The landscape of Decentralized Finance (DeFi) is undergoing a massive shift. We are moving away from purely speculative assets and toward the tokenization of Real World Assets (RWAs). In this transition, @dusk_foundation has emerged as the most critical infrastructure provider, solving the "Privacy-Compliance Paradox" that has long kept institutions away from the blockchain.

Privacy Without Compromise

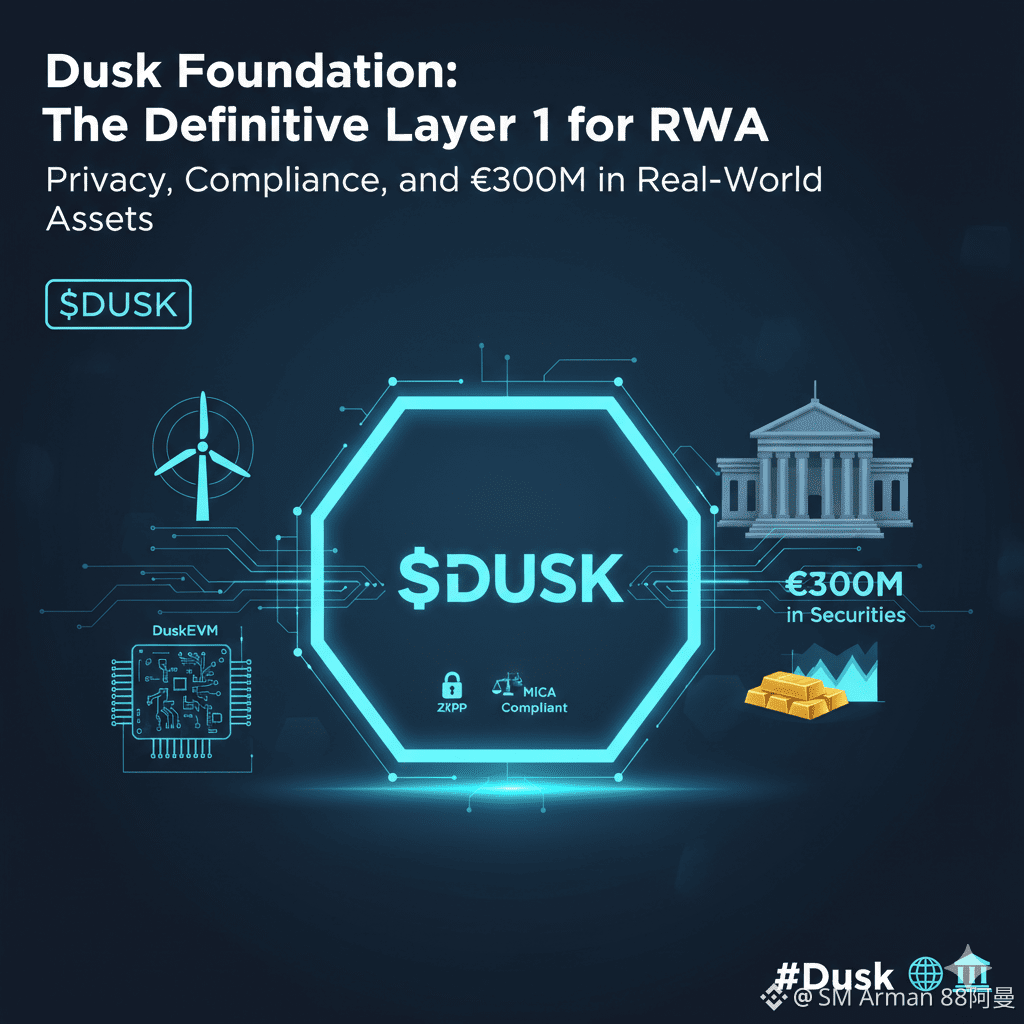

The core strength of $DUSK lies in its focus on "Privacy by Design." Utilizing advanced Zero-Knowledge (ZK) proofs, Dusk allows users and institutions to prove they meet regulatory requirements—such as KYC and AML—without revealing their sensitive personal data or trade secrets on a public ledger. For a bank or a regulated exchange, this isn't just a feature; it is a legal necessity.

One of the most bullish signals for the #Dusk ecosystem is the partnership with NPEX, a regulated Dutch stock exchange. This isn't just a theoretical collaboration; it is a move to bring over 300 million in securities on-chain. By integrating with a regulated entity, Dusk is proving that its technology can handle high-stakes, institutional-grade financial products under the strict MiCA (Markets in Crypto-Assets) regulatory framework.

With the launch of DuskEVM, the network has opened the floodgates for developers. Since it is compatible with Solidity, developers from Ethereum and other EVM chains can easily migrate their dApps to Dusk to take advantage of its built-in privacy and compliance features. This creates a unique environment where the familiarity of Ethereum meets the institutional readiness of a specialized RWA chain.

Conclusion

As we look toward a future where stocks, bonds, and real estate live on-chain, @dusk_foundation stands as the bridge between traditional finance and Web3. With its mainnet live and real-world capital flowing through its pipes, $DUSK is no longer just a project to watch—it is the foundation of the new financial internet.#dusk @Dusk $DUSK