Most blockchain narratives still treat regulation like an external force that arrives after the product, like weather. Dusk is one of the few designs that behaves like regulation is a physical constraint, like latency or bandwidth, and then builds the chain around it. That sounds like a subtle framing choice until you notice what it unlocks. If confidentiality and auditability are both protocol level tools, then “regulated DeFi” stops being a marketing phrase and becomes an engineering surface. Dusk is trying to make that surface composable, so institutions can plug into markets without turning their ledgers inside out, and developers can build financial apps without hand stitching compliance onto every interaction.

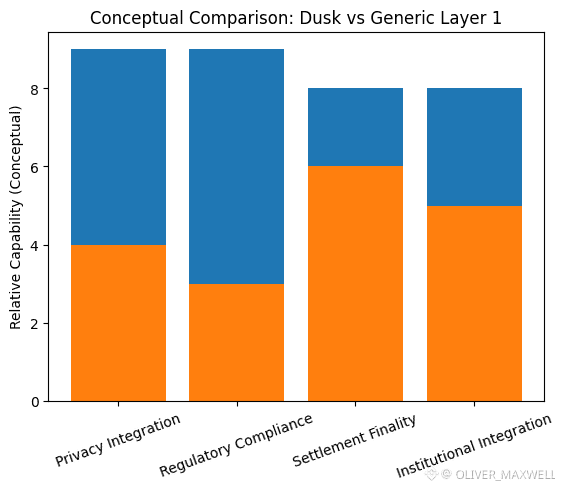

Dusk’s competitive context looks clearer when you compare what each chain has to “pretend” is not its problem. Ethereum is unmatched in tooling and liquidity, but confidentiality for real positions usually lives off chain, in application databases, or in specialized L2s that introduce separate trust and settlement dynamics. Solana pushes throughput, but the default state model still makes market behavior legible in ways that institutional desks often cannot tolerate, even before you get to counterparty rules. Polygon and other Ethereum scaling ecosystems have lots of routes to production, but most privacy features remain bolt ons, optional wrappers, or app specific cryptography, which means compliance and audit become integration projects, not native network behavior. Dusk’s bet is different. It aims to keep settlement finality and compliance controls close to the core, while letting execution environments evolve around that foundation. That is why its architecture is now explicitly modular, with DuskDS as the settlement and data layer and DuskEVM as an execution layer designed to feel familiar to Solidity developers.

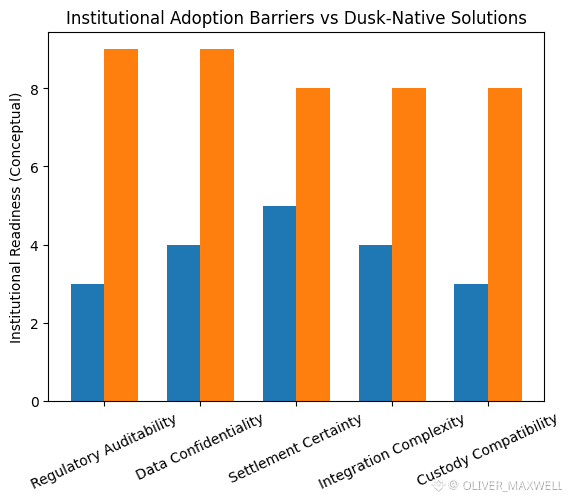

The most underappreciated part of that modular shift is not “EVM compatibility” as a feature. It is the admission that institutional adoption is dominated by integration cost and operational risk more than ideology. Dusk’s own framing is blunt: bespoke L1 integrations can take months, whereas EVM integrations can be done in weeks because the surrounding ecosystem already exists. The strategic move here is that Dusk wants institutions to treat the chain like regulated infrastructure, not an exotic system that demands custom everything. If you accept that premise, the modular stack is not a pivot away from privacy. It is a way to stop privacy and compliance from being punished by tooling isolation.

That brings us to the privacy architecture, where Dusk’s design is more opinionated than most coverage admits. On DuskDS, the chain supports two native transaction models: Moonlight, which is public and account based, and Phoenix, which is shielded and note based using zero knowledge proofs. The interesting sentence in the docs is not that Phoenix hides amounts and linkability. It is that users can selectively reveal information through viewing keys when regulation or auditing requires it. Many privacy systems stop at “hide everything.” Dusk treats selective disclosure as a first class workflow. That matters because institutions rarely need universal transparency. They need controlled transparency, the ability to prove compliance to specific authorized parties, in specific contexts, without broadcasting market structure to everyone else.

