems where ZK is either externalized to rollups or pushed entirely into application logic. Dusk is effectively saying: if regulated finance is going to run here, proof generation is part of the baseline network muscle.

This is also where Dusk’s compliance story becomes more credible than “privacy plus compliance” slogans elsewhere. Compliance is rarely about whether data can be hidden. It is about whether data can be revealed selectively, reliably, and in formats that fit audit workflows. Dusk’s answer is to make selective revelation an intended user action, not an emergency workaround. Viewing keys in Phoenix are a technical mechanism, but the more important design claim is that “authorized transparency” should feel native. In practice, that creates room for financial applications that need to keep positions and counterparties confidential while still proving eligibility, limits, or reporting obligations. The under explored angle here is that Dusk can turn privacy from an adversarial stance into a coordination tool. Institutions do not need to hide from regulators. They need to hide from each other, from predatory flow analysis, and from unnecessary public exposure, while remaining provably compliant. Dusk’s architecture is tuned to that reality.

The modular architecture is the second pillar that makes this work, and it is easy to misread it as just another “multi environment” story. Dusk explicitly separates settlement and data availability from EVM execution by defining DuskDS as the consensus, data availability, settlement, and transaction model layer, and DuskEVM as an Ethereum compatible execution layer where DUSK is the native gas token. Most chains that add EVM compatibility do it to import liquidity and developers. Dusk’s separation feels more like a risk management boundary. If you are building regulated markets, you want the settlement layer to be boring, final, and policy aware, while still allowing application experimentation somewhere that looks like standard smart contract land. In other words, DuskDS is the place you want your securities and compliance critical state to resolve, while DuskEVM is where you want your fast moving product logic and composability to live. The bridge between them is not just a technical convenience. It is a way to keep “regulated settlement reality” insulated from “application innovation chaos.”

This is where Dusk’s design diverges sharply from Ethereum and Solana style thinking. On Ethereum, you can approximate this separation with rollups, permissioned subnets, or application specific chains, but you still inherit a base layer that is transparent by default and probabilistic in its finality character. On Solana, the integrated execution environment is the whole point, which is great for consumer scale apps but forces regulated use cases to accept that the same execution plane carries every meme and exploit cycle risk. Dusk is explicitly choosing complexity in architecture to buy simplicity in compliance reasoning. The question is whether institutions actually want that trade. My view is that regulated infrastructure buyers routinely accept modular complexity if it gives them clean interfaces and clearer risk boundaries. That is normal in traditional finance. Dusk’s modularity is basically a translation of that institutional instinct into a blockchain context.

The consensus layer is the third pillar, and it is more important to regulated finance than raw throughput. Dusk describes Succinct Attestation as a proof of stake, committee based design with deterministic finality once a block is ratified, explicitly emphasizing no user facing reorganizations in normal operation and suitability for low latency settlement. In regulated markets, the enemy is not “high fees.” The enemy is settlement ambiguity. If finality is probabilistic, then every trade has a hidden settlement risk tail that back offices have to paper over with conventions. Deterministic finality in seconds is not a vanity metric. It is the difference between a chain being usable as a settlement system versus being a trading venue that still needs a settlement wrapper. The most interesting nuance in Dusk’s tokenomics documentation is that block rewards are explicitly distributed across the different consensus roles, including block generation and committee validation and ratification, which signals that the protocol is designed to incentivize the multi step attestation process rather than just paying a monolithic validator set. That is consistent with a worldview where settlement integrity is a workflow, not a single signature.

Dusk’s integration story is unusually aligned with that workflow mindset too. Institutions do not integrate with blockchains by reading blocks and parsing JSON until they feel confident. They want event streams, stable APIs, and predictable binary interfaces for proof objects. Dusk’s HTTP API documentation centers the Rusk Universal Event System, describing an event driven architecture designed to handle binary proofs and on demand event dispatching, with mainnet endpoints and a WebSocket session model that looks much closer to enterprise messaging patterns than typical web3 RPC habits. Even more telling is that the docs acknowledge archive node endpoints for historical retrieval and Moonlight transaction history, which is exactly the sort of operational requirement auditors and compliance systems care about. This is one of those details that rarely gets airtime in creator coverage, yet it is where institutional adoption is won or lost.

