Walrus protocol continues to evolve as a decentralized storage layer on Sui, with WAL tokens facilitating payments for blob hosting and node staking rewards. As of early 2026, recent integrations like Sui's verifiable AI economy highlight WAL's growing utility, offering traders signals tied to protocol adoption and fee generation. This positions WAL for traders monitoring on-chain metrics, where blob storage volumes directly influence token demand and staking yields within the ecosystem.

WAL Tokenomics Updates: Supply Dynamics and Trader Implications

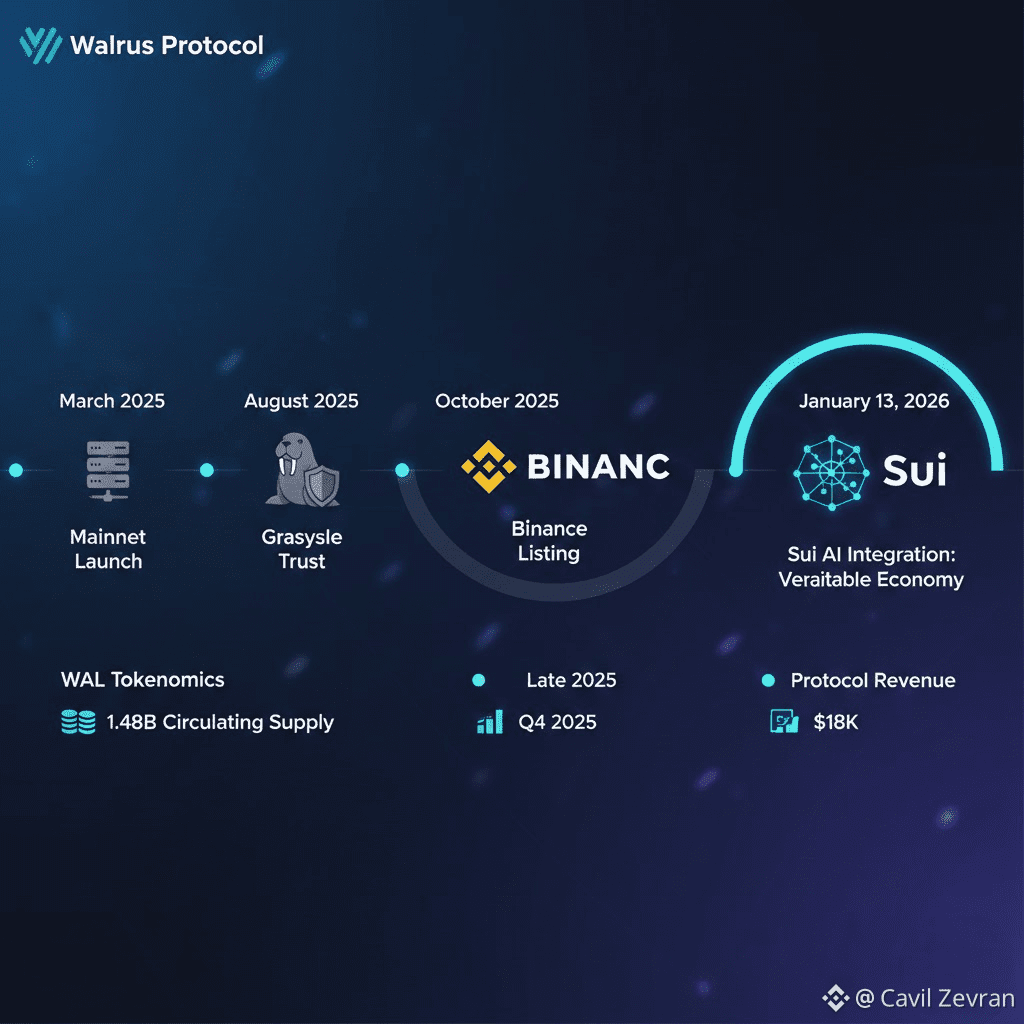

According to official sources, WAL maintains a capped total supply of 5 billion tokens, with allocations including 43% for community reserves and 10% for user airdrops—4% already distributed and 6% reserved for future initiatives. This structure supports ecosystem bootstrapping without inflationary pressures, as no ongoing minting occurs beyond initial distributions. Traders can track circulating supply, currently around 1.48 billion as of late 2025 listings, using Sui explorers to gauge dilution risks from unlocked reserves.