This is where Dusk’s compliance story becomes more than a slogan. If you can selectively disclose at the protocol level, then compliance becomes something you can express as a bounded capability rather than a blanket surrender of privacy. In practice, that reframes what “auditability” means. Traditional audits in finance are not public theater. They are permissioned processes with strict scope, and the scoping itself is part of the compliance contract. Dusk’s viewing key model is essentially an attempt to encode that scoping into the transaction layer. It is not trying to make finance transparent. It is trying to make confidentiality survivable inside regulated processes.

Dusk extends that idea into application execution through its DuskEVM direction, and this is another place where the nuance matters. The Dusk team positions DuskEVM as the environment where smart contracts run and where Hedger lives, with an explicit roadmap to support homomorphic encryption operations for auditable confidential transactions and obfuscated order books. If you are building regulated markets, the order book is the crown jewel of sensitive data. You cannot just “ZK proof” an entire market microstructure away without paying huge complexity costs. Homomorphic operations are a different trade, they aim to let computation happen on encrypted values so you can validate outcomes without exposing raw inputs. Even if that capability ships in constrained forms first, the intent is telling. Dusk is drawing a line between consumer privacy and market privacy, and it is targeting the latter.

The modular design also reveals a practical institutional concern that most chains avoid discussing: finality as a legal and operational parameter. DuskEVM’s own documentation states that it is built on the OP Stack and inherits the 7 day finalization wait from the OP Stack model, with upgrades planned to reach “one block finalization.” That is a big deal for regulated settlement because “maybe final” settlement is not just a UX problem. It breaks reconciliation, custody workflows, and sometimes legal definitions of settlement completion. Dusk’s answer is to keep DuskDS as the final settlement and data layer, and its multilayer architecture description emphasizes a pre verifier on the DuskDS node that checks state transitions before they hit the chain, explicitly noting that this avoids a 7 day fault window like Optimism. My read is that Dusk is trying to decouple developer convenience from settlement certainty. Let developers use familiar EVM rails, but keep regulated settlement anchored to a layer designed for fast final settlement and compliance primitives. It is less “L1 vs L2” and more “execution ergonomics vs settlement obligations,” which is a framing you mostly hear inside financial infrastructure teams, not crypto discourse.

That decoupling becomes especially relevant once you look at Dusk’s real world asset trajectory, where it has been unusually explicit about regulated counterparts. The partnership cluster around the Netherlands is not random. Dusk, NPEX, and Quantoz Payments announced EURQ, a regulated digital euro positioned as an electronic money token, and both the project announcement and independent reporting emphasize MiCA compliance and NPEX’s status as an EU multilateral trading facility. This combination is important because it puts a regulated venue, a regulated token model, and a purpose built compliance oriented chain into the same pilot context. That is closer to how financial infrastructure actually changes: through regulated islands that gradually connect.

Dusk’s collaboration with 21X adds another piece. Dusk states it will be onboarded as a trade participant, with deeper integrations planned including 21X integrating DuskEVM. Independent coverage frames this within the EU’s DLT Pilot Regime context, which is designed to let market infrastructures run tokenized securities under a regulated sandbox with defined exemptions and oversight. The important strategic point is that Dusk is not chasing “RWA” as a generic narrative. It is anchoring itself to regulated exchange and settlement experiments where privacy, disclosure scope, and legal finality are not optional.

The custody angle is another place where Dusk’s positioning is more specific than typical RWA talk. Dusk announced a partnership with Cordial Systems around custody for RWAs and ties it directly to the vision of a blockchain powered stock exchange context with NPEX. If you have ever watched institutional pilots fail, custody is often where dreams go to die. A chain can have perfect cryptography and still be unusable if custody workflows cannot satisfy internal controls, segregation of duties, and regulator expectations. Dusk’s choice to put custody partnerships in the foreground suggests it understands that adoption is gated by operational assurances, not just protocol features.