When you map all of that onto real world asset tokenization, Dusk’s strongest use cases become clearer and narrower, which is a good thing. The obvious fit is tokenized securities and regulated issuance where you need to manage eligibility, disclosure, and corporate actions without exposing cap tables and position data to the entire world. Dusk’s own ecosystem page points to NPEX as an institutional partner for regulated RWA and securities issuance on Dusk. It also lists Quantoz as a provider of a regulated EUR stablecoin integrating with Dusk, plus custody and settlement infrastructure via Cordial Systems, and oracle plus cross chain messaging support via Chainlink. That cluster is not random. It is exactly the stack you need if you want to run a regulated market: issuance, regulated cash leg, custody and settlement rails, and reliable external data. If Dusk succeeds, it will not be because it out memes general purpose chains. It will be because it can offer an end to end regulated market stack where privacy and auditability are not external services.

There is also a quieter but potentially more powerful use case that Dusk is positioned for: compliant DeFi that does not leak institutional positions. A large fraction of institutional reluctance toward DeFi is not philosophical. It is operational and competitive. Institutions cannot trade or lend at scale if their positions, flows, and counterparties are instantly legible to every competitor and every front running bot. Phoenix style shielding for balances and transfers, combined with the ability to selectively reveal to authorized parties, creates room for markets where public price signals can exist without public position signals. Dusk’s two layer design makes this even more plausible because you can run composable logic on DuskEVM while letting sensitive settlement and balance privacy resolve on DuskDS. That is a structural advantage over chains that require you to either accept total transparency or build complex application level privacy scaffolding that breaks composability.

The hard part is not imagining these use cases. The hard part is getting institutions across the adoption gap, and that is where Dusk’s choices look both smart and risky. Institutions face four recurring blockers: regulatory uncertainty, confidentiality requirements, integration complexity, and operational assurance. Dusk clearly targets confidentiality and auditability at the protocol layer, and its integration primitives are built to look like operational infrastructure rather than developer toys. The risk is that the market for regulated tokenization moves slowly, and a chain optimized for that market can look underutilized in its early years. Dusk’s current on chain activity snapshots reinforce that reality. Community explorer stats show roughly 10 second average block times and relatively low daily transaction counts, with a small share of shielded transactions compared to transparent ones, suggesting that the network today is still in an early phase where the privacy heavy use cases have not yet become the dominant traffic driver. That is not automatically bad, but it means Dusk is still proving out its thesis in the only way that matters, by hosting real regulated flows.

Network health and validator economics are where Dusk looks more robust than many people assume, even if transaction activity is early. Dusk’s tokenomics define a 1 billion maximum supply composed of a 500 million initial supply plus 500 million emitted over 36 years, with emissions halving every four years in a geometric decay schedule, and a clear breakdown of block reward distribution across consensus roles and a development fund allocation. Provisioners are required to stake at least 1000 DUSK to participate, which sets a low enough floor to allow broad participation while still filtering out trivial nodes. The protocol’s soft slashing design is also more institution friendly than burn heavy approaches. Instead of destroying stake, Dusk describes penalties as temporary reductions in participation and reward earning power, with penalized portions moved into claimable rewards pools rather than burned, which lowers the existential risk of running infrastructure while still discouraging misbehavior and prolonged downtime.

The most concrete signal of security participation is stake concentration and active node counts, and here Dusk looks meaningfully “alive.” Dusk’s own hyperstaking announcement in March 2025 referenced over 270 active node operators securing the network and introduced stake abstraction that lets smart contracts participate in staking on behalf of users. More recent community dashboards indicate around a bit over 200 active nodes with stake above the minimum threshold. Explorer level stats show total stake in the low 200 million DUSK range, with the majority active. In practical terms, this means Dusk has achieved a level of economic security participation that is credible for an early phase regulated infrastructure chain, especially when you combine it with a deterministic finality consensus design aimed at minimizing settlement ambiguity.

