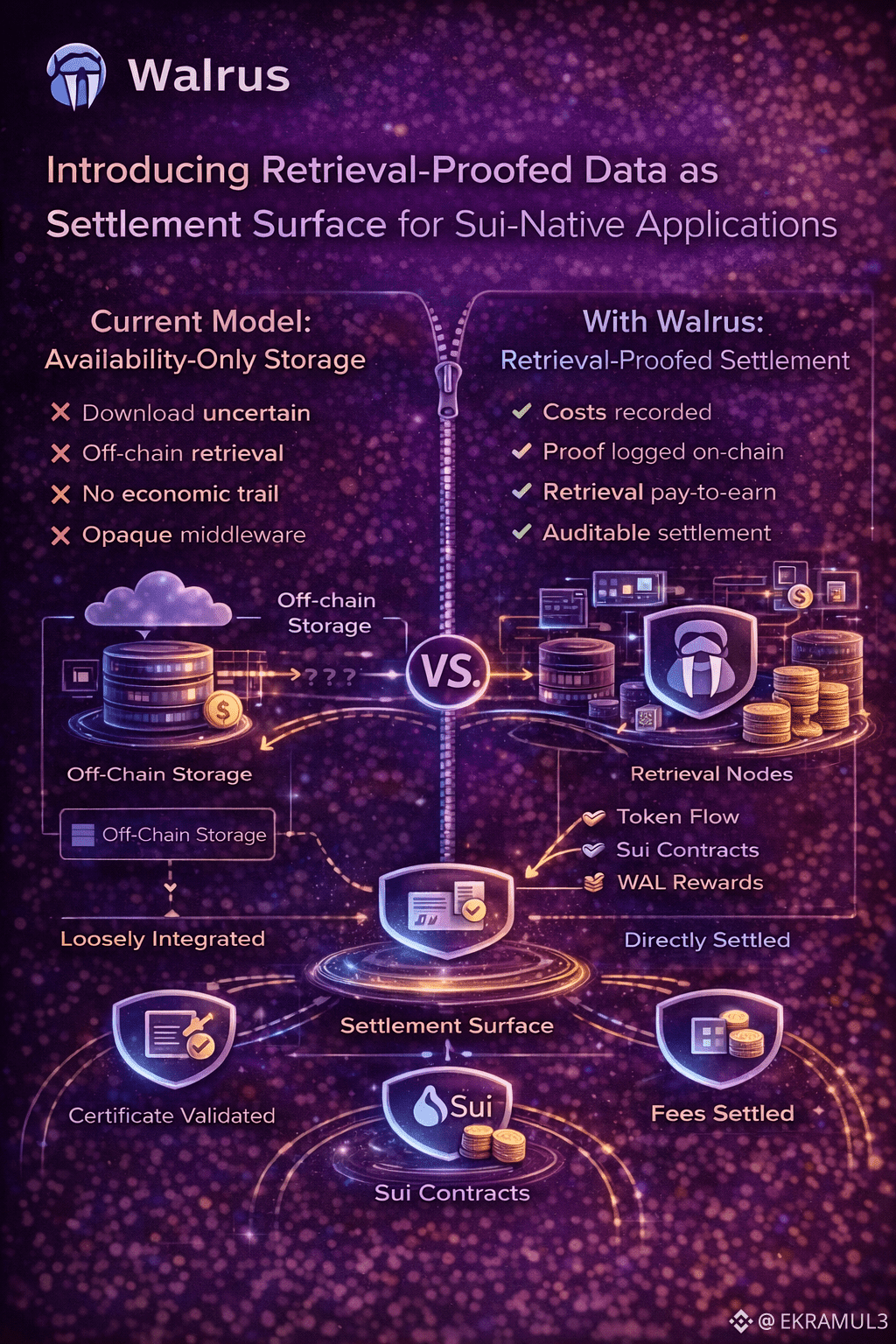

Most decentralized storage systems treat data retrieval as a background event something that “just happens” off-chain without creating any traceable economic or verifiable state. Walrus turns that assumption upside down. For applications on Sui, data retrieval becomes a cryptographically-provable, economically-metered, and contract-settleable event rather than an invisible network side-operation. That shift sounds subtle, but structurally, it unlocks an entire class of application patterns that were previously impossible to build without centralized backends.

