Walrus protocol delivers decentralized storage solutions on the Sui blockchain, where WAL tokens function as the core utility for payments, staking, and governance. For crypto traders, WAL represents an asset tied to real network activity—storage demands drive token usage, creating potential for yield through staking while holdings enable influence over protocol decisions. This setup positions WAL as a token worth monitoring for traders interested in ecosystem-driven value, with utilities that reward participation without requiring operational involvement.

WAL's Role in Blob Storage Payments

Traders can use WAL to pay for storing blobs—defined as arbitrary binary data units like trade logs or market reports—in the Walrus protocol. The payment mechanism calculates fees based on blob size, storage duration, and current epoch rates, designed to approximate consistent costs despite WAL's market fluctuations. Concrete steps for a payment: First, connect a Sui-compatible wallet holding WAL to the Walrus client interface; second, upload the data to generate a unique blob ID via content hashing; third, query the fee via the protocol's API, which factors in parameters like redundancy levels; fourth, approve a Sui transaction transferring the exact WAL amount to lock in storage. Constraints include a minimum storage period of one epoch to deter spam, and fees must cover node compensations proportionally. In the Walrus ecosystem, this utility means traders holding WAL can secure personal data on-chain, directly contributing to token demand as more users store blobs, which in turn supports WAL's circulation and potential price stability for position sizing.

Expanding on this, blob payments in Walrus use a fiat-pegged rate system where the protocol adjusts WAL requirements per epoch based on oracle inputs for stability. For traders, this reduces exposure to short-term volatility when budgeting for storage—say, reserving WAL for monthly renewals of trading journals. According to official sources, the system avoids fixed burns, instead recycling fees into reward pools, which indirectly benefits WAL holders by funding staking yields. Traders might strategize by accumulating WAL during low-activity periods when fees dip, anticipating ecosystem growth that increases blob uploads and token velocity.