Stake abstraction is a particularly interesting Dusk specific lever for adoption because it bridges the cultural gap between DeFi style yield seeking and institutional style delegation. Hyperstaking lets a smart contract act as a staking participant, which means staking can be packaged into products with controlled logic, compliance constraints, or operational guarantees that a normal retail staking interface cannot enforce. For experienced traders, this creates a path to staking yield strategies that are not just “run a node or delegate and pray,” but structured staking products with transparent rules. For institutions, it is a way to participate in network security while embedding internal policy constraints, such as limiting exposure, controlling withdrawal logic, or aligning staking operations with governance and reporting requirements.

Governance is the one area where Dusk’s public footprint looks more process focused than decision heavy, which is typical for networks that are still early in their mainnet lifecycle. Dusk has a formal Dusk Improvement Proposal repository that defines DIPs as the primary mechanism for proposing protocol adjustments and documenting design decisions, which is an explicit move toward structured, auditable governance rather than ad hoc announcements. What is more interesting is that Dusk’s consensus reward allocation implicitly acknowledges governance like roles inside block production, since validation and ratification committees are compensated as distinct actors. That alignment matters because regulated infrastructure buyers often care less about tokenholder spectacle governance and more about whether protocol changes follow a disciplined process that can be audited and explained.

The regulatory landscape is where Dusk’s early focus could age exceptionally well, but it is also where timing risk lives. The direction of travel globally is toward more explicit rules for tokenization, stablecoins, and market infrastructure, and toward privacy preserving compliance rather than blanket transparency, particularly as privacy laws collide with public ledgers. Dusk is unusually explicit about aiming at that collision point, positioning itself as regulation aware and privacy enabled rather than privacy maximalist. The advantage of this stance is that when regulators ask how a market can protect customer confidentiality while still supporting AML, reporting, and audit obligations, Dusk has a protocol native answer rather than a story about external middleware. The vulnerability is that regulatory clarity is uneven across jurisdictions, and institutions move at the pace of legal sign off. Dusk’s strategy is essentially to build the correct infrastructure first and wait for the market to catch up, which can look slow until it suddenly looks obvious.

If I had to summarize Dusk’s forward trajectory in one thought, it would be this. Dusk is not competing to be the busiest chain today. It is competing to become the chain you choose when the cost of leaking financial state becomes larger than the benefit of public composability. Its modular separation of DuskDS settlement and privacy from DuskEVM execution, its native dual transaction model that treats selective disclosure as a first class workflow, its deterministic finality oriented consensus, and its event driven integration architecture all point to a single thesis: regulated markets will only come on chain at scale when the chain looks like a regulated system, not like a public forum.

The inflection points to watch are therefore Dusk specific and very concrete. First, whether the institutional partner stack listed in the ecosystem, especially NPEX and regulated stablecoin integration, translates into visible production issuance and real settlement flows on chain, because that is when Phoenix usage and archive data demand should rise in a way that validates the design. Second, whether the network’s current security participation, with stake levels in the low hundreds of millions of DUSK and a couple hundred active nodes, remains resilient as emissions decay and as the chain needs fee based demand to start carrying more of the security budget. Third, whether developers building on DuskEVM can create compliant DeFi primitives that preserve institutional confidentiality without destroying usability, because that is where Dusk’s separation of execution and settlement becomes a market advantage rather than just an architectural choice.

My conclusion is that Dusk’s defensibility is real, but it is not the kind that shows up in the usual crypto scoreboards. It is defensible because it makes the hard institutional tradeoffs explicit and bakes them into protocol primitives that are difficult to retrofit elsewhere. If regulated finance wants chains to behave like settlement systems with confidentiality controls and audit paths, Dusk is already designed like that. If the market instead decides that institutions will tolerate public ledgers plus permissioned overlays, then Dusk becomes a beautifully engineered answer to a question the market chose not to ask. The next phase will not be won by louder narratives. It will be won by whether Dusk can turn its current early network reality, where blocks are steady and staking participation is meaningful but transaction activity is still modest, into a regulated application flywheel that makes its privacy and compliance architecture feel inevitable rather than aspirational.