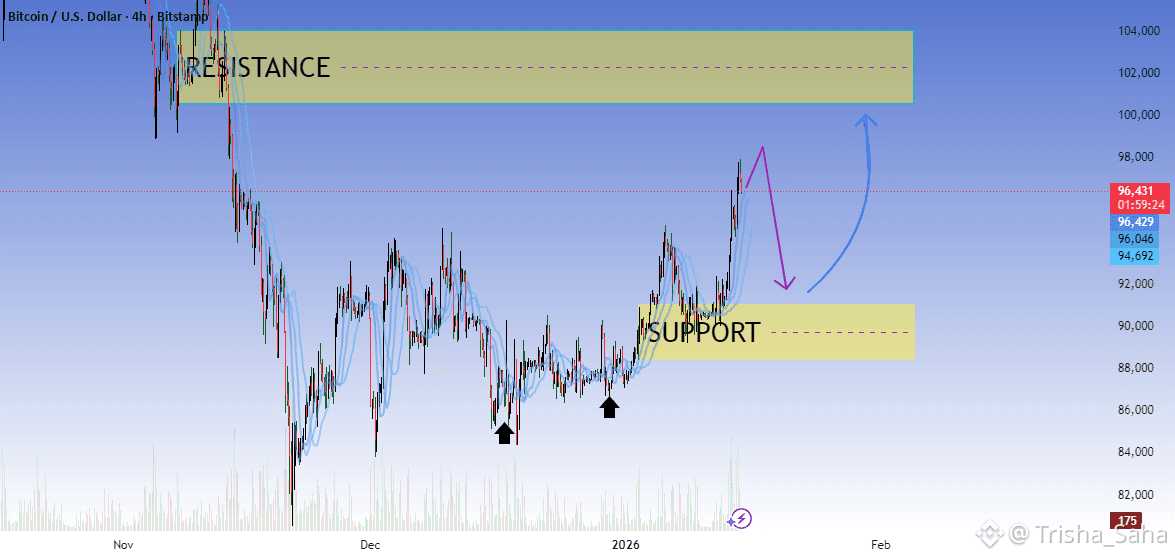

Market Structure

Overall structure:

After a sharp sell-off from the prior highs (left side), Bitcoin has transitioned into a range / accumulation phase, then recently broke upward from consolidation.

The series of higher lows marked by the black arrows suggests bullish structure building since late December.

2. Key Zones

🔴 Resistance Zone (≈ 100k – 104k)

This is a major supply zone where price was aggressively rejected before.

Strong selling pressure previously entered here → expect:

First test = rejection likely

Multiple tests = higher chance of breakout

The dotted mid-line inside the zone is a reaction level, not a clean breakout area.

🟡 Support Zone (≈ 88k – 90k)

Former resistance → now acting as support (role reversal).

Price recently:

Broke above it

Pulled back

Held → bullish confirmation

This zone is critical for maintaining the bullish bias.

3. Current Price Action

Price pushed impulsively to ~96–97k (strong bullish momentum).

The purple path suggests a healthy pullback:

This would likely be a bullish retracement, not weakness.

As long as price holds above the support zone, the trend remains intact.

4. Likely Scenarios

✅ Bullish Continuation (Higher Probability)

Pullback into 90k–92k

Buyers step in (bullish candle / volume)

Push toward 100k+

Possible:

First rejection

Then consolidation

Break into resistance zone

📈 Target: 100k – 104k

⚠️ Bearish / Invalid Scenario

Clean 4H close below ~88k

Would indicate:

Failed breakout

Return to range

That could open downside toward 85k–82k

5. Momentum & Volatility Insight

The smooth blue curves indicate volatility compression → expansion.

Expansion happened upward → bias remains bullish until structure breaks.

Sharp moves followed by shallow pullbacks = trend strength, not exhaustion (yet).

6. Trading Takeaway (Not Financial Advice)

Bias: Bullish while above support

Best risk area: Support retest (90k zone)

Worst place to enter: Mid-range (95k–97k)

Key decision point: Reaction at 100k resistance