In practice, WAL's deflationary design incorporates burning mechanisms: a portion of storage fees and slashing penalties are burned, reducing supply over time. For traders, this creates scarcity potential as blob activity rises—each payment in WAL for data hosting contributes to burns, tightening economics. Constraints include governance-approved burn rates, which adjust via on-chain votes to balance incentives without over-deflation.

Bullet points on supply monitoring for trades:

Query Sui state for locked WAL in staking and governance.

Calculate burn impacts from epoch fee pools.

Watch airdrop announcements for short-term supply influxes.

This tokenomics setup appeals to traders holding WAL for long positions, as ecosystem growth—evidenced by increasing blob creations—amplifies burn effects, potentially supporting price floors during low-volatility periods.

Traders should note that community reserves deploy gradually for grants, per official guidelines, providing predictable supply events. In the Walrus ecosystem, this ties WAL value to real utility: higher storage demand from integrations burns more tokens, offering on-chain signals for entry points before yield spikes.

Payment Mechanisms: Stable Fees and WAL Demand Forecasting

Payments for blob storage in Walrus use WAL to compensate nodes, with rates dynamically adjusted per 24-hour epoch to approximate fiat stability via oracle inputs. A blob payment process: Upload data through the Walrus CLI or SDK, generate a content-hash ID, query the API for size-based fees multiplied by duration, then submit a Sui transaction transferring WAL to the protocol pool. Constraints mandate minimum durations of one epoch to filter spam, ensuring payments reflect committed usage.

For traders, this mechanism forecasts WAL demand—rising blob volumes, like those from AI data markets, increase fee inflows, creating buy pressure. According to recent data, protocol revenue reached $18k in Q4 2025, a metric traders can track on Sui dashboards for correlations with WAL price.

A walkthrough for fee-based trading: Monitor epoch rate adjustments on Walrus tools; estimate WAL needed for a 1GB blob over three epochs; accumulate tokens if rates signal upcoming hikes from ecosystem surges. This utility makes WAL a demand-driven asset, where traders position ahead of integrations boosting storage needs.

In-depth, payments recycle into rewards without fixed pegs, allowing WAL volatility to influence short-term costs but stabilized over epochs. Constraints on overpayments provide buffers, protecting users while tying trader strategies to Walrus adoption metrics like daily blob transactions.

Traders can leverage this by hedging WAL holdings against fee trends: buy during stable epochs, stake portions for yields offsetting potential rate increases. In the ecosystem, payment mechanics reinforce WAL circulation, where higher utility from features like deletable blobs—introduced in testnet—drives sustained demand.

Staking Enhancements: Epoch Rewards and Node Selection Strategies

Staking WAL secures the network through delegated proof-of-stake, where tokens assign to nodes for blob handling, earning rewards from fee pools at epoch ends. Rewards distribute proportionally to staked WAL and node uptime, verified by availability proofs. Traders select nodes via Walrus dashboards, focusing on those with slash rates under 1% for reliable yields.

Recent enhancements, per 2025 testnet updates, include staking apps for easier delegation, appealing to traders farming passive returns. Constraints lock WAL for one epoch minimum, with cooldowns preventing rapid exits, suiting mid-term positions.

Bullet points on node strategies:

Delegate to nodes with high fee contributions from media blobs.

Diversify WAL across 4-6 nodes to mitigate slashing.

Claim rewards promptly to compound via restaking.

In the Walrus ecosystem, staking ties directly to blob economics: integrations like Sui's AI stack, launched January 13, 2026, could surge data storage, swelling pools and WAL yields.

A detailed walkthrough: Query node metrics for uptime above 95%; delegate WAL via Sui batches to minimize gas; track accruals per epoch; redelegate if performance dips below averages. This yields provide traders buffers, with estimated APRs scaling from protocol revenue.

Traders optimize by correlating stakes with ecosystem events—AI transparency features in Sui enhance Walrus utility, potentially lifting rewards. Constraints on node capacities ensure competitive delegation, making WAL staking a tactical play for yield hunters.

