The second week of January 2026 brought a key update for those trading privacy-focused assets—DuskEVM's mainnet launch on Dusk Network. This EVM-compatible layer streamlines the deployment of standard Solidity smart contracts, settling them directly on Dusk's Layer 1 for secure, compliant operations. For traders, this means easier access to DeFi and RWA tools within Dusk, potentially boosting DUSK's role in fee generation and staking rewards as activity ramps up in the ecosystem.

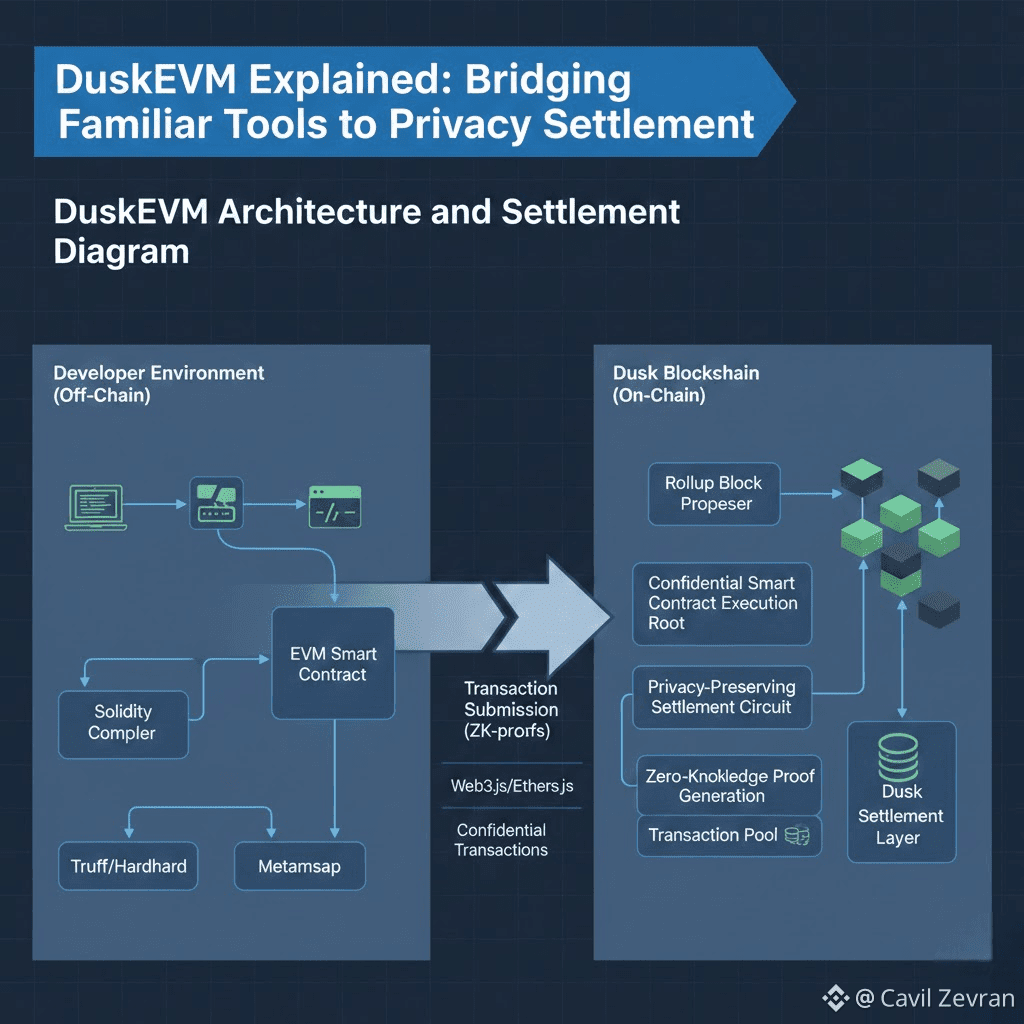

DuskEVM Explained: Bridging Familiar Tools to Privacy Settlement

DuskEVM acts as Dusk Network's execution environment, fully compatible with the Ethereum Virtual Machine, allowing traders to interact with contracts written in Solidity without modifications. According to official sources, it launched in the second week of January 2026, with chain ID 744 for mainnet and RPC endpoints like https://rpc.evm.dusk.network. This setup inherits Dusk's privacy features, such as zero-knowledge proofs, ensuring transactions remain confidential while auditable. Traders can now engage in DeFi activities on Dusk, like lending or swapping, with settlements on Dusk's base layer providing finality through Succinct Attestation consensus. DUSK tokens pay for gas in these executions, tying directly into network economics where increased DeFi volume could enhance DUSK's utility through fees.

