#Dusk $DUSK

Dusk Foundation is where tokenization are no longer being a slide and starts touching people who keep spreadsheets open for a living.

Not at trading.

At the first corporate action that changes the state and refuses to ask permission.

A dividend posts. A split rewrites quantities. A redemption window shuts while someone is still "in progress" though. The asset do not live a tidy object life and starts behaving like a living register.. entitlements diverge in Dusk tokenization eligibility matters at a specific cut-off, and suddenly everyone wants the same thing at once certainty—without turning the cap table into a public exhibit.

Plenty chains don't explode at this point. They fray. Quietly. In the gaps.

Because corporate actions are not about price. They're reconciliation events with consequences. The annoying kind. The ones ops teams inherit when two systems both claim they're looking at "the final state" and they are not. TradFi hides this under layers of process: snapshots, record dates, adjustment files post-event calls that sound routine until they're not.

Dusk has to survive it without building a second back office out of emails.

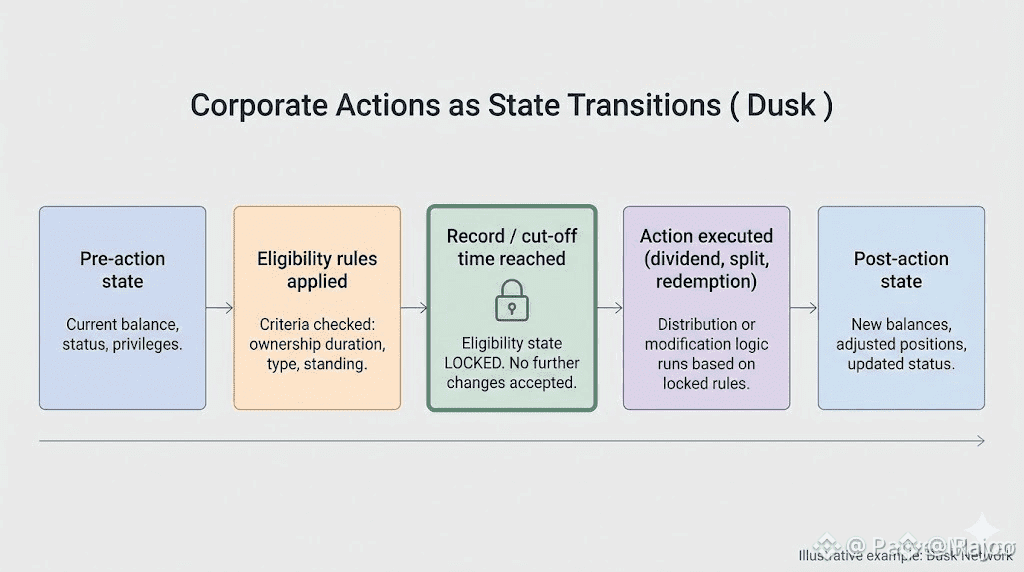

When a corporate action fires on Dusk... it is a state transition with rules welded to it. Who qualifies. When eligibility locks. What counts as "in time." What a venue can prove later without begging the issuer for a spreadsheet export. Identity-linked eligibility can be enforced without becoming a public label. Holder lists don't need to be sprayed onto the chain to make a dividend de

fensible.