Its second Buyback & Burn is now complete and this time it wasn’t funded by emissions, inflation, or incentive, it was funded by real protocol revenue.

Infact, this is a big shift.

Instead of letting earnings sit idle or get diluted, @DeFi_JUST is running a model where performance directly tightens $JST supply.

𝙃𝙚𝙧𝙚’𝙨 𝙝𝙤𝙬 𝙩𝙝𝙚 𝙨𝙮𝙨𝙩𝙚𝙢 𝙬𝙤𝙧𝙠𝙨: 👇

➤ Every dollar of JustLend DAO net income is used to buy back $JST

➤ USDD multichain revenue above $10M is added to the same pool

➤ Purchased tokens go straight to a burn address

➤ Everything runs on chain, automatically, no manual intervention

For this second cycle (Jan 15, 2026 SGT), the DAO deployed:

➾ $10.19M from Q4 2025 earnings

➾ $10.34M carried over from previous periods

That capital permanently removed:

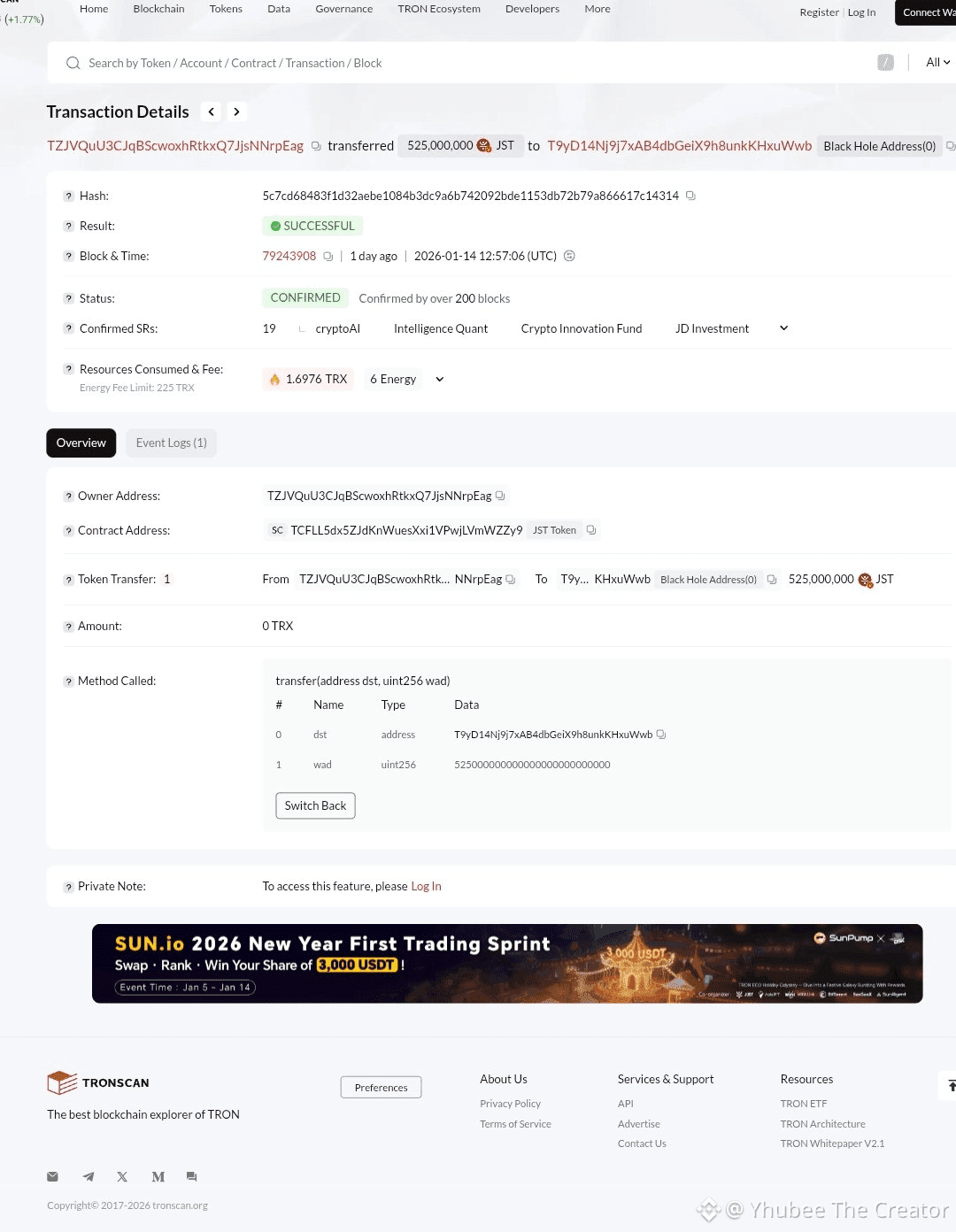

→ 525,000,000 $JST

→ ≈ $21M in value

→ Burned in a single verified on chain transaction

From a supply angle, that’s huge.

This one event erased about 5.3% of total $JST supply.

Across both burns so far, 1,084,890,753 $JST are now gone forever, nearly 11% of all tokens ever minted.

𝙏𝙝𝙚 𝙨𝙞𝙜𝙣𝙞𝙛𝙞𝙘𝙖𝙣𝙘𝙚 𝙗𝙚𝙝𝙞𝙣𝙙 𝙩𝙝𝙞𝙨:

➤ Revenue now feeds directly into scarcity

More protocol usage = more income = more $JST destroyed. That links token economics to real activity, not hype.

➤ DAO governance isn’t cosmetic

This wasn’t a last minute decision. The community approved a strict rule back in Oct 2025, and it was executed exactly as written.

➤ Dilution pressure is being reversed

Quarterly, revenue funded burns create a structural counterweight to inflation.

➤ Transparency is built in

Every dollar, every token, every burn can be verified on chain. No PR reports required.

What comes next:

↪ Buyback & Burns continue every quarter

↪ Operations handled through JustLend Grants DAO

↪ Financials and transactions disclosed each cycle

↪ The model scales as the protocol grows

This is JustLend DAO moving from incentive led growth to revenue backed sustainability, where governance, cash flow, and token mechanics reinforce each other.

For anyone watching DeFi mature into real financial infrastructure, this isn’t just a burn, it’s proof that the system is actually working.

#JustLendDAO @justinsuntron #TRONEcoStar