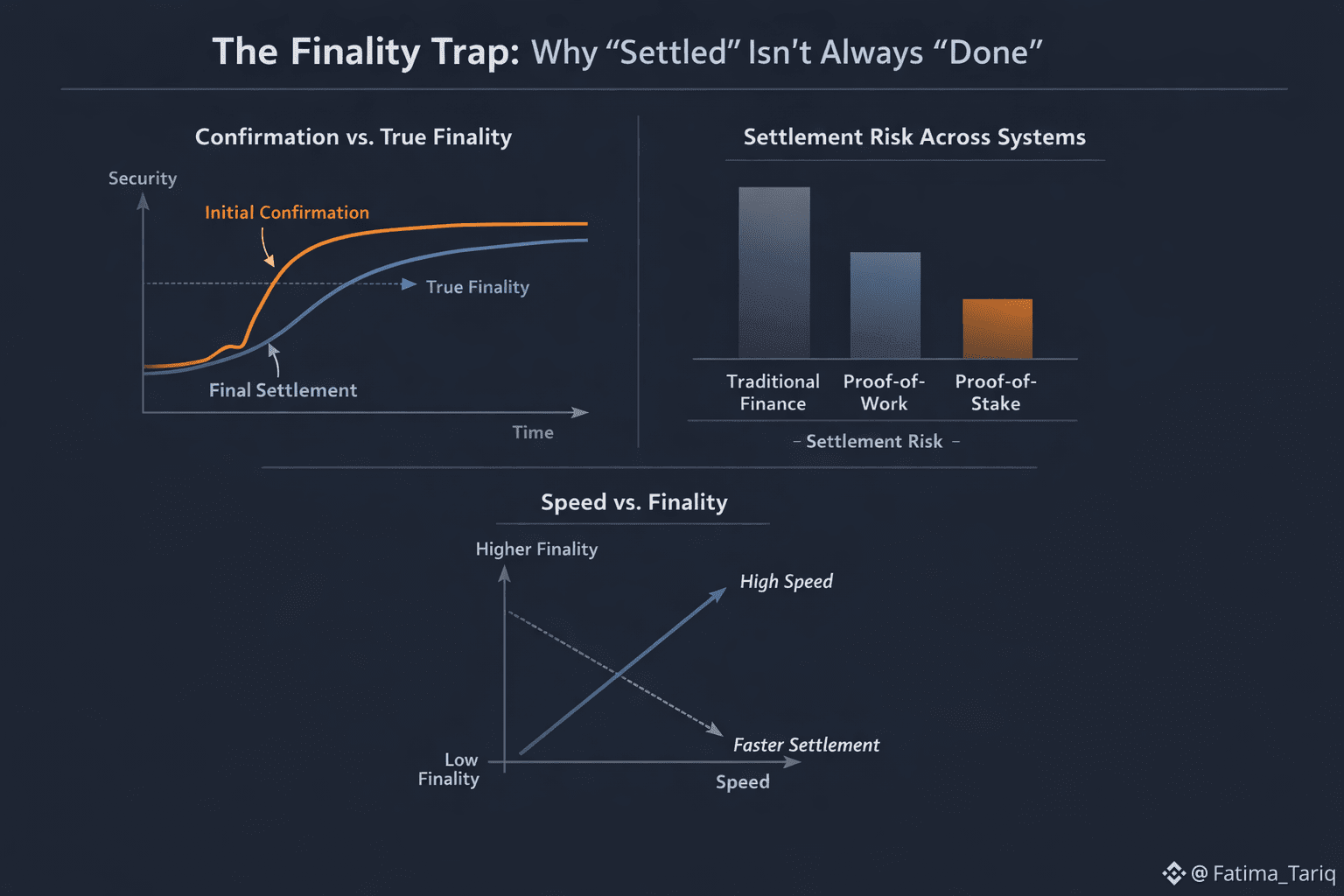

In the engineering circles surrounding the Dusk Foundation, we talk about deterministic finality as the holy grail of settlement. We measure success in milliseconds and slot times. But in the institutional world, there is a yawning chasm between on-chain finality and off-chain acceptance.The hard truth is that a transaction can be finalized, immutable, and cryptographically perfect, yet remain permanently "pending" in the eyes of a counterparty. We are entering an era where the protocol is no longer the bottleneck—the disclosure scope is.