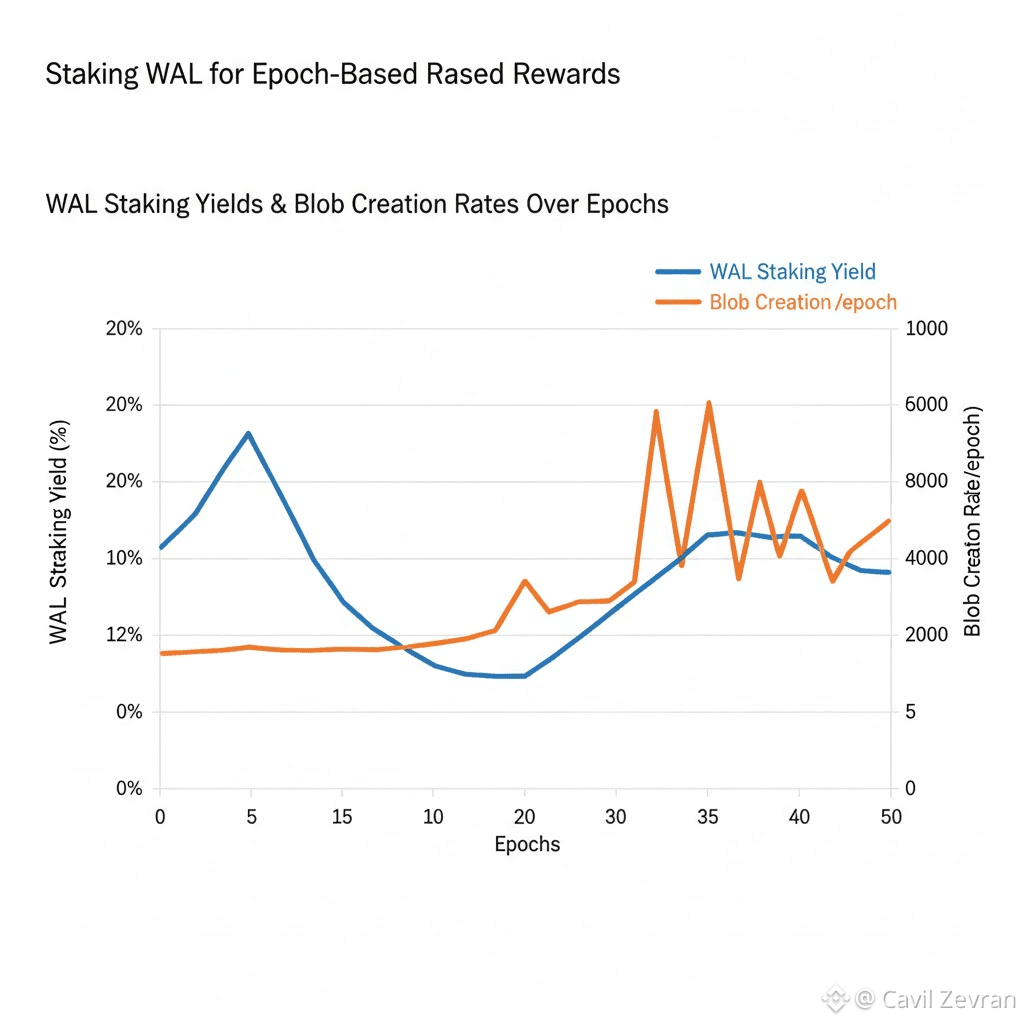

Staking WAL for Epoch-Based Rewards

Staking WAL in Walrus delegates tokens to storage nodes, earning rewards from the protocol's fee pool without running infrastructure. Rewards are distributed at epoch ends, calculated as a share of collected WAL fees proportional to delegated amounts and node performance. Bullet points on key mechanics:

Delegation weights node selection for blob assignments, increasing reward eligibility.

Rewards accrue in WAL, claimable via Sui transactions.

Slashing deducts up to a predefined percentage of staked WAL for node downtime.

Constraints lock staked WAL for the delegation period, with a cooldown—typically one epoch—for undelegations to prevent rapid shifts that could destabilize the network. For traders, this offers a yield strategy: by staking WAL, positions generate passive returns tied to ecosystem usage, such as rising blob storage from AI data markets built on Walrus. This utility appeals to traders seeking diversified yields, where WAL's staking APR fluctuates with protocol activity, providing signals for entry or exit based on on-chain metrics like total staked WAL.

To dive deeper, traders can monitor node metrics via Walrus dashboards, selecting those with high uptime to maximize rewards—avoiding those with slash histories that could erode principal. A practical approach involves splitting WAL stakes across 3-5 nodes for risk diversification, as the protocol's verifiable random function assigns blobs based on aggregate stake weights. In high-usage scenarios within the Walrus ecosystem, like during surges in media blob storage, reward pools swell, making WAL staking a hedge against holding idle tokens. Traders should note that undelegation cooldowns constrain liquidity, so position sizing should account for potential opportunity costs in volatile markets.

Governance Voting: Influencing WAL Economics

WAL holders participate in governance by voting on proposals that adjust protocol parameters, directly impacting token utilities like fee structures or staking requirements. Voting power scales with held or staked WAL, executed through on-chain Sui contracts during fixed windows. A walkthrough for voting: Lock WAL in a governance vault via the Walrus interface; review active proposals detailing changes, such as tweaking erasure coding ratios; cast votes weighted by your WAL amount before the epoch closes; outcomes auto-apply via smart contracts. Constraints mandate a minimum WAL threshold for proposal submissions to filter noise, and votes are binding only if quorum is met. This ties WAL to ecosystem control, allowing traders to vote on updates that could enhance token demand, like subsidy expansions for new blob types.

