For Institutional Onboarding, DUSK Tools For Identity, KYC, And Compliance

The greatest friction for institutional capital entering blockchain is not volatility, it is the absence of native tools for the rules they cannot break. Traditional finance operates within a rigid perimeter of identity checks and transaction monitoring. Bringing that capital on chain, without simply replicating opaque off chain processes, is the real puzzle. DUSK approaches this not as an afterthought, but as a first principle. My review of their technical documentation reveals an architecture built for this specific tension, enabling privacy while providing the necessary proofs for regulated participation.

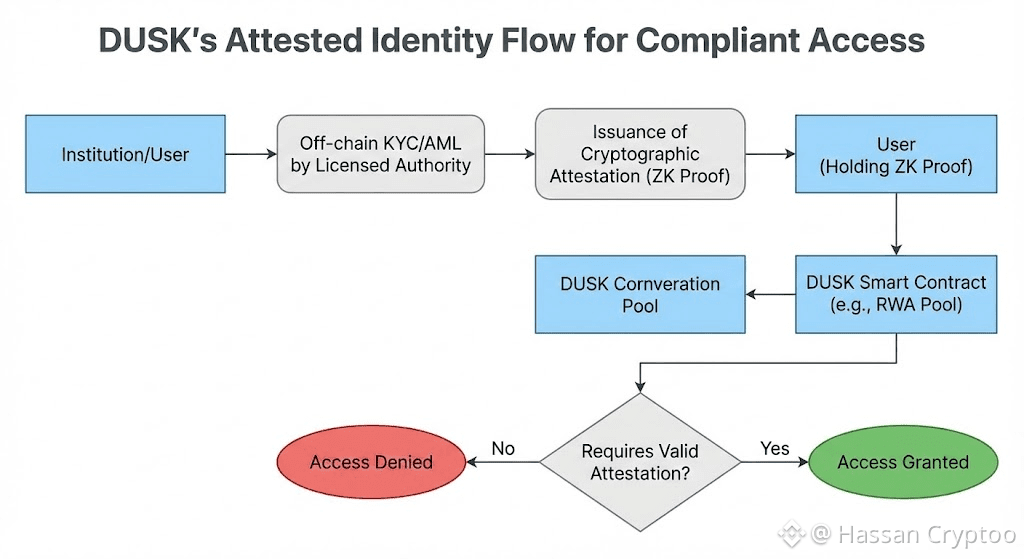

DUSK foundation is its consensus mechanism, SBA, or Segregated Byzantine Agreement, designed for high throughput and finality. However, the layer that interests me here is what is built atop it. The whitepaper details a concept called "attested identity." This is not about storing personal data on chain. Instead, it is a cryptographic system where a trusted authority can issue a credential, an attestation, confirming an entity has passed certain checks. This credential is a zero knowledge proof. In practice, a financial institution could verify a user accredited investor status or KYC completion. The user then holds a private, cryptographic certificate of that verification. They can use this certificate to access permissioned services or pools on the DUSK network without ever revealing the underlying personal information publicly. This separates identity from activity, which is really crucial.

This connects directly to their compliance modules. The vision outlined in their documents is for "Compliance as a Service" layers within smart contracts. Imagine a decentralized bond issuance or a private securities trading pool. The smart contract governing that activity can be programmed to require a valid, unexpired attestation credential of a specific type, say, a KYC attestation from a licensed European entity. The contract logic checks for the proof validity automatically upon entry. This creates what some in traditional finance might call a "gated" environment, but it is enforced by transparent, auditable code rather than manual review. It automates the rulebook. The privacy preserving nature of the credential means participants interact pseudonymously within the pool, yet every interaction is backed by a verified real world identity known to the compliance provider. This balance is the core of their proposition for regulated DeFi, or RDeFi, and tokenized assets.