Most decentralized storage systems treat data retrieval as a background event something that “just happens” off-chain without creating any traceable economic or verifiable state. Walrus turns that assumption upside down. For applications on Sui, data retrieval becomes a cryptographically-provable, economically-metered, and contract-settleable event rather than an invisible network side-operation. That shift sounds subtle, but structurally, it unlocks an entire class of application patterns that were previously impossible to build without centralized backends.

From Availability Guarantees to Retrieval Guarantees

Web3 has historically focused on availability proofs, i.e., “the data exists somewhere.” But availability alone doesn’t support consumer-facing or enterprise workloads. A dataset that exists but cannot be reliably retrieved on demand is effectively useless. Walrus introduces an upgraded semantic: retrieval-proofed data meaning the system can not only prove data exists, but that the data can be actively pulled from the network when needed, not merely archived.

This distinction turns storage from a passive durability service into an active reliability surface. For AI workloads, social feeds, decentralized websites, and encrypted media, this matters far more than slogans about decentralization.

Retrieval Becomes a Settlement Event

The second transformation Walrus introduces is economic. Retrieval isn’t free. It consumes bandwidth, computing overhead, and node availability. Instead of treating these as externalities absorbed by operators (or worse, subsidized indefinitely), Walrus makes retrieval a first-class transaction routed through Sui contracts.

When a blob is retrieved:

✔ a certificate is validated

✔ a retrieval-proof is generated

✔ a fee is settled on-chain

✔ and token flows are recorded

This creates correct pricing, correct incentives, and most importantly auditable consumption.

Storage stops being a sunk cost. It becomes a market with lifecycle economics.

Why Sui Is the First Place This Makes Sense

Sui’s object-centric execution model is a surprisingly good substrate for retrieval surfaces:

objects can mutate without global consensus overhead

proofs can be stored as first-class state

data usage can trigger downstream logic

fees can be distributed per retrieval

ownership models support gated access

In most chains, retrieval would need to be simulated through opaque off-chain middleware. On Sui, retrieval certificates can be referenced directly as Move objects, aligning data consumption with programmatic logic.

For example, a dApp can require that a dataset was successfully retrieved before allowing an AI agent to run inference on it and pay accordingly.

New Composability Primitives Emerge

Making retrieval verifiable and settleable introduces new primitives:

Retrieval-gated execution

Contracts can require verified data access before they execute certain branches.

Consumption-based billing

Data owners can charge for downstream retrieval rather than upfront uploads.

Lease-style renewal

Long-lived data can expire and renew based on real usage rather than arbitrary time windows.

Cross-tenant privacy

Encrypted blobs can be accessed selectively without exposing raw data to the protocol.

These patterns align with real-world SaaS and cloud models, except without centralized trust.

AI and Enterprise Workloads Are the Real Drivers

Walrus’s retrieval-centric design is not optimized for NFT hype; it aligns with workloads where:

datasets are heavy

retrieval is frequent

privacy is mandatory

cost predictability matters

This includes:

✔ AI inference datasets

✔ ML training records

✔ enterprise audit logs

✔ regulated document flows

✔ private social graphs

✔ multi-user CMS systems

These are the exact categories centralized cloud controls today. Walrus gives them a path onto Sui without degrading privacy or data integrity.

Downstream Economic Implications for $WAL

Once retrieval becomes a settlement surface, the WAL token inherits deeper utility:

storage → paid upfront

retrieval → paid per consumption

renewals → paid per lifecycle

staking → collateral for operators

governance → sets pricing curves

This is not yield farming. It’s cost-of-service economics, similar to infrastructure tokens like bandwidth and compute credits.

If retrieval volume grows with AI and data-rich applications, WAL demand becomes structurally tied to usage instead of sentiment a distinction most tokens never achieve.

The Quiet Shift Underway

The broader implication is simple:

Walrus moves storage from a trust assumption to a programmable resource, and moves retrieval from a side-effect to a settlement event.

Chains that only offer execution cannot scale beyond financial experimentation. Real applications need memory, privacy, availability, and retrieval guarantees all priced correctly and settled transparently.

Walrus is quietly building that layer for Sui before most developers realize they need it.