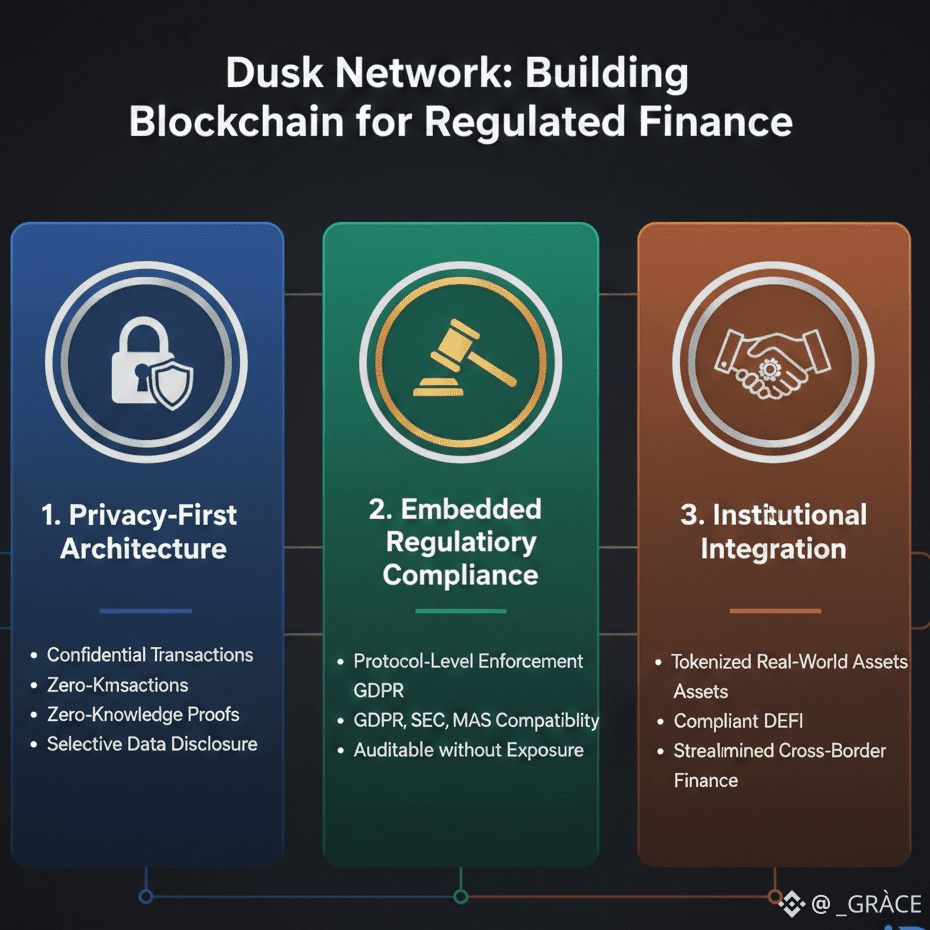

Dusk Network represents a fundamental shift in how blockchain technology can integrate with regulated financial systems. Unlike public blockchains that prioritize full transparency, Dusk recognizes that privacy is not an optional feature in financial environments, it is a regulatory and operational necessity. In traditional finance, institutions manage sensitive client data, investment strategies, and transaction histories that cannot be disclosed publicly without severe legal and operational consequences. Standard blockchains, by design, make all transactional data publicly visible, creating a barrier for any institution attempting to adopt decentralized infrastructure while remaining compliant. Dusk’s design directly addresses this challenge by providing a privacy-first framework at the protocol level, allowing financial actors to leverage blockchain innovation without violating legal or regulatory standards.

At the core of Dusk Network is its commitment to confidentiality. It allows transactions to remain private by default, ensuring that only authorized parties or regulators can access relevant information when required. This approach fundamentally shifts the paradigm of how blockchain interacts with regulated finance: rather than treating compliance as a retrofitted feature, Dusk embeds it directly into its architecture. This design philosophy opens the door for applications that were previously incompatible with blockchain, such as compliant decentralized finance (DeFi) protocols and tokenized real-world assets, both of which require careful management of sensitive data while maintaining operational transparency where necessary.