Unlocking Compliant DeFi: Opportunities for Position Building

With DuskEVM live, Dusk Network unlocks compliant DeFi applications that cater to regulated environments, removing integration barriers for institutions and traders alike. Solidity contracts on DuskEVM can implement features like private lending pools, where borrowers prove creditworthiness via zero-knowledge without exposing details. This is designed to align with frameworks like MiCA, enabling traders to access yield-bearing positions in Dusk without data leakage risks. For instance, a trader might stake DUSK to provide liquidity in a DeFi protocol on DuskEVM, earning rewards while benefiting from Dusk's privacy to shield strategies. Constraints include higher gas costs in DUSK for proof-intensive ops, so position sizing should account for this in the Dusk ecosystem.

RWA Integration: Tokenized Assets via DuskEVM

DuskEVM's mainnet facilitates real-world asset tokenization on Dusk Network, allowing traders to trade digitized securities or bonds through compliant contracts. Institutions can deploy Solidity-based RWAs that settle on Dusk's Layer 1, leveraging privacy to protect investor data during transfers. Official documentation highlights how DuskEVM removes friction, enabling seamless bridges from traditional finance to Dusk. Traders could arbitrage between RWA yields and DUSK staking returns, as tokenized assets generate fees paid in DUSK. However, regulatory alignment in Dusk means slower onboarding for new RWAs, requiring traders to monitor Dusk's partnerships for volume spikes in the ecosystem.

DUSK Token Dynamics Post-DuskEVM Launch

DUSK's utility amplifies with DuskEVM's activation on Dusk Network, as it's the native gas token for all contract executions and settlements. Each DeFi interaction or RWA trade consumes DUSK, with fees redistributing to stakers via Dusk's reward model—70% to block generators, 10% to development, and the rest to committees. This creates demand pressure on DUSK as mainnet activity grows, potentially benefiting long holders. Traders staking DUSK secure the network while earning yields, but must navigate the 7-day unbonding period in Dusk, which limits quick exits. In compliant DeFi, higher transaction complexity on DuskEVM could elevate DUSK fees, offering trading signals around ecosystem adoption.

Step-by-Step: Trading in a DuskEVM DeFi Pool

Engaging with DeFi on Dusk Network via DuskEVM follows a practical sequence for traders. First, connect a compatible wallet like MetaMask to Dusk's RPC, funding it with DUSK for gas. Select a Solidity-based pool contract on DuskEVM, approving DUSK spend for liquidity provision. Deposit assets, triggering a zero-knowledge proof to validate privately without revealing balances. The contract executes on DuskEVM, settling states on Dusk's Layer 1 with consensus confirmation. Monitor yields via Dusk explorers, withdrawing after unbonding if staked. This workflow ensures compliance in Dusk, but proof generation adds seconds to confirmations, a trade-off for privacy in time-sensitive trades.

Hedger Synergy: Private Yet Auditable Trades on DuskEVM

DuskEVM integrates Hedger, Dusk Network's tool for compliant privacy using zero-knowledge proofs and homomorphic encryption. Traders can execute auditable transactions on DuskEVM, proving validity without disclosure—ideal for DeFi where regulators need oversight. For example, a swap on DuskEVM hides amounts but allows selective reveal for audits. This is designed for regulated financial cases in Dusk, enhancing trader confidence in RWAs. DUSK covers the elevated gas for these features, with staking rewards offsetting costs for long-term participants in the Dusk ecosystem.

Consensus and Security: How DuskEVM Leverages Dusk's Layer 1

DuskEVM relies on Dusk Network's Succinct Attestation consensus for settlement, where staked DUSK validators propose and ratify blocks efficiently. This provides quick finality—under 10 seconds in Dusk—while inheriting security from the base layer. Traders benefit from robust protection against reorgs in DeFi positions on DuskEVM, but must consider the minimum 1,000 DUSK stake for validation participation. Soft slashing in Dusk penalizes downtime without token loss, maintaining network integrity. As DuskEVM drives more activity, DUSK staking could yield higher rewards, appealing to traders seeking passive income alongside active positions.