For traders, governance utilities in Walrus provide a layer of influence over long-term value—proposing or supporting fee reductions could boost adoption, increasing WAL circulation. According to official sources, no automatic burns occur, but governance can allocate reserves for incentives, conservatively managed to sustain the ecosystem. Traders holding significant WAL can form voting blocs, tracking proposal trends on Sui explorers to anticipate shifts in staking yields or payment rates. This mechanism encourages accumulating WAL not just for yields but for strategic input, where successful votes on node incentive tweaks might amplify reward pools, benefiting staked positions.

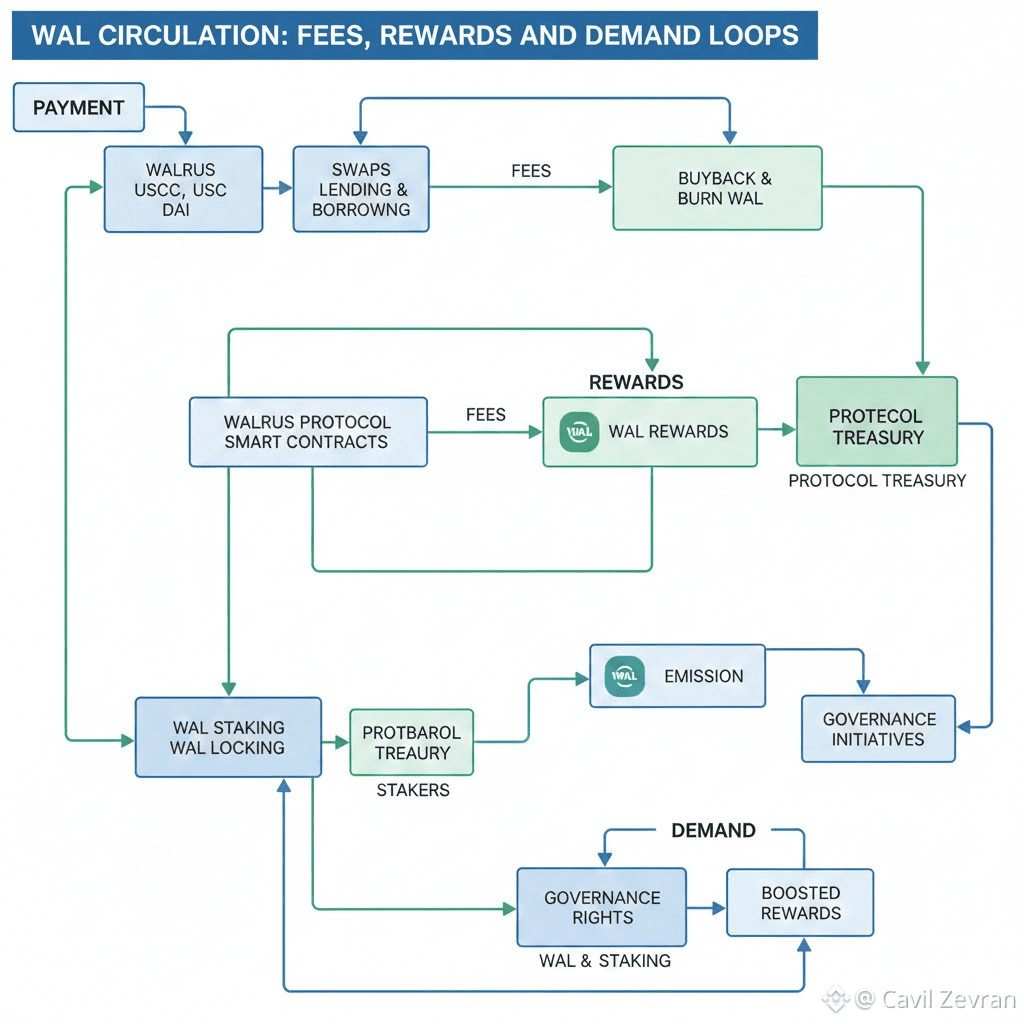

WAL Circulation: Fees, Rewards, and Demand Loops

Circulation of WAL in Walrus creates self-reinforcing demand loops, where storage fees feed reward pools that distribute back to stakers, encouraging more participation. Fees from blob uploads and extensions are pooled in WAL, then allocated based on node contributions verified through availability proofs. Constraints ensure fees cover at least the minimum node compensation, with overflow supporting subsidies. Traders can analyze this by tracking on-chain data: higher blob activity correlates with larger pools, signaling WAL buy pressure from users needing tokens for payments. In the ecosystem, this dynamic positions WAL as a utility-driven asset, where traders might front-run adoption waves by monitoring blob creation rates on Sui.