When you step back, Dusk’s strongest use case positioning looks less like “tokenize everything” and more like “make regulated market infrastructure composable without making it naked.” In equities and credit markets, pre trade confidentiality is not just preference. It is part of market integrity. In private funds and structured products, position data can be material non public information. In treasury management for stablecoin reserves, counterparties and flows carry risk signals. The chains that win these workloads will not be the ones with the loudest transparency story. They will be the ones that can express privacy, disclosure, and compliance as programmable constraints. Dusk’s Phoenix model with viewing keys on the settlement layer, paired with a roadmap for confidential computation primitives on an EVM layer, is a coherent answer to that problem.

The hard question is whether Dusk’s modular architecture is an advantage or an admission of complexity. Institutions like modularity because they can isolate risk domains. Developers like modularity when it reduces friction, and Dusk is explicitly chasing that with standard Ethereum tooling on DuskEVM. But modularity also creates seams, and seams are where integration failures and governance disputes happen. Dusk’s native bridge design is described as validator run and trustless, avoiding wrapped assets and custodians. That is the right direction if you want institutions to accept cross layer movement without external trust dependencies, but it also places more responsibility on validator operations and protocol correctness. In other words, Dusk is moving complexity from user space into protocol space, which is exactly what institutions want, as long as the protocol earns that trust.

This is why Dusk’s audit posture matters more than usual. Dusk highlights multiple security and protocol audits, including Oak Security auditing the consensus and economic protocol, and Zellic auditing the migration contract. Kadcast, the networking protocol for data propagation, also underwent an audit process, and external audit reporting exists from the auditor side as well. There is also a public GitHub repository that hosts Dusk audit reports. The institutional relevance here is not only “they got audited.” It is that Dusk is treating security assurance as part of the product surface, which aligns with how regulated infrastructure is evaluated.

Now look at tokenomics and validator economics, where Dusk quietly shows its hand about what kind of network it wants to be. Dusk documents a maximum supply of 1 billion DUSK, composed of a 500 million initial supply and 500 million emitted over 36 years, with a geometric decay schedule that halves emissions every four years. That is a long duration security budget, and it fits a chain that expects institutions to adopt slowly and then stay. The incentive structure is also unusually explicit. Rewards are split across roles in Succinct Attestation, with allocations to the block generator, committee roles, and a development fund. Soft slashing is described as suspension and penalization that reduces effective stake and rewards, without burning stake outright, and it targets repeated faults such as running outdated software or missing duties.

This is not theoretical. A public statement from Hein Dauven describes a large slashing event where around 5 million DUSK, about 2.5 percent of total stake out of roughly 180 million, was slashed, attributed to validators running outdated versions, and he notes the protocol behaved as intended. That is the kind of real world validator incident that actually matters for institutional confidence, because it shows whether incentives are enforceable and whether operational discipline is required. Around the end of 2025, the Dusk Foundation also stated that over 200 million DUSK was staked, about 36 percent of total supply. Combine that with the circulating supply figure exposed on Dusk’s own supply endpoint and you get a network that is leaning into staking participation as a visible signal of security posture.

The deeper insight, and the one I think most analysts still miss, is that Dusk is trying to sell institutions a different definition of decentralization. Many chains implicitly argue that decentralization means maximum public observability, maximum permissionlessness, and minimal governance discretion. Institutions do not buy that package as a whole. They buy operational guarantees. They buy bounded disclosure. They buy settlement certainty. Dusk’s architecture suggests it is optimizing for what I would call regulated decentralization: a permissionless validator set and public settlement, but with privacy and compliance controls embedded so institutions can participate without leaking their core data. That is a narrower market, but it is also a market where willingness to pay is high, and where switching costs become meaningful once real issuance and settlement flows land.

This is where the regulatory landscape becomes a tailwind if Dusk executes. In the EU, the DLT Pilot Regime created a regulated framework for market infrastructures to experiment with tokenized securities on DLT, and its purpose is to let these systems operate under supervision while exploring necessary adaptations to existing market rules. MiCA, meanwhile, has been rolling into application in phases, including rules for electronic money tokens and asset referenced tokens, with a broader regime for crypto asset service providers. Dusk’s own documentation explicitly frames on chain compliance in relation to European regimes like MiCA, MiFID II, and the DLT Pilot Regime, and its EURQ partnership messaging leans into MiCA alignment for regulated use cases. The key is not that Dusk name drops regulations. It is that Dusk is aligning product surfaces to the exact places regulators are building controlled adoption corridors.

