It Matters!

Among the most significant applications of Dusk is the physical tokenization of assets in the real world - the transfer of shares, bonds, real estate and corporate securities to the blockchain in an authorized, confidential manner.

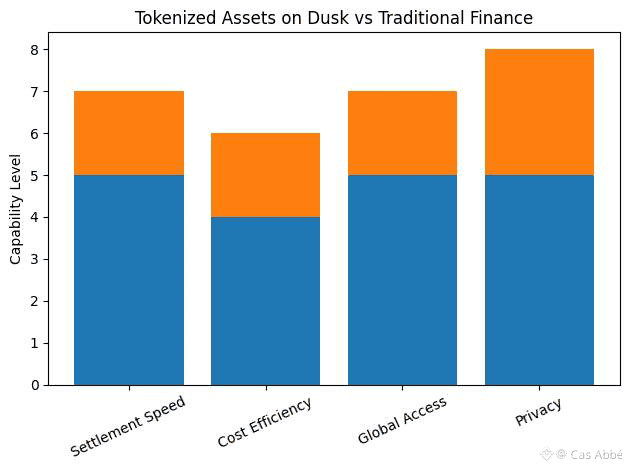

What it shows:

Faster settlement

Better global access

Stronger privacy

Digital financial instruments are represented as tokenized assets. These assets may be issued, traded and settled on-chain using the XSC Confidential Security Contract standard on Dusk. This standard provides ownership and transaction privacy as well as incorporates legal compliance into the smart contract logic.

Pros to Issuers and Investors:

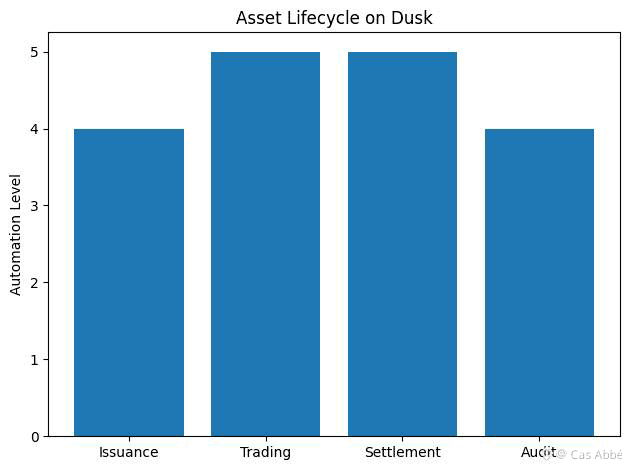

Conventional accumulating methods of securities are expensive and sluggish to the extent of the reconciliation, clearing and custody checks. To a large extent, that work is automated by tokenization.

What it shows:

Issuance → Trading → Settlement → Audit automation

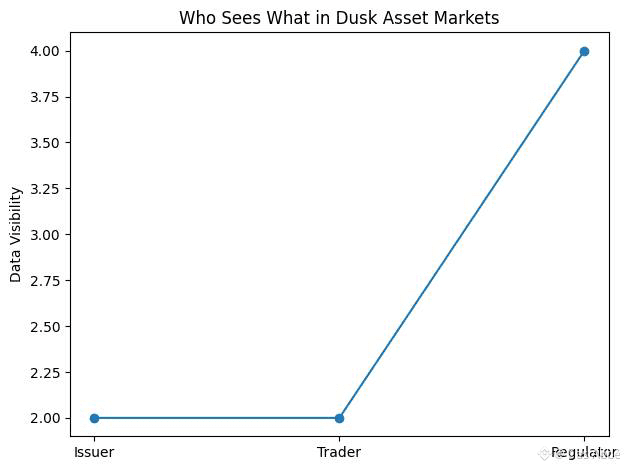

The privacy of Dusk means that you are not blasting sensitive financial statuses and its tooling makes certain that there is legal compliance (such as eligibility and reporting) built into the token itself.

Secondary Markets:

Privacy (enhanced) and compliance (enhanced) By enhancing with privacy, Dusk will be able to facilitate secondary trading conditions, in which the assets may travel fast and safely, without losing sensitive information.

What it shows:

Issuers & traders see limited data

Regulators see what they need

That is one of the major steps toward institutional adoption of blockchain to regulated finance.