The Dusk Network was not designed for the speculative experiment or a short-term incentive machine which is just for some time. It's tokenomic, staking rules, and slashing mechanics reflect a deeper objective because it's design like that it's not design as simple : building a privacy-preserving to give it priority, regulated financial infrastructure that can survive in the real-world usage ensuring existing system is not affect Ed by it , compliance pressure, and long operational timelines make it more better . Every economic decision inside the protocol is exists to align participants with that long-term vision to make is just not like a dream.

At the center of this system is the DUSK token because without this nothing will happened like this. DUSK is more than a reward token and just a name ; it is the economic glue that binds security to participation, and utility together in just one frame with no compromising in anything .

From staking and consensus to transaction fees and application deployment, DUSK functions as the native unit of value that keeps the network operational.

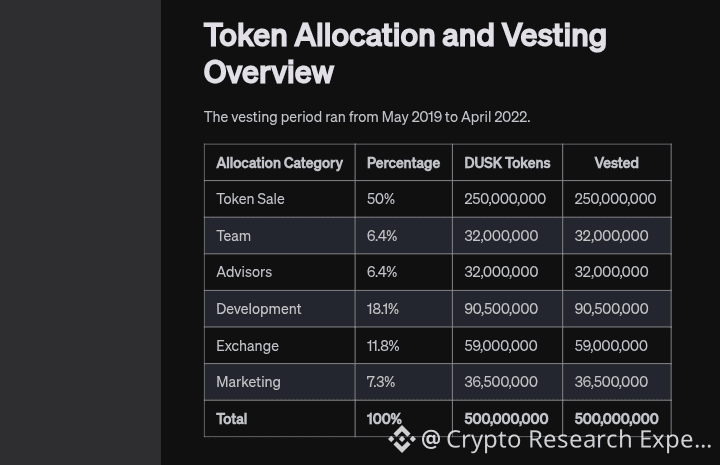

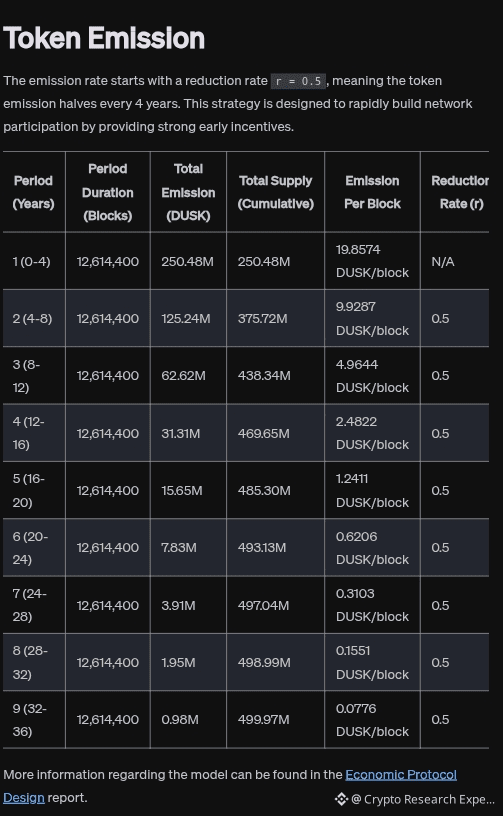

WHY DUSK look like a notable token not just supply numbers or like nothing which has aim, but timing and intent matters always . With an initial supply of 500 million and an additional 500 million emitted gradually over 36 years yes total 1B is not small number but it has a long time , the protocol avoids the two most common failures in crypto economics which is normally to see and has a bad affect: front-loaded inflation and sudden reward cliffs. That's why , Dusk adopts a slow, predictable emission curve which is based on geometric decay and this is choose because . Emissions halve every four years, rewarding early network bootstrapping while steadily reducing inflation in the shape of transaction fees and real usage for begin it to matter more.

the protocol avoids the two most common failures in crypto economics which is normally to see and has a bad affect: front-loaded inflation and sudden reward cliffs. That's why , Dusk adopts a slow, predictable emission curve which is based on geometric decay and this is choose because . Emissions halve every four years, rewarding early network bootstrapping while steadily reducing inflation in the shape of transaction fees and real usage for begin it to matter more.

Over the time, as it adoption increases, reliance on emissions decreases. Dusk’s emission schedule reflects this reality rather than fighting it.Staking sits at the intersection of this economic model and network security. By requiring a minimum stake, the protocol ensures that consensus participants have real economic exposure. At the same time, the absence of a maximum stake avoids artificial centralization limits while letting market forces determine optimal participation. The two-epoch maturity period reinforces patience and commitment, discouraging short-term hopping in and out of consensus.

Where Dusk truly differentiates itself is in how it handles failure and misbehavior. Instead of adopting harsh, destructive slashing mechanisms that permanently burn stake, Dusk uses soft slashing. This choice is not accidental. In a network designed for regulated finance, punishment must be corrective rather than catastrophic.

Soft slashing recognizes an important truth: most validator failures are not malicious. They are operational. Servers go down. Software versions lag. Networks experience congestion. Burning stake for these realities would discourage professional operators and concentrate power among a small group with extreme infrastructure budgets.

Instead, Dusk temporarily reduces a misbehaving provisioner’s ability to participate and earn rewards. When faults accumulate, the stake is suspended from committee selection for a period of time. During that suspension, the node earns nothing. This creates a real economic cost without destroying capital or destabilizing the system.

At the same time, penalization reduces the effective stake used for selection. The penalized portion is not destroyed; it is redirected into the rewards pool. This design keeps total supply intact while ensuring that poorly performing nodes naturally fade from influence until they correct their behavior. If penalties compound to the point where effective stake drops below the minimum, the operator must consciously reset participation by unstaking and restaking.

This mechanism sends a clear message: reliability matters more than raw capital. You cannot buy influence and then disappear. You must show up consistently.

Why does Dusk place such importance on this balance? Because privacy-preserving finance cannot tolerate instability. When institutions, applications, and users rely on confidential transactions, downtime is not just inconvenient—it is unacceptable. Soft slashing enforces discipline while preserving decentralization and long-term operator trust.

The incentive structure reinforces this philosophy. The Block of rewards are shared across proposals, validations, and ratification roles, ensuring that every step of consensus is economically recognized nothing issue happened in them. Transaction fees are folded into rewards this system as said before for bring the dusk more strong , linking real network usage directly to validator income is also a part of it . Even the partial burning of undistributed rewards introduces deflationary pressure tied to efficiency, not arbitrary scarcity.

It is optimizing for durability. It rewards those who operate correctly, penalizes those who do not, and avoids irreversible punishment that would undermine long-term participation.

In practice, avoiding slashing is straightforward: run official software, stay updated, remain online, and monitor performance. The fact that this is enough is itself intentional. Dusk is not trying to trap operators. It is trying to professionalize them.

Ultimately, Dusk’s tokenomics and soft slashing model reflect a network built for the future of on-chain capital markets. One where incentives are predictable, penalties are proportional, and economic design supports privacy, compliance, and trust—not just speculation. #Dusk @Dusk $DUSK