The Chainlink partnership announcement adds another angle that is easy to dismiss as standard crypto PR, but is more interesting in this context. Dusk and NPEX describe adopting Chainlink interoperability and data standards including CCIP, DataLink, and Data Streams, aiming to support compliant cross chain settlement and regulatory grade market data delivery, with NPEX described as supervised by the Dutch financial markets authority and having facilitated over 200 million euros of financing for over 100 SMEs. If this is implemented seriously, it suggests Dusk is not just trying to host regulated assets. It is trying to standardize how regulated assets move and how their official data is consumed by on chain applications. That is a larger ambition, because data integrity and corporate actions data are as important as token standards in real markets.

So what are the adoption barriers, and does Dusk actually solve them. The first barrier is confidentiality with provable compliance. Dusk has a credible path here through Phoenix with viewing keys on the settlement layer, and a roadmap for confidential computation primitives on the EVM layer. The second barrier is operational integration. Dusk’s modular move to DuskEVM is explicitly about lowering friction and using standard Ethereum tooling. The third barrier is regulated counterparties. Dusk’s partnerships with NPEX, Quantoz, 21X, and custody focused work with Cordial are the right category of evidence, because they are not random dApps, they are pieces of market structure. The fourth barrier is network reliability and enforcement. Dusk’s documented slashing framework and the public slash event anecdote show that operational discipline is enforced, not optional, which is closer to how institutional systems behave.

The remaining risk is that Dusk is effectively attempting to build a chain that behaves like financial infrastructure, and financial infrastructure adoption is slow until it suddenly is not. The slow part is political and organizational. The sudden part happens when a regulated venue, a stable settlement asset, and a compliance capable chain align, and then someone realizes the operating cost reduction is structural. Dusk’s EURQ angle is a strong candidate for that kind of catalyst because regulated EMT style money is one of the missing pieces for atomic settlement in European tokenized securities experiments. If Dusk can become the place where regulated euro rails and regulated issuance rails meet, then its privacy story becomes less like “privacy coin vibes” and more like “market integrity tooling.”

Competitive threats are real, but they are also oddly validating. Ethereum aligned ecosystems will keep improving privacy tooling, but much of it will remain optional and app specific, which means compliance remains a bespoke integration story. Specialized privacy chains often struggle to demonstrate regulator friendly disclosure workflows, because their culture is built around non disclosure as a principle rather than controlled disclosure as a feature. Dusk’s defensibility, if it exists, will come from being boring in the right way. If it becomes the chain whose default posture matches regulated market instincts, then it will not need to win mindshare in general crypto. It will need to win a few infrastructure decisions inside a few regulated corridors, and then compound from there.

My forward looking view is that Dusk’s trajectory will hinge on one strategic inflection point: whether it can prove that compliance can be composable without being contagious. Contagious compliance is what developers fear, it infects every contract with bespoke constraints and kills innovation. Composable compliance is what institutions need, it gives them reusable primitives for identity, disclosure scope, audit triggers, and settlement rules. Dusk’s multilayer architecture, its Phoenix and Moonlight dual model, and its documented incentive structure are all pointing toward composable compliance as the product. If that becomes real in production, Dusk will occupy a defensible position that is hard to replicate without rethinking first principles. If it does not, then the network risks becoming a technically impressive compromise that neither pure DeFi nor pure institutions fully adopt.

The reason this analysis matters now is that Dusk is no longer just a whitepaper chain. It has a live mainnet token migration path documented, a staking system with explicit economics, evidence of meaningful staked participation, and public examples of protocol enforcement under stress. It also has a partnership stack that is unusually coherent around European regulated market structure. If you want to understand whether regulated on chain finance is becoming real, you should watch the projects that are building the uncomfortable middle, where privacy and compliance have to coexist. Dusk is making that middle its entire identity. If it succeeds, it will not be because it outperformed general purpose L1s on raw TPS. It will be because it turned confidentiality, audit scope, and settlement certainty into default network behavior, and made regulated markets feel like they belong on chain.