Real-world assets do not fail on blockchains because they are difficult to tokenize. They fail because blockchains were never designed to host markets that resemble real finance. Tokenization is an interface problem. Scale is a market structure problem. Dusk’s approach to RWAs begins where most projects stop: not at representation, but at infrastructure.

Traditional financial markets scale because they separate functions. Issuance, ownership, trading, settlement, and oversight operate as coordinated but independent systems. This separation allows markets to grow without collapsing under information leakage, legal ambiguity, or operational risk. Public blockchains collapse these functions into a single transparent layer. That architectural decision makes scale impossible for RWAs.

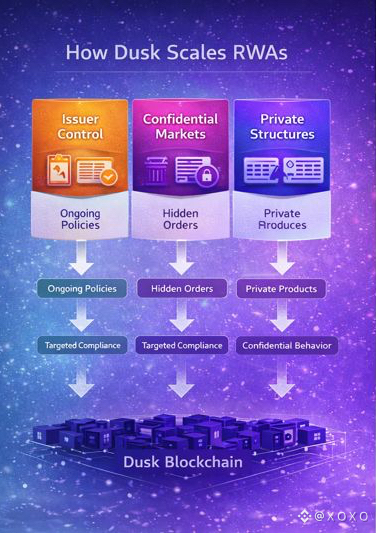

@Dusk takes a different path. It reconstructs financial market infrastructure on-chain by isolating the components that real-world assets require to function at scale. This is not an incremental improvement over existing RWA platforms. It is a structural redesign.

Issuance scalability through persistent issuer control

In traditional finance, issuance is not a one-time event. Issuers maintain long-term responsibility for who can hold an asset, how it can be transferred, and under what conditions it remains valid. Securities law, fund regulations, and debt covenants all require ongoing governance. Most blockchains treat issuance as a terminal act. Once a token is minted, control is effectively lost.

Dusk scales RWAs by allowing issuers to retain cryptographic authority over asset behavior throughout its lifecycle. Transfer permissions, investor eligibility, jurisdictional constraints, and corporate actions are enforced at the protocol level. These rules are not external compliance layers bolted on top of smart contracts. They are embedded directly into how assets move.

This enables assets to scale in distribution without losing legal coherence. An issuer can expand from hundreds to tens of thousands of holders without rewriting contracts or relying on off-chain enforcement. Control scales alongside adoption.

Market scalability through confidential price formation

Markets do not scale when every participant can see every intention. In public blockchain environments, visible order flow destroys liquidity. Large trades become signals. Strategies are extracted. Spreads widen. Professional market makers withdraw.

Dusk solves this by enabling confidential price formation. Orders are not broadcast. Trade intent is not exposed. Execution occurs without revealing size, direction, or timing to the broader market. This allows RWAs to trade under conditions that resemble institutional venues rather than speculative retail platforms.

Liquidity scales because it is protected. Market participants can commit capital without becoming targets. This is the difference between a token that exists and a market that functions.

Structural scalability for complex financial products

Real-world assets are rarely simple. Funds track net asset value. Bonds distribute coupons. Equities manage dividends, voting rights, and ownership registries. These structures rely on controlled visibility and private accounting. Public blockchains break these mechanisms by default.

Dusk allows complex financial structures to exist on-chain without exposing their internal state. Cap tables remain private. Cash flows can be computed and distributed without revealing individual positions. Governance rights can be exercised without public disclosure of holdings.

This allows financial products to grow in complexity and scale without collapsing into transparency-driven dysfunction. Dusk does not simplify RWAs to fit blockchains. It adapts blockchains to support real financial complexity.

Regulatory scalability through precise auditability

Regulatory oversight does not require universal transparency. It requires accurate reconstruction. Regulators need to know what happened, not everything that happened to everyone at all times. Public blockchains overwhelm oversight with irrelevant data while still failing to provide legally meaningful records.

Dusk enables targeted auditability. Ownership, transfers, and compliance events can be reconstructed cryptographically for authorized parties. Oversight scales because it is precise. Privacy is preserved because access is controlled.

This allows RWAs to operate across jurisdictions without fragmenting markets or compromising confidentiality. Regulation becomes a participant in the system rather than an external threat to it.

Capital scalability through protected behavior

Capital does not scale in environments where behavior is punished. Funds will not deploy meaningful size into systems that expose positions, reveal flows, or allow competitors to reverse-engineer strategy. Transparency becomes a tax on participation.

Dusk removes that tax. Capital can accumulate, rebalance, hedge, and exit without broadcasting intent. This is not secrecy for its own sake. It is the condition required for serious capital formation.

As capital scales, liquidity deepens. As liquidity deepens, RWAs become usable beyond passive holding. Markets emerge where assets can be priced, traded, and financed efficiently.

Scaling markets, not representations

Most RWA platforms focus on expanding the catalog of tokenized assets. Dusk focuses on expanding the capacity of markets to absorb them. This distinction determines whether RWAs remain a niche experiment or become a foundational layer of on-chain finance.

Dusk does not promise scale through throughput. It delivers scale through architecture. By rebuilding the conditions under which real markets operate, it enables RWAs to grow in issuance, liquidity, complexity, regulatory acceptance, and capital participation simultaneously.

This is what scaling looks like when applied to finance rather than technology.

My take

Real-world assets do not need better tokens. They need functioning markets. Dusk understands this distinction, and that is why its approach to RWAs is structurally different from everything else in the space.