Governance Evolutions: Proposal Impacts on WAL Economics

Governance in Walrus evolves with on-chain voting, where staked WAL weights decisions on parameters like fee multipliers or subsidy deployments. Proposals require WAL deposits, refunded on approval, and execute via Sui contracts post-quorum. Recent evolutions include RFP programs for ecosystem grants, per foundation announcements, allowing traders to influence funding that boosts adoption.

For traders, governance offers levers: voting on burn rate increases could accelerate deflation, supporting WAL holds. Constraints include minimum locks for proposals, deterring spam while rewarding committed holders.

A walkthrough for impact plays: Lock WAL in vaults; submit or vote on parameter tweaks like encoding ratios; monitor outcomes for yield adjustments. In the ecosystem, this empowers WAL traders to shape utilities, such as expanding subsidies—10% allocation per sources—for AI integrations.

In-depth, the January 2026 Sui AI economy launch positions Walrus for governance focus on data markets, where proposals could prioritize WAL-backed features. Traders track votes on Sui for signals, as passed changes like node incentive tweaks amplify staking attractiveness.

Governance constraints tie to epochs, creating timed opportunities where WAL locks reduce liquid supply, offering scarcity trades. In Walrus, evolutions like community-driven upgrades reinforce token value through aligned incentives.

Ecosystem Integrations: AI and Data Markets Driving WAL Utility

Walrus ecosystem integrates with Sui's four-layer AI stack, announced January 13, 2026, using blobs for transparent data storage in verifiable AI systems. This enhances WAL utility for payments in AI workflows, where tokens cover hosting large datasets. Traders watch integration metrics: increased blob usage from AI apps signals WAL demand spikes.

Key integrations include Talus for AI agents and Itheum for data tokenization, per recent news, expanding WAL's role in monetizable data markets. Constraints limit blob sizes to Sui transaction caps, requiring segmentation for massive AI files, each incurring WAL fees.

Bullet points on utility drivers:

Pay WAL for AI dataset redundancy via erasure coding.

Stake to nodes optimized for high-bandwidth AI retrievals.

Govern parameters for market-specific subsidies.

In the Walrus ecosystem, these drive token velocity: AI economy features position WAL as infrastructure, with traders positioning on adoption news like Grayscale trusts from August 2025.

A walkthrough for utility trades: Query Sui for Walrus blob counts post-integration; accumulate WAL if volumes rise 15%; stake to capture fee-derived yields. This ties WAL to emerging markets, offering growth plays.

Traders analyze integrations for long-term holds: Sui's AI push, emphasizing Walrus, could elevate protocol revenue beyond 2025's $18k quarterly, boosting burns and rewards. Ecosystem constraints ensure scalable growth, making WAL a bet on decentralized AI data.

Risk Assessment: Volatility Factors in WAL Trading

Assessing WAL risks involves epoch volatility from fee adjustments and slashing events deducting up to fractions of stakes for node failures. Traders assess via historical Sui data, where slashes remain rare under 1% for reliable nodes. Recent factors include mainnet stability since March 2025, reducing early risks.

Constraints on cooldowns extend exposure, so traders profile by simulating 5-10% WAL losses in models, capping stakes accordingly. In the ecosystem, risks link to blob adoption: low volumes dampen yields, signaling exits.

A detailed assessment: Compile epoch slash rates; factor integration risks like AI stack dependencies; diversify WAL between staking and liquid holds. This mitigates in Walrus, where protocol security via delegated PoS protects against broader attacks.

In-depth, volatility from listings—like Binance in October 2025—creates short-term swings, but utility anchors WAL. Traders hedge by monitoring market cap at $246M (rank 258), using 24-hour volumes of $2.29M for liquidity checks.

Risk constraints include no insurance, emphasizing diversification. In Walrus, assessments guide resilient trading, balancing yields with ecosystem uncertainties.

Walrus protocol's 2026 advances, like AI integrations, strengthen WAL as a utility token for traders on Sui. By leveraging payments, staking, and governance, WAL positions offer yields tied to storage growth, enabling informed ecosystem plays.