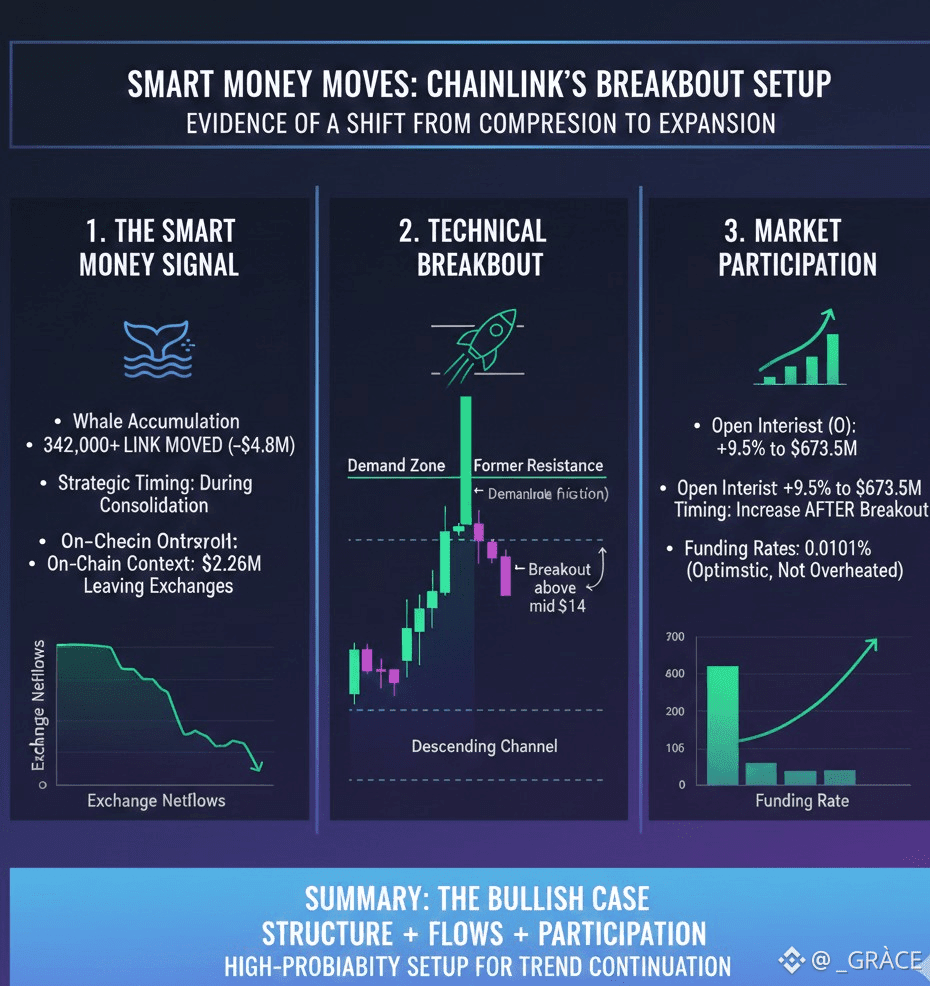

Large holders have been quietly pulling Chainlink off exchanges, and the timing tells an important story. One whale alone withdrew over 342,000 LINK worth nearly $4.8 million in just two days. This wasn’t panic buying after a big pump. It happened during consolidation and the early stages of a breakout, which usually points to planned accumulation rather than emotional chasing. When big players remove tokens from exchanges, it often signals expectation of higher prices instead of preparation to sell.

This behavior matters even more because exchange withdrawals reduce the amount of LINK readily available to sell. With fewer tokens sitting on centralized platforms, short-term selling pressure naturally eases. On its own, whale activity doesn’t guarantee a rally, but when it lines up with improving structure and shrinking supply, it strengthens the overall setup. In LINK’s case, the message is clear: large holders appear positioned for continuation, not distribution.

From a price perspective, Chainlink recently escaped a structure that had capped it for months. The market had been stuck in a descending channel, consistently printing lower highs and rejecting every recovery attempt. That pattern kept sellers in control. The shift came when price pushed above the upper boundary of that channel around the mid-$14 area. More importantly, it didn’t fall straight back inside. Instead, price held above the former resistance, suggesting buyers accepted higher levels rather than running out of strength.

That kind of behavior lowers the risk of a fake breakout. The old channel top now acts as a demand zone, where buyers are expected to step in. As long as price holds above it, the structure stays constructive. The next area of friction sits near $14.69, tied to past reactions. Clearing that level opens the door toward the broader $20 zone, where supply previously appeared heavier.

On-chain and exchange data support this shift. Chainlink has continued to see negative netflows, with around $2.26 million worth of LINK leaving exchanges recently. These are steady withdrawals, not sharp spikes driven by fear. This suggests a gradual tightening of available supply. When outflows persist after a breakout, they often make pullbacks shallower because there’s less overhead supply waiting to sell.

Still, outflows alone don’t push price higher. They simply create better conditions. For continuation to happen, buyers must remain active. So far, that seems to be the case, as price continues to hold above reclaimed levels while exchange balances trend lower.

Derivatives data adds another layer. Open Interest has risen about 9.5% to roughly $673.5 million, showing that traders are adding new positions. What stands out is the timing. This increase came after the breakout, not before it. That suggests traders are reacting to confirmed structure rather than gambling on a move that hasn’t happened yet. Participation looks measured, not crowded, which reduces the risk of sudden forced unwinds.

Funding rates have also flipped positive, sitting near 0.0101%. Traders are willing to pay to hold long positions, signaling growing confidence. At the same time, funding isn’t overheated. That balance is important. Extremely high funding often leads to sharp shakeouts, but here the market looks optimistic without being reckless. As long as price continues to move higher or at least holds structure, this leverage supports the trend instead of threatening it.

Taken together, Chainlink’s breakout looks backed by real signals rather than hype. Whale accumulation, declining exchange supply, rising Open Interest, and controlled positive funding all line up with a clear change in structure. The market appears to be shifting from a long period of compression into a phase of expansion.

As long as LINK stays above the former channel boundary, buyers remain in control and continuation stays the favored path. Risks increase if price slips back into the old structure, especially if leverage starts unwinding. For now, though, structure, flows, and participation all point in the same direction, giving buyers a clear technical edge.