Tokenized real-world assets, for instance, highlight the importance of privacy within blockchain. When a financial institution digitizes real-world securities or commodities, it must safeguard ownership data, trading activity, and settlement information. Any inadvertent public disclosure could expose sensitive strategies, violate investor confidentiality, or trigger regulatory scrutiny. Dusk enables these assets to exist on-chain with cryptographic guarantees of privacy, while still providing mechanisms for proof-of-compliance. Regulators can verify the legitimacy of transactions without accessing underlying private data, achieving a balance that few public blockchains offer.

The importance of this balance extends into decentralized finance, where projects increasingly aim to offer alternatives to traditional banking and investment services. Compliance-focused DeFi platforms require granular privacy controls to protect both institutional and individual participants, particularly when operating under jurisdictional regulations like the European Union’s GDPR, the U.S. SEC mandates, or the Singaporean MAS guidelines. Dusk’s architecture accommodates these requirements, allowing DeFi platforms to innovate while remaining within the bounds of the law. In doing so, it reduces one of the largest friction points in institutional blockchain adoption: the perceived conflict between decentralization and regulatory compliance.

Dusk’s strategy emphasizes alignment over disruption. Many blockchain projects aim to reinvent financial systems or bypass regulation entirely, often creating friction with established institutions. Dusk, by contrast, works within the existing financial and regulatory frameworks. Its design does not attempt to subvert traditional systems but instead creates a complementary infrastructure that enables existing institutions to explore blockchain capabilities. This approach resonates with banks, funds, and other financial intermediaries, who often struggle with public blockchain exposure yet want the efficiency, security, and transparency benefits that blockchain offers.

Technologically, Dusk achieves this balance through several innovations. Confidential transactions are a cornerstone, allowing amounts, participants, and sensitive metadata to remain hidden from the general public. At the same time, zero-knowledge proofs and cryptographic verification ensure that transaction integrity can be validated by authorized parties. This creates a system in which data privacy does not compromise trust or accountability, a critical factor for adoption in regulated sectors. Unlike conventional blockchains where every node sees every transaction, Dusk selectively reveals information only when compliance or audit requirements demand it.

The implications of this design extend beyond individual transactions. Consider institutional investment platforms where client holdings, trading strategies, and liquidity positions must be confidential. On a typical public blockchain, exposure of these details could lead to front-running, market manipulation, or competitive disadvantage. Dusk mitigates these risks by ensuring that transaction details are encrypted and only accessible to those with legitimate authority, thereby protecting institutions while still providing verifiable proofs of transaction validity.

Moreover, Dusk supports complex financial instruments that require nuanced compliance checks. Tokenized bonds, equity derivatives, or structured products often carry restrictions on who can hold, trade, or transfer them. Dusk enables these rules to be enforced at the protocol level. Smart contracts can manage eligibility, prevent unauthorized transfers, and ensure adherence to regulatory requirements automatically. This reduces the reliance on manual oversight, lowers operational risk, and streamlines reporting benefits that are particularly appealing to large financial institutions exploring blockchain adoption.

From a strategic perspective, Dusk addresses one of the most common barriers to blockchain adoption: trust. Traditional financial institutions operate under stringent regulatory oversight, and any system that fails to meet these standards is unlikely to gain acceptance. By designing its network around privacy and compliance from the outset, Dusk reduces perceived risk and increases confidence among regulators, auditors, and internal governance teams. This approach fosters an environment in which blockchain can be integrated into existing workflows rather than being viewed as an experimental or disruptive technology.

The Dusk model also has implications for cross-border finance. Financial institutions often face complex regulatory landscapes when transacting across jurisdictions, with varying requirements for transparency, reporting, and data protection. Public blockchains struggle in these contexts because they cannot differentiate between domestic and international compliance rules. Dusk’s selective disclosure and compliance-by-design approach allows institutions to operate globally while adhering to local regulations, creating a bridge between decentralized technology and real-world regulatory frameworks.

Another key aspect of Dusk’s role in regulated finance is its potential to reduce operational inefficiencies. Traditional financial systems rely on intermediaries, manual reconciliations, and legacy IT infrastructure, which can be slow, costly, and prone to error. By embedding privacy and compliance at the protocol level, Dusk enables institutions to streamline processes without compromising legal obligations. Transactions can settle faster, audits can be conducted more efficiently, and reporting can be automated while preserving confidentiality. This represents a powerful combination of speed, security, and regulatory adherence that few blockchain platforms currently offer.