Delving into details, WAL's FROST subunits—where one WAL equals one billion FROST—enable micro-payments for small blobs, appealing to traders storing frequent but minor data like trade signals. According to official sources, the 5 billion total supply allocates portions for community incentives, ensuring circulation without over-dilution. Traders can exploit this by timing purchases around epoch transitions, when reward claims increase liquid WAL supply temporarily. The ecosystem's demand loops amplify during integrations, like Walrus supporting AI datasets, where sustained payments lock up WAL, reducing available supply for trading.

Managing Blobs: WAL Strategies for Traders

Traders manage blobs in Walrus by paying WAL for creations, extensions, and retrievals, treating storage as a portfolio tool for data security. Blob IDs serve as on-chain references, allowing traders to embed them in smart contracts for automated access. Bullet points on management constraints:

Extensions require WAL payments before expiration to avoid data loss.

Retrievals may incur optional WAL fees for priority queuing.

Size limits per blob necessitate splitting large datasets, multiplying WAL costs.

A walkthrough for blob renewal: Scan your wallet's blob inventory via Walrus tools; select expiring IDs; calculate WAL needed using current rates; batch transactions to renew multiple at once for efficiency. This utility helps traders safeguard sensitive info, with WAL expenditures deductible from yields if staked. In the ecosystem, effective blob management optimizes WAL usage, freeing tokens for trading while leveraging protocol features like metadata attachments for organized storage.

Further, traders can use Walrus resolvers for low-cost blob fetches, paying minimal WAL for non-urgent access—ideal for reviewing historical trades. Constraints on resolver loads cap concurrent requests, so batching is key. This approach integrates WAL into trading workflows, where ecosystem growth in blob volume directly uplifts token utility, providing traders with on-chain signals for position adjustments.

Risk Assessment in WAL Staking for Traders

Assessing risks in WAL staking involves evaluating slashing events, where node failures deduct staked WAL—up to limits set by governance. Traders mitigate this by delegating to vetted nodes with proven uptime, tracked via protocol metrics. Constraints include no insurance mechanisms, so diversification across nodes is essential. In the Walrus ecosystem, slashing rarity—triggered only by verifiable faults like missed proofs—makes WAL staking lower-risk than some alternatives, but traders should factor in opportunity costs during lock-ups.

To quantify, slashing caps at a fraction of stake per incident, allowing traders to model worst-case scenarios using historical data from Sui. A strategy: Allocate 20-30% of WAL holdings to staking, reserving the rest for liquidity. This balances yields from ecosystem fees with trading flexibility, as Walrus's proof-based security minimizes arbitrary losses.

Long-Term WAL Holding: Ecosystem Signals

Long-term holding of WAL benefits from ecosystem signals like total locked value in staking, indicating protocol health. Traders watch blob creation trends, as each requires WAL payments, forecasting demand. Constraints on holdings include no vesting cliffs for community allocations, per official sources. In Walrus, subsidies for projects increase adoption, potentially elevating WAL utility over time.

Traders can use on-chain analytics to gauge holding viability—rising staked WAL suggests confidence, while fee pool growth signals yields. This informs accumulation strategies, tying WAL to sustained ecosystem expansion.

Walrus protocol integrates WAL as a multifaceted utility token, offering traders staking yields, payment functions, and governance roles on Sui. By engaging with these mechanics, WAL holders can optimize positions based on ecosystem activity, fostering informed trading decisions.