Why Privacy and Compliance Can Work Together in DeFi

How Dusk Network Delivers Confidential Finance While Maintaining Regulatory Confidence

Introduction

Privacy has always been a key selling point in crypto. But in DeFi, privacy and regulation often seem like they’re at odds. Most privacy tools either hide everything—making oversight difficult—or reveal too much, which isn’t ideal for those who need to protect sensitive information.

Dusk Network changes this dynamic. Instead of avoiding regulation, it integrates privacy with compliance from the ground up. This is a major breakthrough for regulated DeFi, tokenized real-world assets, and any financial product aiming to comply with rules without sacrificing security.

The Core Challenge: Privacy vs. Regulation

Most DeFi is fully transparent. Every transaction and position is visible to everyone. While this builds trust, it creates issues for businesses and institutions that need some privacy while still complying with laws.

Go too far in the other direction—make everything private—and regulators lose visibility. Without the ability to audit, oversight is impossible.

Dusk Network aims for the middle ground: strong, but not absolute, privacy.

What Makes Dusk Network Different

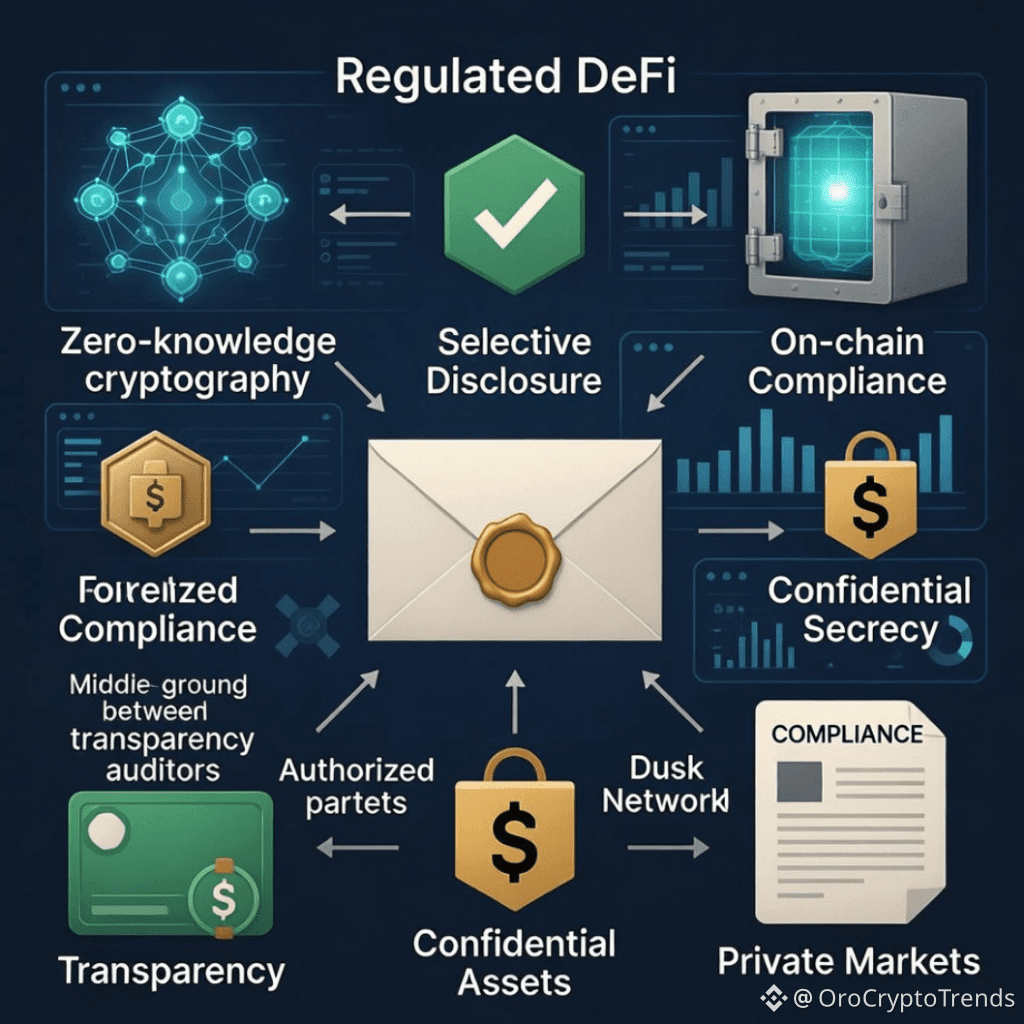

Dusk isn’t built for anonymous, untraceable trading. It’s focused on regulated finance. The protocol uses zero-knowledge cryptography so users can prove that actions or rules have been followed without revealing all the underlying data.

Sensitive information stays confidential, but can be accessed by authorized parties, like auditors, when needed.

Think of it like a sealed envelope: the contents are hidden until someone with permission needs to check inside.

How Regulated DeFi Operates on Dusk

In regulated DeFi, privacy can’t be absolute. Dusk enables:

Selective disclosure: Share information with regulators or auditors, but keep it private from the public.

On-chain compliance: The network enforces rules automatically, so you don’t only rely on external oversight.

Confidential assets: Tokenized securities or funds can be traded without exposing sensitive details to everyone.

This structure allows DeFi applications to meet requirements—KYC, audits, reporting—without reverting to traditional centralized systems.

Dusk Network’s Role in Practice

Dusk is especially useful for:

Tokenized real-world assets (stocks, bonds, etc.)

Private markets that require confidential trading

Institutional DeFi platforms that need auditability

Enterprise financial products that must comply with regulations

In short, any scenario where transparency alone isn’t enough and traditional DeFi tools fall short.

Why This Is Important

Crypto regulation is becoming more defined globally. DeFi is shifting from experiments to real-world use. Projects that can’t support compliance won’t scale.

Dusk’s strategy demonstrates that privacy isn’t only about hiding. It’s about protecting financial information in a way that regulators can accept. This is crucial for institutions and is likely where the next generation of DeFi infrastructure will emerge—not at the extremes, but in solutions that balance privacy, trust, and legality.

Conclusion

Privacy doesn’t have to mean secrecy, and compliance doesn’t have to remove control. Dusk Network shows that DeFi can be confidential and still follow the rules.

As regulated DeFi grows, networks that strike this balance will become increasingly important.

Call to Action

When evaluating privacy projects, look beyond just anonymity. Check if they offer selective disclosure, auditability, and real-world compliance. That’s where true, sustainable adoption will happen.

FAQs

What is Dusk Network used for?

Regulated DeFi, tokenized assets, and financial applications that must comply with regulations.

Is Dusk completely private, like some other blockchains?

No. Dusk provides privacy with built-in compliance. You get confidentiality, but with the ability to verify when necessary.

Disclaimer: Not Financial Advice