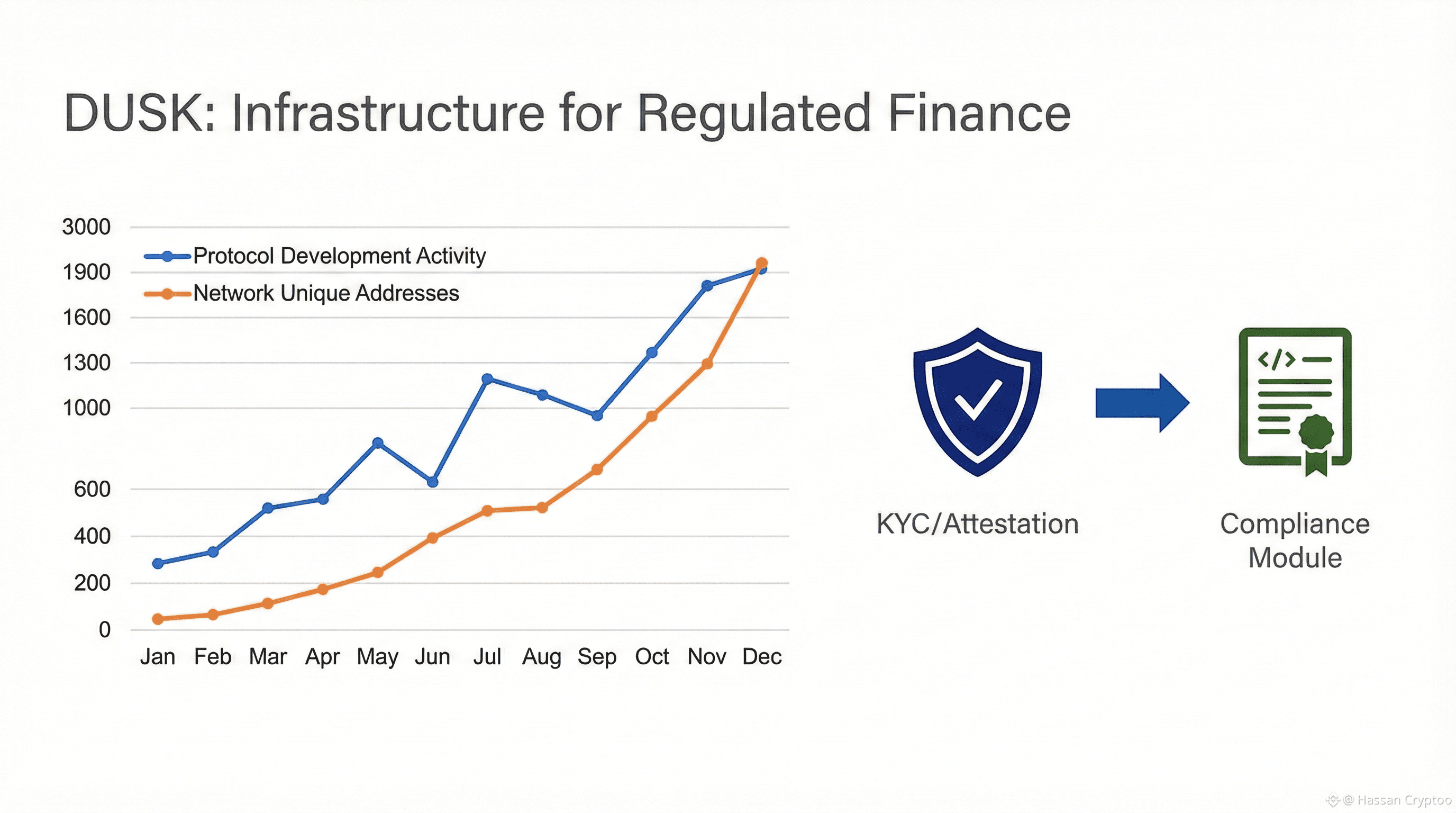

Recent developments show this is not theoretical. In their communications, DUSK has been actively engaging with the concept of MiCA, or Markets in Crypto Assets regulation in Europe. Their focus is on positioning their protocol native features, like these attestation mechanisms, as building blocks for projects that need to be regulation aware. The tools do not force compliance, they enable developers to bake it into their application logic from the start. For an institution, the appeal is a blockchain environment where they can participate or build products that inherently satisfy their legal and operational risk requirements, without sacrificing the efficiency of automation.

Looking at the token role, DUSK is the network fuel. It is used for staking by node operators to secure the chain, and for paying transaction fees. Within specific compliance oriented applications built on DUSK, the token could be used as collateral or as a means to pay for attestation services from providers. The token's value is linked to how widely the network is adopted for these regulated applications. Checking the DUSK/USDT pair on Binance Spot, you can see it's had the kind of wide price movements that are pretty normal for crypto. These days, the price has mostly been bouncing around a certain range, with spikes in trading volume often happening around major network upgrades. On the daily chart, clear support and resistance have formed around a few key levels from the past. However, the present market stage appears more dependent upon wider cryptocurrency capital movements than on news specific to the project. The relative strength index has moved from oversold territories earlier in the year into more neutral ground, suggesting some stabilization.

Fundamentally, data from CoinMarketcap lists DUSK with a market cap that places it within the broader layer 1 ecosystem. What stands out to me is the project categorization, it is often tagged under "Privacy" but also "Platform". This duality is accurate, it is a platform for private, compliant finance. On chain metrics related to developer activity and network transactions, which are more telling for infrastructure projects, show gradual growth. The real fundamental driver will be the launch of major applications using its compliance features. A partnership or a significant RWA issuance on the network would be a more concrete milestone than price action alone.

The broader implication is about trajectory. Many blockchains beg for institutional adoption by being fast or cheap. DUSK is building for it by being legible. They are creating the cryptographic and programmatic language that translates "Know Your Customer" and "Anti Money Laundering" into smart contract conditions. This is not about replacing regulators with code. It is about giving regulators and institutions a clear, auditable, and privacy respecting on chain framework to work within. The success of this approach will not be measured in transactions per second, but in the complexity and value of the financial instruments that feel safe enough to transition onto its ledger. My analysis of their path suggests they are constructing the rails first, understanding that the trains of institutional finance will only run where the signaling and safety systems are deeply installed.

by Hassan Cryptoo