Financial actors are beginning to recognize the value of such an approach. Industry participants often cite regulatory uncertainty and privacy concerns as the primary obstacles to blockchain integration. Dusk directly addresses these issues by offering a system where confidentiality and compliance coexist. This positions it not merely as a blockchain technology provider but as an enabler of institutional adoption, bridging the gap between theoretical benefits and practical application.

Furthermore, the network architecture encourages ecosystem growth around compliant applications. Developers can build privacy-preserving DeFi protocols, tokenized asset platforms, and other financial services without needing to retrofit compliance features. This lowers the technical and operational barriers for financial innovation and encourages a wave of applications that respect privacy while remaining accountable. By reducing friction at the protocol level, Dusk promotes a healthier, more sustainable blockchain ecosystem aligned with the needs of regulated finance.

Dusk’s focus on real-world financial requirements also challenges conventional notions of blockchain value. Many projects emphasize decentralization or transparency as ends in themselves, often neglecting the operational realities of financial institutions. Dusk shifts the conversation toward practical alignment with financial workflows, showing that blockchain’s benefits can be realized without compromising privacy or legal obligations. This approach underscores the importance of designing technology around real-world constraints rather than theoretical ideals, a principle increasingly relevant as blockchain adoption expands beyond experimental pilots.

In addition to privacy and compliance, Dusk supports transparency where it matters most. Regulatory audits, investor reporting, and governance oversight can all be conducted without exposing sensitive transactional data publicly. This capability ensures that institutions remain accountable to stakeholders while safeguarding proprietary information. The result is a system in which trust, verification, and operational security are not mutually exclusive but mutually reinforcing.

Looking ahead, Dusk’s relevance is likely to grow as financial use cases increasingly explore decentralized technology. As tokenized assets, DeFi, and cross-border finance expand, the need for infrastructure that respects privacy and legal compliance becomes critical. Dusk is uniquely positioned to provide this infrastructure, offering a blockchain that is not just a technological experiment but a practical tool for regulated finance. Its approach demonstrates that blockchain can coexist with existing financial rules rather than forcing institutions to choose between innovation and compliance.

Ultimately, Dusk’s value proposition lies in its nuanced understanding of financial systems. It does not seek to disrupt or bypass regulation; it acknowledges that legal frameworks exist to protect participants, maintain market integrity, and ensure financial stability. By building privacy and compliance into its protocol from the ground up, Dusk offers a pragmatic pathway for financial institutions to adopt blockchain technology responsibly. This makes it a compelling choice for banks, investment funds, and other regulated entities exploring the potential of digital finance.

Dusk Network exemplifies the convergence of innovation and practicality. It shows that blockchain does not have to be a choice between transparency and privacy, innovation and compliance, decentralization and accountability. By embedding confidentiality and verifiability at the protocol level, it provides institutions with a tool that is both technologically advanced and operationally aligned with existing financial norms. As blockchain continues to evolve, Dusk’s approach offers a blueprint for integrating decentralized systems into the complex world of regulated finance.

By focusing on alignment rather than disruption, Dusk demonstrates that blockchain can serve as an enabler rather than a challenge to existing financial systems. Its privacy-first design, regulatory compatibility, and protocol-level compliance mechanisms collectively reduce the barriers that have historically limited institutional adoption. For organizations seeking to explore decentralized finance, tokenized assets, or cross-border transactions, Dusk offers an infrastructure that is ready for real-world use, balancing innovation with responsibility.

In conclusion, Dusk Network is more than just another blockchain project is a solution tailored to the realities of regulated finance. Its architecture respects privacy, enforces compliance, and ensures verifiability, creating a foundation for financial applications that cannot exist on traditional public blockchains. By aligning technology with legal and operational requirements, Dusk provides institutions with a pathway to integrate blockchain responsibly, efficiently, and securely. In doing so, it highlights a critical evolution in the blockchain space: one where innovation and regulation are not opposing forces but complementary partners in building the future of finance.