Finality is a Protocol Event; Acceptance is a Legal One

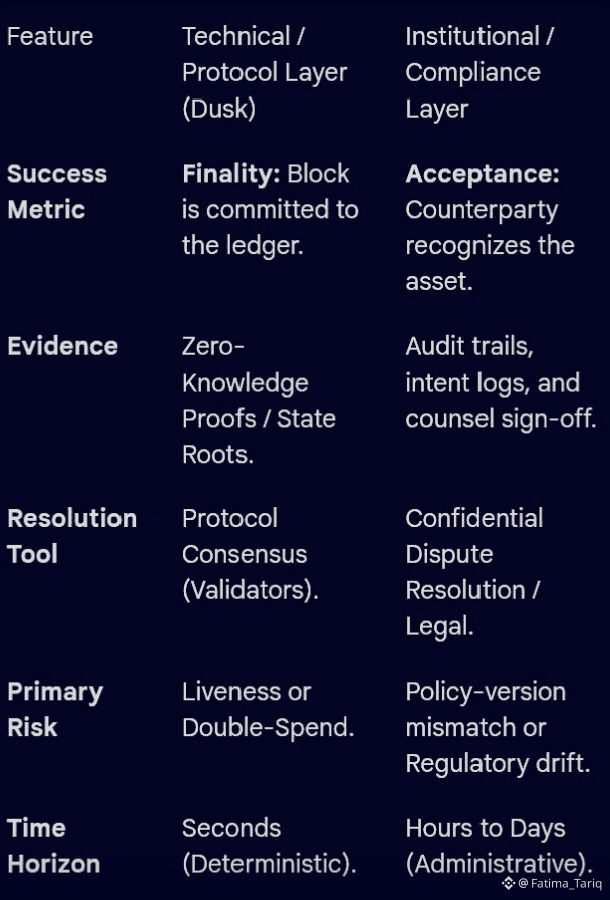

Deterministic finality closes the ledger, but it does not compel a counterparty to accept the outcome. In regulated environments, post-finality refusal is a quiet, non-technical event. There is no rollback, no hard fork, and no protocol failure. Instead, the transaction simply enters a state of confidential dispute resolution.The chain proves the execution was correct according to the code, but humans, venues, and general counsel don't care about execution; they care about defensibility. If the evidence package doesn't match the internal policy version—perhaps a mismatch between Class A and Class B credential requirements—the state change on the ledger is practically irrelevant.

The Disclosure Bargaining Surface

In a privacy-preserving ecosystem like Dusk, disputes hinge on a delicate negotiation: How much are you willing to reveal to prove you were right?

When a counterparty refuses acceptance, the resolution isn't found by "checking the chain." It’s found by assembling a scope-bound evidence package. This creates a new, dangerous operational drag:Broad disclosure proves correctness but creates fresh compliance and governance risks.Narrow disclosure protects confidentiality but fails to satisfy the counterparty’s risk desk.Suddenly, the "disclosure scope" becomes a bargaining surface. Time-to-acceptance begins to exceed time-to-finality by orders of magnitude, turning a "fast" blockchain into a slow, manual negotiation process.

The Institutional Normalization of Friction

The Institutional Normalization of Friction

We are seeing a shift where these "failures" are no longer treated as protocol incidents. They aren't bugs; they are checkboxes in a runbook. Risk has migrated from the chain into internal policy, counterparty limits, and approval workflows.Institutions are responding to this ambiguity not by fixing the tech, but by hardening their shells:

Longer acceptance windows that ignore the chain’s actual speed.

Tighter counterparty limits to mitigate the risk of "provisional" finality.

Stricter upfront credentials to prevent disputes before they happen.

The Ghost Transaction

The core thesis for anyone building in this space must be this: Closure only happens when the disclosure scope is signed off. You can have a finalized transaction sitting on the Dusk ledger, immutable and secure, that is effectively a "ghost." It exists in the state, but it cannot be used, cannot be recognized by compliance, and cannot be moved because the off-chain evidence expectation hasn't been met.We have spent years solving for the technical finality of data. We have spent almost no time solving for the institutional finality of intent. Until we treat the evidence package as being as important as the block itself, "fast finality" will remain a technical achievement that fails to survive its first contact with a compliance department.