Reimagining Tokenized Securities for Real-World Finance

How Dusk Network integrates privacy, compliance, and automation into STOs

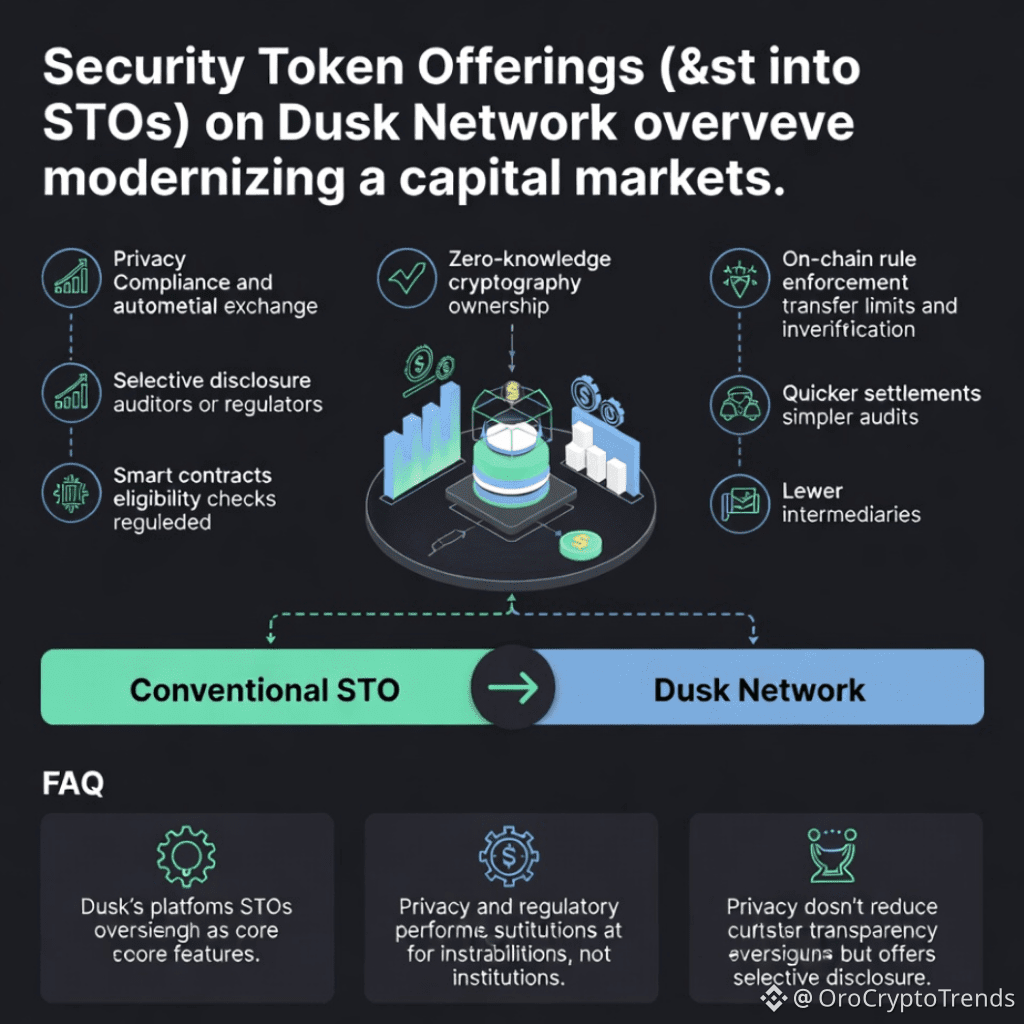

Security Token Offerings set out to modernize capital markets, but early attempts ran into significant challenges. Compliance became a burden, privacy standards fell short, and most platforms relied on outdated, off-chain processes.

Dusk Network takes a new approach by creating STOs for regulated environments—where privacy and regulatory oversight are both essential.

Here’s the core issue: most conventional STO platforms either expose sensitive investor data on public blockchains or handle compliance off-chain. That’s inefficient for issuers and makes institutions wary.

Dusk Network addresses this directly. Compliance and confidentiality aren’t added on later—they’re integrated into the protocol from the ground up.

Using zero-knowledge cryptography, Dusk offers:

• Confidential ownership: Investor identities and holdings remain private by default.

• Selective disclosure: Auditors or regulators can access necessary details—without revealing everything.

• On-chain rule enforcement: Transfer limits, investor verification, and local restrictions are managed automatically.

Imagine a digital securities exchange where compliance rules are embedded into the system—not an afterthought.

And Dusk doesn’t just simplify compliance—it makes it programmable. Smart contracts perform eligibility checks instantly. Issuers save on manual processes, and the risk of mistakes decreases.

For institutions, this is a familiar environment. Financial controls remain strict, but now you benefit from blockchain advantages: quicker settlements, simpler audits, and fewer intermediaries.

STOs on Dusk aren’t about avoiding regulations. They’re about making regulations work for today’s world. When privacy and compliance are truly compatible, tokenized securities become realistic for real financial markets.

So, when evaluating an STO platform, don’t just look at the technical specs. Consider whether compliance, privacy, and enforcement are built-in or just an afterthought.

FAQs

What sets Dusk’s STOs apart?

Compliance and privacy aren’t optional—they’re core features.

Are Dusk STOs suited for institutions?

Yes. Dusk is built for regulated issuers and investors.

Does privacy reduce transparency?

No. With selective disclosure, you get transparency where it matters, without making everything public.

Educational overview of security tokens and regulated blockchain infrastructure.

Not financial advice.