Gas and Fee Structures: Managing Costs on DuskEVM

Transactions on DuskEVM use DUSK as gas, measured in LUX (10^-9 DUSK), with users setting limits and prices. Privacy ops like proofs increase consumption on Dusk Network, so traders optimize by batching trades to lower effective costs. Fees collect into block rewards, distributed per Dusk's model, creating a deflationary pressure on DUSK supply. For compliant DeFi, this means budgeting extra DUSK for RWAs, but the fixed 1 billion cap in Dusk supports value as usage grows. Traders watch fee trends post-mainnet for entry points, as lower congestion periods offer cheaper positioning in the ecosystem.

Staking Strategies: Earning with DUSK in the DuskEVM Era

Post-DuskEVM launch, staking DUSK on Dusk Network becomes more attractive for traders, securing the chain while earning from DeFi fees. A minimum 1,000 DUSK matures over 2 epochs (about 4,320 blocks in Dusk), with rewards from emissions decaying geometrically over 36 years. Traders delegate to nodes for hyperstaking flexibility in Dusk, balancing yields against lockups. As DuskEVM integrates RWAs, staking could hedge volatility, with DUSK rewards funding further trades. Constraints like penalization for inactivity require active management in Dusk.

RWA Yield Farming: Practical Plays on DuskEVM

DuskEVM enables yield farming for RWAs on Dusk Network, where traders farm tokenized bonds or equities via Solidity contracts. Deposit DUSK-collateralized assets into pools, earning yields from real-world returns settled privately on Dusk. This unlocks compliant farming without exposure, but gas in DUSK for frequent claims adds up. Traders compound by restaking rewards, leveraging Dusk's privacy to avoid tax tracking leaks. Official sources note Dusk's focus on MiCA compliance, so verify yields align with regulations in the ecosystem.

Privacy Tools in Action: Hedger for Traders on DuskEVM

Hedger on DuskEVM allows traders to perform privacy-preserving trades in Dusk Network, using proofs to hide details while enabling audits. Execute a private swap: encrypt inputs, compute homomorphically, prove validity, settle on Dusk. This suits high-net-worth traders avoiding scrutiny in DeFi. DUSK fees for Hedger ops are higher, but the tool's design for regulated cases justifies it in Dusk. Monitor DUSK supply for inflation from rewards, as emissions halve every 4 years.

Network Metrics: Tracking DuskEVM Adoption

Traders track metrics like total value locked on DuskEVM to gauge Dusk Network's growth, as rising TVL signals DeFi traction. Use Dusk explorers for transaction counts, with DUSK gas usage indicating activity. Post-mainnet, watch staking ratios—targeting over 50% in Dusk for security. Low metrics early on could offer dip buys for DUSK, anticipating RWA inflows. Constraints: Dusk's modular design scales execution, but Layer 1 bottlenecks during peaks affect settlement speeds.

Governance and Upgrades: Influencing Dusk's Future

DUSK holders influence upgrades to DuskEVM via Dusk Network's governance, voting on proposals for features like fee adjustments. This empowers traders to shape compliant DeFi, potentially optimizing yields. Staked DUSK weighs votes, tying utility to decision-making in Dusk. Post-launch, expect proposals for RWA expansions, impacting DUSK demand. Participation requires holding through epochs, a commitment for active traders in the ecosystem.

Long-Term Trading Outlook: DUSK in Compliant Ecosystems

As DuskEVM matures on Dusk Network, traders position for sustained growth in privacy-compliant DeFi and RWAs. DUSK's fixed supply and fee model support accumulation during lulls, with mainnet milestones like integrations driving catalysts. Balance portfolios with staked DUSK for rewards, trading unlocked portions on dips. Dusk's EU focus via partnerships could limit global reach initially, but expands opportunities as regulations harmonize.

DuskEVM's mainnet launch equips Dusk Network with tools for compliant trading, enhancing DUSK's role in secure DeFi. Traders gain from privacy without friction, positioning for RWA yields and fee-driven utility. This development solidifies Dusk as a strategic hold for regulated on-chain plays.